Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all questions i can't post them separetly If a US firm wants to set up a money market hedge for their MXN payables,

please answer all questions i can't post them separetly

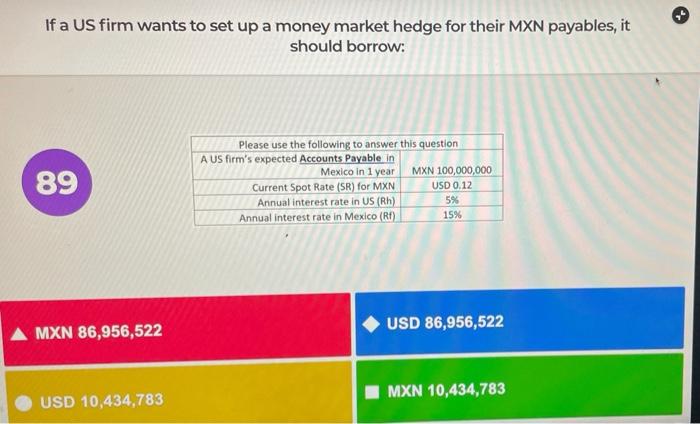

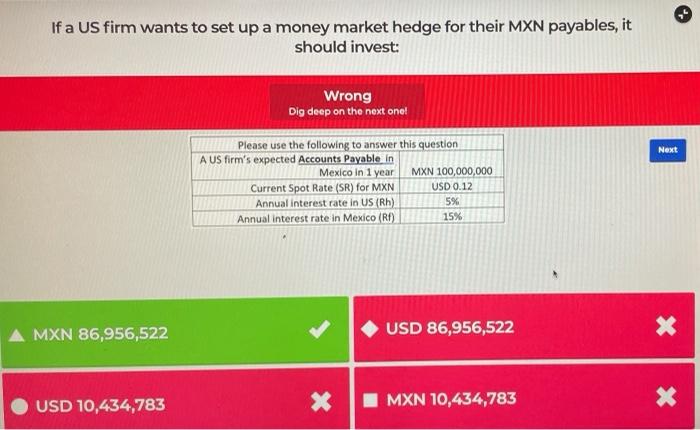

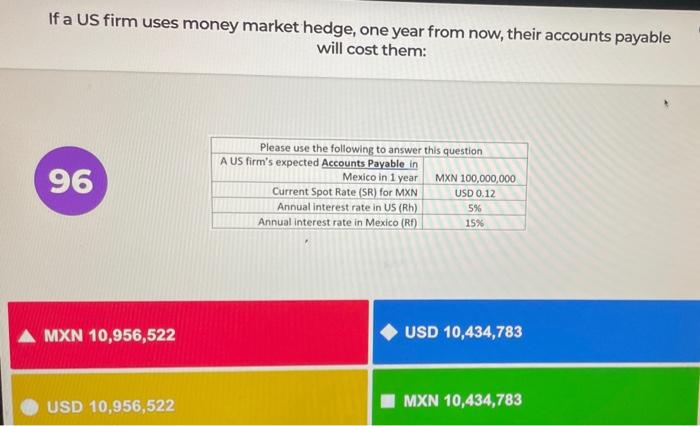

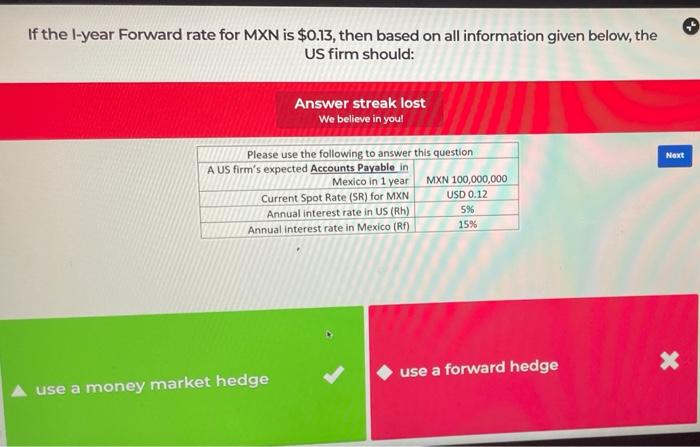

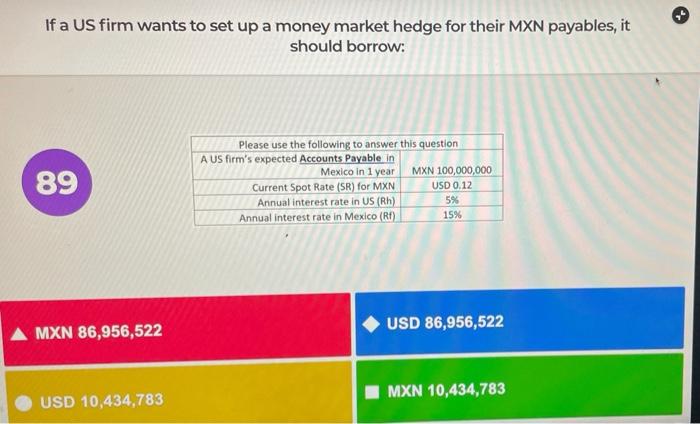

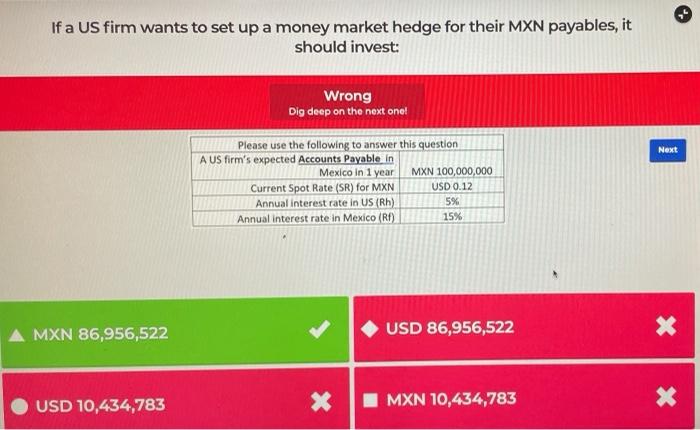

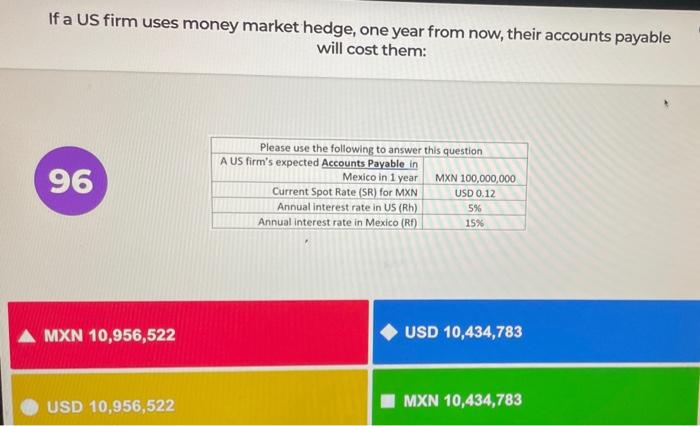

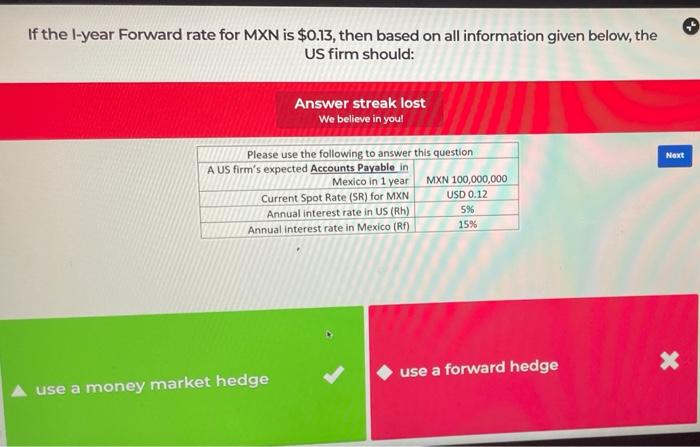

If a US firm wants to set up a money market hedge for their MXN payables, it should borrow: 89 Please use the following to answer this question A US firm's expected Accounts Payable in Mexico in 1 year MXN 100,000,000 Current Spot Rate (SR) for MXN USD 0.12 Annual interest rate in US (Rh) 5% Annual interest rate in Mexico (Rt) 15% USD 86,956,522 A MXN 86,956,522 MXN 10,434,783 USD 10,434,783 If a US firm wants to set up a money market hedge for their MXN payables, it should invest: Wrong Dig deep on the next one! Next Please use the following to answer this question A US firm's expected Accounts Payable in Mexico in 1 year MXN 100,000,000 Current Spot Rate (SR) for MXN USD 0.12 Annual interest rate in US (Rh) 5% Annual interest rate in Mexico (RF) 15% A MXN 86,956,522 USD 86,956,522 * USD 10,434,783 X MXN 10,434,783 X If a US firm uses money market hedge, one year from now, their accounts payable will cost them: 96 Please use the following to answer this question A US firm's expected Accounts Payable in Mexico in 1 year MXN 100,000,000 Current Spot Rate (SR) for MXN USD 0.12 Annual interest rate in US (Rh) 5% Annual interest rate in Mexico (R) 15% A MXN 10,956,522 USD 10,434,783 USD 10,956,522 MXN 10,434,783 If the l-year Forward rate for MXN is $0.13, then based on all information given below, the US firm should: Answer streak lost We believe in you! Next Please use the following to answer this question A US firm's expected Accounts Payable in Mexico in 1 year MXN 100,000,000 Current Spot Rate (SR) for MXN USD 0.12 Annual interest rate in US (RH) 5% Annual Interest rate in Mexico (RF) 15% X use a forward hedge use a money market hedge

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started