Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL QUESTIONS ASAP PLEASE!!! ALL PARTS Holy Cow Stake House (HCSH) is a well-known restaurant based in Baton Rouge. The company itself is

PLEASE ANSWER ALL QUESTIONS ASAP PLEASE!!! ALL PARTS

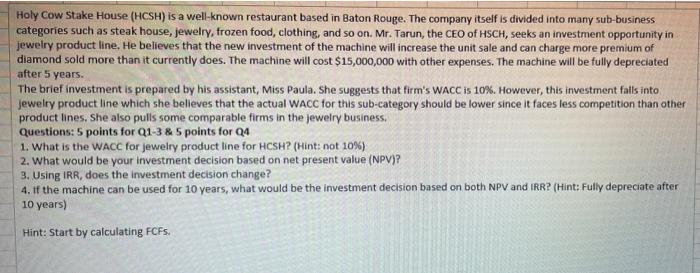

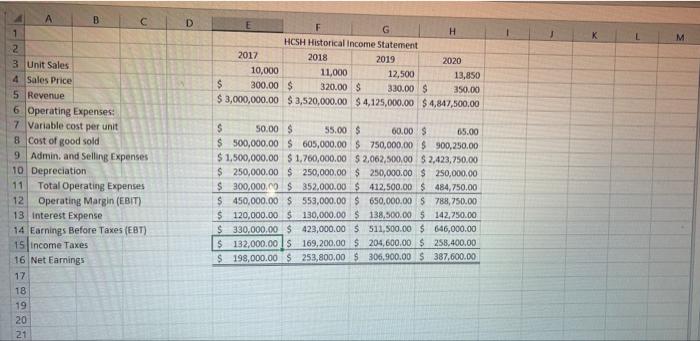

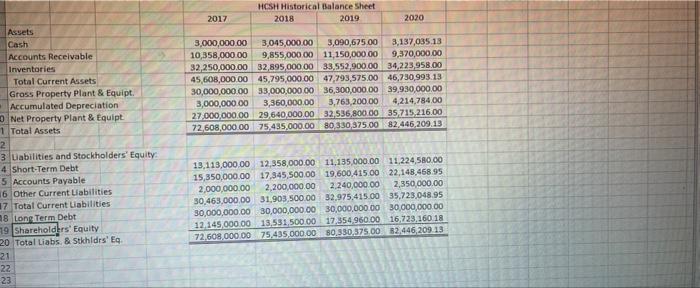

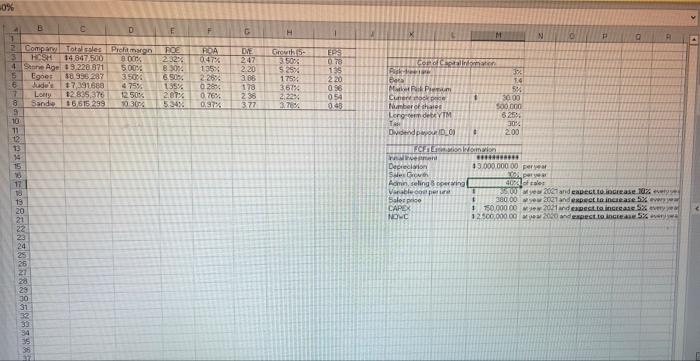

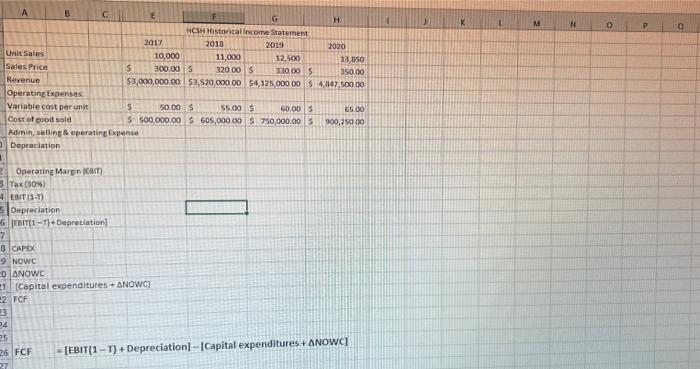

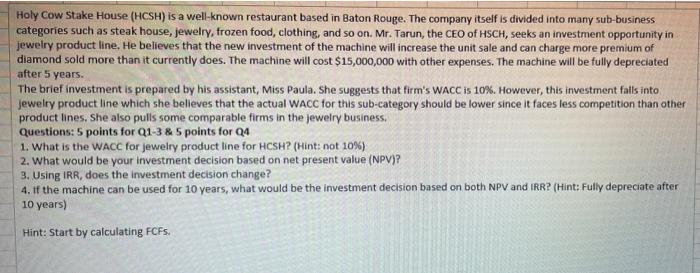

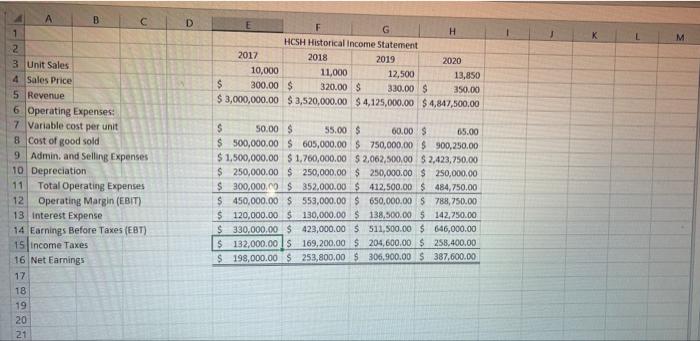

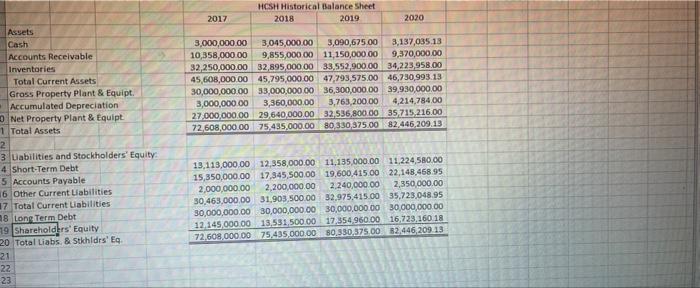

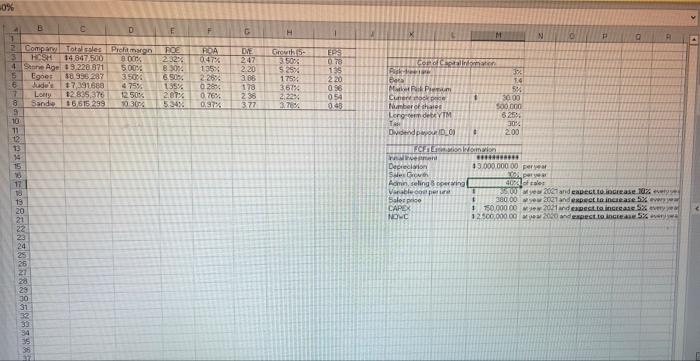

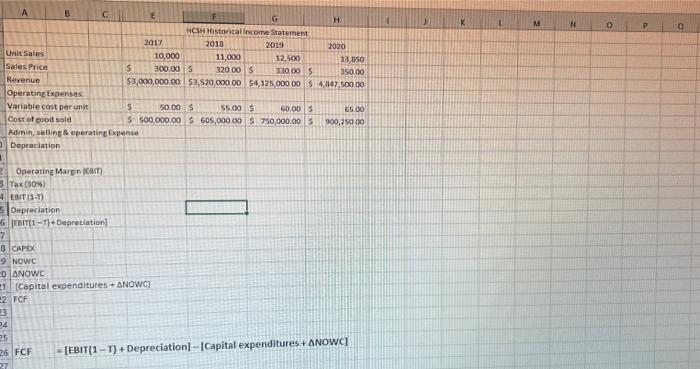

Holy Cow Stake House (HCSH) is a well-known restaurant based in Baton Rouge. The company itself is divided into many sub-business categories such as steak house, jewelry, frozen food, clothing, and so on. Mr. Tarun, the CEO of HSCH, seeks an investment opportunity in jewelry product line. He believes that the new investment of the machine will increase the unit sale and can charge more premium of diamond sold more than it currently does. The machine will cost $15,000,000 with other expenses. The machine will be fully depreciated after 5 years. The brief investment is prepared by his assistant, Miss Paula. She suggests that firm's WACC is 10%. However, this investment falls into Jewelry product line which she believes that the actual WACC for this sub-category should be lower since it faces less competition than other product lines. She also pulls some comparable firms in the jewelry business, Questions: 5 points for Q1-3 & 5 points for 24 1. What is the WACC for jewelry product line for HCSH? (Hint: not 10%) 2. What would be your investment decision based on net present value (NPV)? 3. Using IRR, does the investment decision change? 4. If the machine can be used for 10 years, what would be the investment decision based on both NPV and IRR? (Hint: Fully depreciate after 10 years) Hint: Start by calculating FCFs. C D - M E H HCSH Historical income Statement 2017 2018 2019 2020 10,000 11,000 12,500 13,850 $ 300.00 $ 320.00 S 330.00 $ 350.00 $ 3,000,000.00 $3,520,000.00 $4,125,000.00 $4,847,500.00 4 B 1 2 3 Unit Sales 4 Sales Price 5 Revenue 6 Operating Expenses: 7 Variable cost per unit 8 Cost of good sold 9 Admin, and Selling Expenses 10 Depreciation 11 Total Operating Expenses 12 Operating Margin (EBIT) 13 Interest Expense 14 Earnings Before Taxes (EBT) 15 Income Taxes 16 Net Earnings 17 18 19 20 21 $ 50.00 $ 55.00 $ 60.00 65.00 $ 500,000.00 $ 605,000.00 $ 750,000.00 $ 900,250.00 $ 1,500,000.00 $ 1,700,000.00 $ 2,062,500.00 $ 2,423,750.00 $ 250,000.00 $ 250,000.00 $ 250,000.00 $ 250,000.00 $ 300,000.00 $352,000.00 $ 412,500.00 $ 484,750.00 $ 450,000.00 $ 553,000.00 $ 650,000.00 S 788,750.00 $ 120,000.00 $ 130,000.00 $ 138,500.00 $ 142,750.00 $ 330,000.00 $ 423,000.00 $ 511,500.00 $ 646,000.00 $ 132,000.00 $ 169,200.00 $ 204,600.00 $ 258,400.00 $ 198,000.00 $ 253,800.00 $ 306,900.00 S 387,600.00 HOSH Historical Balance Sheet 2018 2019 2017 2020 3,000,000.00 3,045,000.00 3,090,675 00 3,137,035.13 10,358,000.00 9,855,000.00 11,150,000.00 9,370,000.00 32,250,000.00 32,895,000.00 33.552,900.00 34,223,958.00 45,608,000.00 45,795,000.00 47,793,575.00 46,730,993.13 30,000,000.00 33,000,000.00 36,300,000.00 39.930,000.00 3,000,000.00 3,360,000.00 3,763,200.00 4,214,784.00 27.000.000,00 29,640,000.00 32,536,800.00 35 715,216.00 72.608,000.00 75.435,000.00 80 330,375.00 82.446.209.13 Assets Cash Accounts Receivable Inventories Total Current Assets Grass Property Plant & Equipt. Accumulated Depreciation Net Property Plant & Equipt 1 Total Assets 2 3 Uabilities and Stockholders' Equity 4 Short-Term Debt 5 Accounts Payable 16 Other Current Liabilities 17 Total Current Liabilities 28 Long Term Debt 19 Shareholders' Equity 20 Total Liabs & Stkhidrs' Eq 21 22 23 13,113,000.00 12,358,000.00 11,135,000.00 11,224,580.00 15,350,000.00 17,345,500.00 19,600,415.00 22,148,458 95 2,000,000.00 2,200,000.00 2.240,000.00 2,350,000.00 30,463,000.00 31.903.500.00 32.975,415.00 35,723,048.95 30,000,000.00 30,000,000.00 30,000,000.00 30,000,000.00 12.145,000.00 13,531,500.00 17,354 960.00 16,223,160 18 72.608,000.00 75.435,000.00 80.330.375,00 32.446,209 13 -0% F H M N 0 TI A EDA LE 20 B D E 1 2 CompTotales Pretman ROE 14 847,500 300K 232% 4 San Age 89 220 871 500 80% 5 Egoer 18935227 3900 6.50 6 Judo 17.91689 6 75% 135%. 7 Loty 12835,376 1250% 2.87 Sande 16 515 299 203034 524 3 10 11 135% 2.26% 0.285. 0.76% 097 2.20 388 178 236 3.77 Growth 35000 $ 25% 175) 361 2.22 3.7% 0.78 135 220 OS 054 0.48 Code 32 Bers EG Premium 58 Cuento . 30.00 Number of shares too to Lorgendet VTM 6259 TAR 30% Dividend payou 200 1 14 75 17 FCFS Wowo *** Depreciation $3.000.00000 per Se Go Admin, seling bering 40 tale: Vanable per Uw and expect to increased Seleti 380.00 2031 and expect to increase 5% CAPEX 1 150,000.00 2021 and peste % NOC 32.500,000.00 2000 and best once 5% 13 20 21 22 8858 K M N 0 o P 5 C G . HCS Historical income Statement 2017 2018 2019 2020 Unit Sales 10,000 11,000 12.50 18,850 Sales Price s 300.00 S 320 00 S 330.00 350 00 Revenue $3,000,000.00 52,520,000.00 54,125,000.00 $ 4.847,500.00 Operating Expenses Variable cost per unit S 50.00 $ 55.00 $ 60.00 65.00 Cost of good sold $ 500,000.00 S 605,000.00 $ 750,000.00 S 500,250.00 Admin, selling operating Expense Depreciation 2 Operating Margin EMT Tax (30%) 4. ESIT 6-1) Depreciation 5 EBIT1-T)Depreciation 7 8 CAPEX 9 NOWC 0 ANOWC 1 (Capital expenditures + ANOWCI 22 FCF 23 25 26 FCF 27 [EBIT(1-T) + Depreciation - Capital expenditures + ANOWC] Holy Cow Stake House (HCSH) is a well-known restaurant based in Baton Rouge. The company itself is divided into many sub-business categories such as steak house, jewelry, frozen food, clothing, and so on. Mr. Tarun, the CEO of HSCH, seeks an investment opportunity in jewelry product line. He believes that the new investment of the machine will increase the unit sale and can charge more premium of diamond sold more than it currently does. The machine will cost $15,000,000 with other expenses. The machine will be fully depreciated after 5 years. The brief investment is prepared by his assistant, Miss Paula. She suggests that firm's WACC is 10%. However, this investment falls into Jewelry product line which she believes that the actual WACC for this sub-category should be lower since it faces less competition than other product lines. She also pulls some comparable firms in the jewelry business, Questions: 5 points for Q1-3 & 5 points for 24 1. What is the WACC for jewelry product line for HCSH? (Hint: not 10%) 2. What would be your investment decision based on net present value (NPV)? 3. Using IRR, does the investment decision change? 4. If the machine can be used for 10 years, what would be the investment decision based on both NPV and IRR? (Hint: Fully depreciate after 10 years) Hint: Start by calculating FCFs. C D - M E H HCSH Historical income Statement 2017 2018 2019 2020 10,000 11,000 12,500 13,850 $ 300.00 $ 320.00 S 330.00 $ 350.00 $ 3,000,000.00 $3,520,000.00 $4,125,000.00 $4,847,500.00 4 B 1 2 3 Unit Sales 4 Sales Price 5 Revenue 6 Operating Expenses: 7 Variable cost per unit 8 Cost of good sold 9 Admin, and Selling Expenses 10 Depreciation 11 Total Operating Expenses 12 Operating Margin (EBIT) 13 Interest Expense 14 Earnings Before Taxes (EBT) 15 Income Taxes 16 Net Earnings 17 18 19 20 21 $ 50.00 $ 55.00 $ 60.00 65.00 $ 500,000.00 $ 605,000.00 $ 750,000.00 $ 900,250.00 $ 1,500,000.00 $ 1,700,000.00 $ 2,062,500.00 $ 2,423,750.00 $ 250,000.00 $ 250,000.00 $ 250,000.00 $ 250,000.00 $ 300,000.00 $352,000.00 $ 412,500.00 $ 484,750.00 $ 450,000.00 $ 553,000.00 $ 650,000.00 S 788,750.00 $ 120,000.00 $ 130,000.00 $ 138,500.00 $ 142,750.00 $ 330,000.00 $ 423,000.00 $ 511,500.00 $ 646,000.00 $ 132,000.00 $ 169,200.00 $ 204,600.00 $ 258,400.00 $ 198,000.00 $ 253,800.00 $ 306,900.00 S 387,600.00 HOSH Historical Balance Sheet 2018 2019 2017 2020 3,000,000.00 3,045,000.00 3,090,675 00 3,137,035.13 10,358,000.00 9,855,000.00 11,150,000.00 9,370,000.00 32,250,000.00 32,895,000.00 33.552,900.00 34,223,958.00 45,608,000.00 45,795,000.00 47,793,575.00 46,730,993.13 30,000,000.00 33,000,000.00 36,300,000.00 39.930,000.00 3,000,000.00 3,360,000.00 3,763,200.00 4,214,784.00 27.000.000,00 29,640,000.00 32,536,800.00 35 715,216.00 72.608,000.00 75.435,000.00 80 330,375.00 82.446.209.13 Assets Cash Accounts Receivable Inventories Total Current Assets Grass Property Plant & Equipt. Accumulated Depreciation Net Property Plant & Equipt 1 Total Assets 2 3 Uabilities and Stockholders' Equity 4 Short-Term Debt 5 Accounts Payable 16 Other Current Liabilities 17 Total Current Liabilities 28 Long Term Debt 19 Shareholders' Equity 20 Total Liabs & Stkhidrs' Eq 21 22 23 13,113,000.00 12,358,000.00 11,135,000.00 11,224,580.00 15,350,000.00 17,345,500.00 19,600,415.00 22,148,458 95 2,000,000.00 2,200,000.00 2.240,000.00 2,350,000.00 30,463,000.00 31.903.500.00 32.975,415.00 35,723,048.95 30,000,000.00 30,000,000.00 30,000,000.00 30,000,000.00 12.145,000.00 13,531,500.00 17,354 960.00 16,223,160 18 72.608,000.00 75.435,000.00 80.330.375,00 32.446,209 13 -0% F H M N 0 TI A EDA LE 20 B D E 1 2 CompTotales Pretman ROE 14 847,500 300K 232% 4 San Age 89 220 871 500 80% 5 Egoer 18935227 3900 6.50 6 Judo 17.91689 6 75% 135%. 7 Loty 12835,376 1250% 2.87 Sande 16 515 299 203034 524 3 10 11 135% 2.26% 0.285. 0.76% 097 2.20 388 178 236 3.77 Growth 35000 $ 25% 175) 361 2.22 3.7% 0.78 135 220 OS 054 0.48 Code 32 Bers EG Premium 58 Cuento . 30.00 Number of shares too to Lorgendet VTM 6259 TAR 30% Dividend payou 200 1 14 75 17 FCFS Wowo *** Depreciation $3.000.00000 per Se Go Admin, seling bering 40 tale: Vanable per Uw and expect to increased Seleti 380.00 2031 and expect to increase 5% CAPEX 1 150,000.00 2021 and peste % NOC 32.500,000.00 2000 and best once 5% 13 20 21 22 8858 K M N 0 o P 5 C G . HCS Historical income Statement 2017 2018 2019 2020 Unit Sales 10,000 11,000 12.50 18,850 Sales Price s 300.00 S 320 00 S 330.00 350 00 Revenue $3,000,000.00 52,520,000.00 54,125,000.00 $ 4.847,500.00 Operating Expenses Variable cost per unit S 50.00 $ 55.00 $ 60.00 65.00 Cost of good sold $ 500,000.00 S 605,000.00 $ 750,000.00 S 500,250.00 Admin, selling operating Expense Depreciation 2 Operating Margin EMT Tax (30%) 4. ESIT 6-1) Depreciation 5 EBIT1-T)Depreciation 7 8 CAPEX 9 NOWC 0 ANOWC 1 (Capital expenditures + ANOWCI 22 FCF 23 25 26 FCF 27 [EBIT(1-T) + Depreciation - Capital expenditures + ANOWC]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started