Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all questions. Blue Crab, Inc. plans to issue new bonds, but is uncertain how the market would set the yield to maturity. The

Please answer all questions.

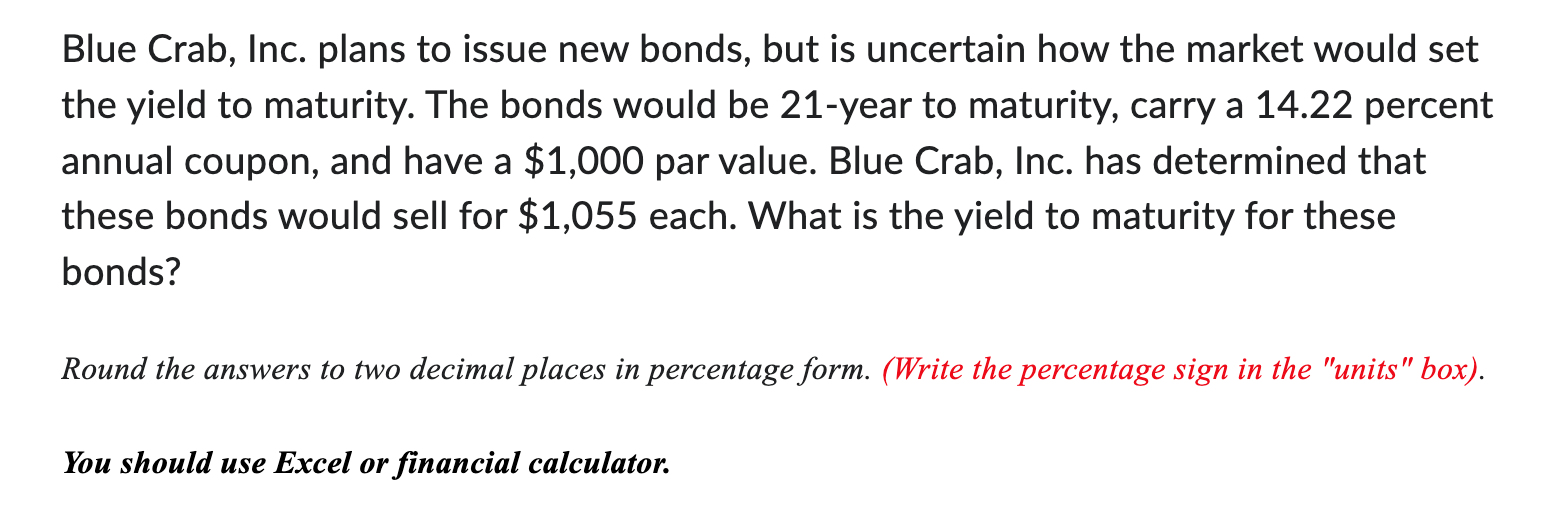

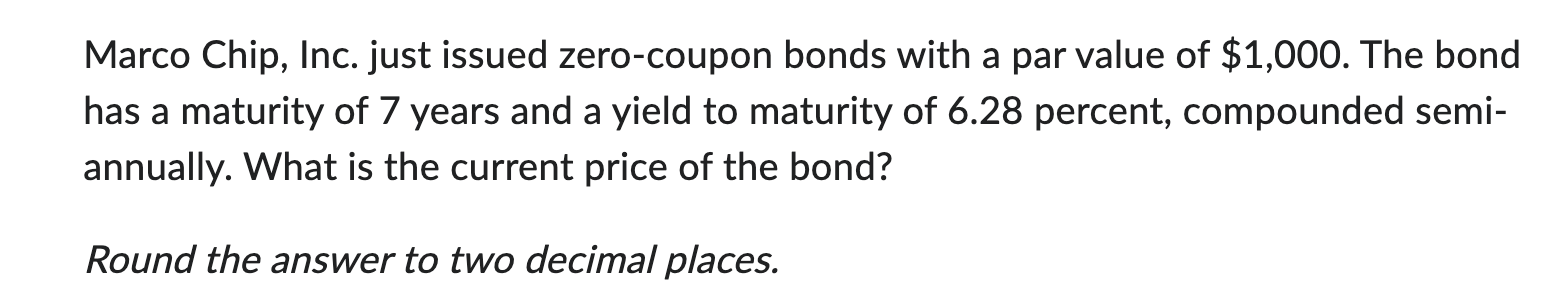

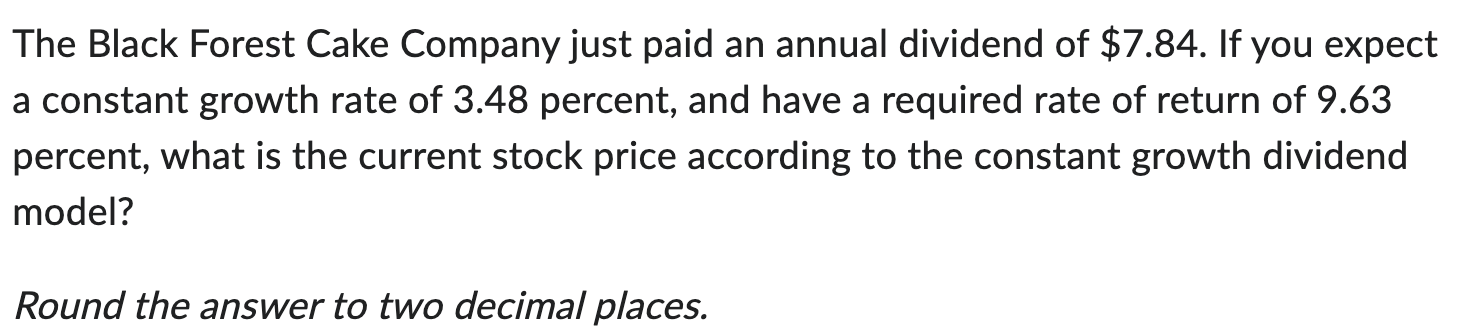

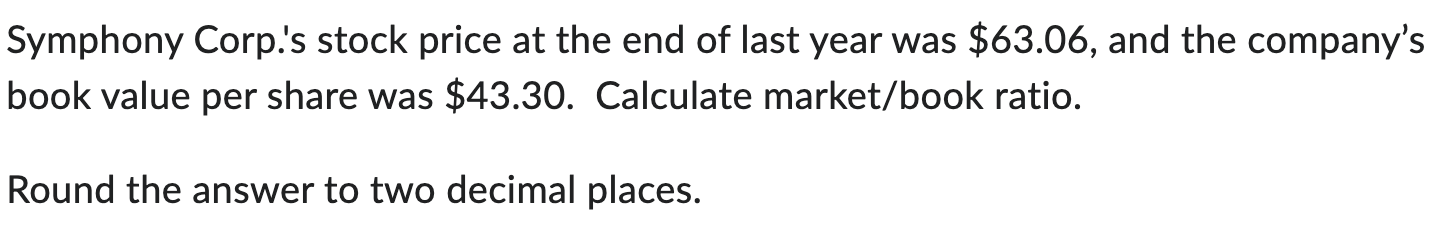

Blue Crab, Inc. plans to issue new bonds, but is uncertain how the market would set the yield to maturity. The bonds would be 21-year to maturity, carry a 14.22 percent annual coupon, and have a \\$1,000 par value. Blue Crab, Inc. has determined that these bonds would sell for \\( \\$ 1,055 \\) each. What is the yield to maturity for these bonds? Round the answers to two decimal places in percentage form. (Write the percentage sign in the \"units\" box). You should use Excel or financial calculator. Marco Chip, Inc. just issued zero-coupon bonds with a par value of \\( \\$ 1,000 \\). The bond has a maturity of 7 years and a yield to maturity of 6.28 percent, compounded semiannually. What is the current price of the bond? Round the answer to two decimal places. The Black Forest Cake Company just paid an annual dividend of \\( \\$ 7.84 \\). If you expect a constant growth rate of 3.48 percent, and have a required rate of return of 9.63 percent, what is the current stock price according to the constant growth dividend model? Symphony Corp.'s stock price at the end of last year was \\( \\$ 63.06 \\), and the company's book value per share was \\( \\$ 43.30 \\). Calculate market/book ratio. Round the answer to two decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started