Answered step by step

Verified Expert Solution

Question

1 Approved Answer

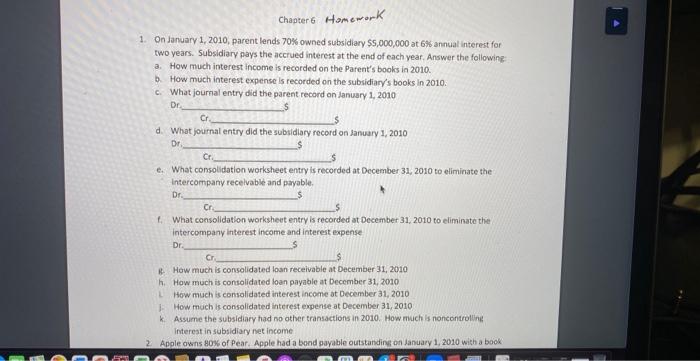

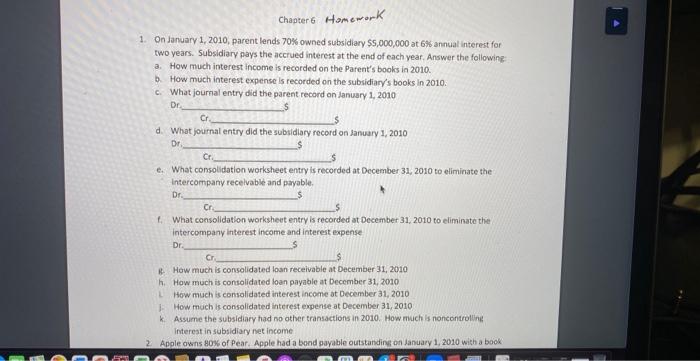

please answer all questions, explain, and show work 1. On January 1,2010 , parent lends 70% owned subsidiary $5,000,000 at 6% annual interest for two

please answer all questions, explain, and show work

1. On January 1,2010 , parent lends 70% owned subsidiary $5,000,000 at 6% annual interest for two years. Subsidiary pays the accrued interest at the end of each year. Answer the followin?: 3. How much interest income is recorded on the Parent's books in 2010 b. How much interest expense is recorded on the subsidiary's books in 2010 . c. What journal entry did the parent record on lanuary 1,2010 Dr. 5 Cr d. What joumal entry did the subsidiary record on lanuary 1, 2010 Dr, 5 Cr. e. What consolidation worksheet entry is recorded at December 31, 2010 to eliminate the Intercompany recelvable and payable. Dr. 5 Cr 5 f. What consolidation worksheet entry is recorded at December 31, 2010 to eliminate the intercompany interest income and interest expense Dr. s Cr 8. How much is consolidated loan receivable at December 31,2010 h. How much is consolidated loan payable at December 31,2010 1. How much is consolidated interest income at December 31, 2010 1. How mach is consolidated interest expense at December 31, 2010 k. Assume the subsidiary had no other transactions in 2010. How much is noncontrolling interest in subsidiary net income 2. Apole ouns 800 of Pear. Apple had a bond payable outstanding on lanuary 1, 2010 with a book

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started