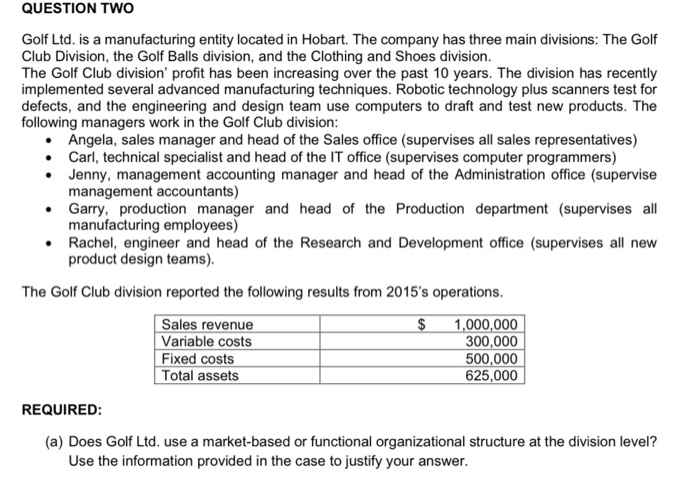

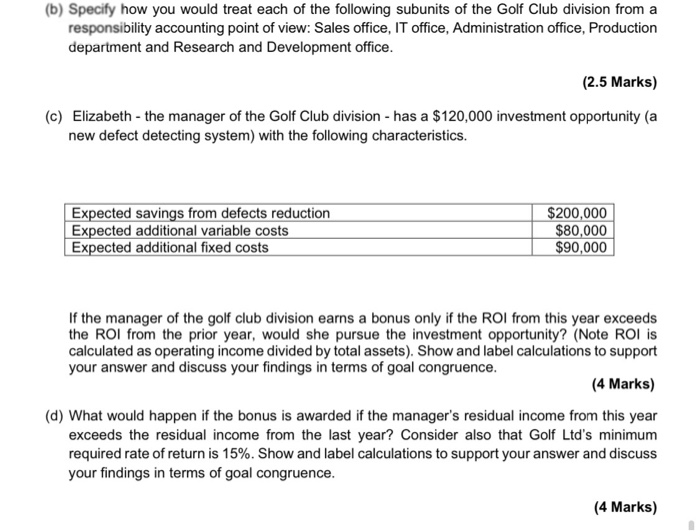

QUESTION TWO Golf Ltd. is a manufacturing entity located in Hobart. The company has three main divisions: The Golf Club Division, the Golf Balls division, and the Clothing and Shoes division. The Golf Club division' profit has been increasing over the past 10 years. The division has recently implemented several advanced manufacturing techniques. Robotic technology plus scanners test for defects, and the engineering and design team use computers to draft and test new products. The following managers work in the Golf Club division: Angela, sales manager and head of the Sales office (supervises all sales representatives) Carl, technical specialist and head of the IT office (supervises computer programmers) Jenny, management accounting manager and head of the Administration office (supervise management accountants) Garry, production manager and head of the Production department (supervises all manufacturing employees) Rachel, engineer and head of the Research and Development office (supervises all new product design teams). The Golf Club division reported the following results from 2015's operations. $ Sales revenue Variable costs Fixed costs Total assets 1,000,000 300,000 500,000 625,000 REQUIRED: (a) Does Golf Ltd. use a market-based or functional organizational structure at the division level? Use the information provided in the case to justify your answer. (b) Specify how you would treat each of the following subunits of the Golf Club division from a responsibility accounting point of view: Sales office, IT office, Administration office, Production department and Research and Development office. (2.5 Marks) (c) Elizabeth - the manager of the Golf Club division - has a $120,000 investment opportunity (a new defect detecting system) with the following characteristics. Expected savings from defects reduction Expected additional variable costs Expected additional fixed costs $200,000 $80,000 $90,000 If the manager of the golf club division earns a bonus only if the ROI from this year exceeds the ROI from the prior year, would she pursue the investment opportunity? (Note ROI is calculated as operating income divided by total assets). Show and label calculations to support your answer and discuss your findings in terms of goal congruence. (4 Marks) (d) What would happen if the bonus is awarded if the manager's residual income from this year exceeds the residual income from the last year? Consider also that Golf Ltd's minimum required rate of return is 15%. Show and label calculations to support your answer and discuss your findings in terms of goal congruence. (4 Marks)