Answered step by step

Verified Expert Solution

Question

1 Approved Answer

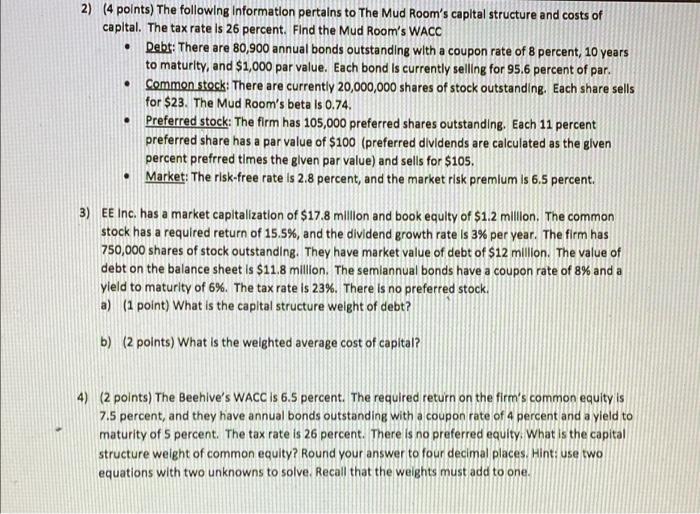

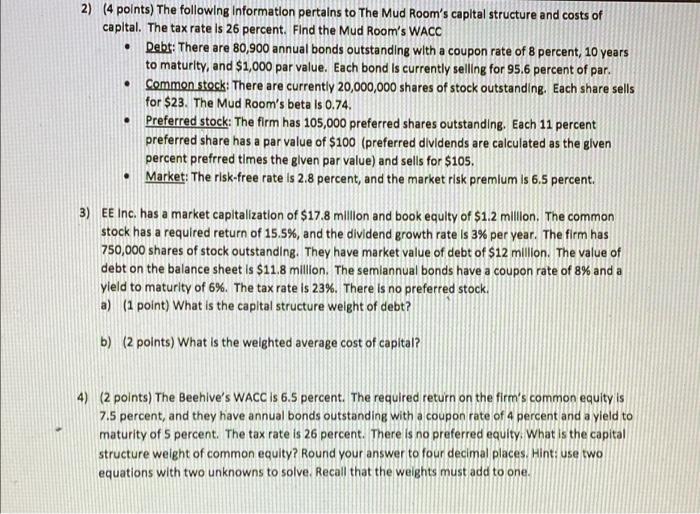

please answer all questions. please show all your work . 2) (4 points) The following information pertains to The Mud Room's capital structure and costs

please answer all questions.

. 2) (4 points) The following information pertains to The Mud Room's capital structure and costs of capital. The tax rate is 26 percent. Find the Mud Room's WACO Debt: There are 80,900 annual bonds outstanding with a coupon rate of 8 percent, 10 years to maturity, and $1,000 par value. Each bond is currently selling for 95.6 percent of par. Common stock: There are currently 20,000,000 shares of stock outstanding. Each share sells for $23. The Mud Room's beta Is 0.74 Preferred stock: The firm has 105,000 preferred shares outstanding. Each 11 percent preferred share has a par value of $100 (preferred dividends are calculated as the glven percent prefrred times the given par value) and sells for $105. Market: The risk-free rate is 2.8 percent, and the market risk premium is 6.5 percent. . . 3) EE Inc. has a market capitalization of $17.8 million and book equity of $1.2 million. The common stock has a required return of 15.5%, and the dividend growth rate is 3% per year. The firm has 750,000 shares of stock outstanding. They have market value of debt of $12 million. The value of debt on the balance sheet is $11.8 million. The semiannual bonds have a coupon rate of 8% and a yield to maturity of 6%. The tax rate is 23%. There is no preferred stock. a) (1 point) What is the capital structure weight of debt? b) (2 points) What is the welghted average cost of capital? 4) (2 points) The Beehive's WACC is 6.5 percent. The required return on the firm's common equity is 7.5 percent, and they have annual bonds outstanding with a coupon rate of 4 percent and a yield to maturity of 5 percent. The tax rate is 26 percent. There is no preferred equity. What is the capital structure weight of common equity? Round your answer to four decimal places. Hint: use two equations with two unknowns to solve. Recall that the weights must add to one please show all your work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started