please answer all questions thank you

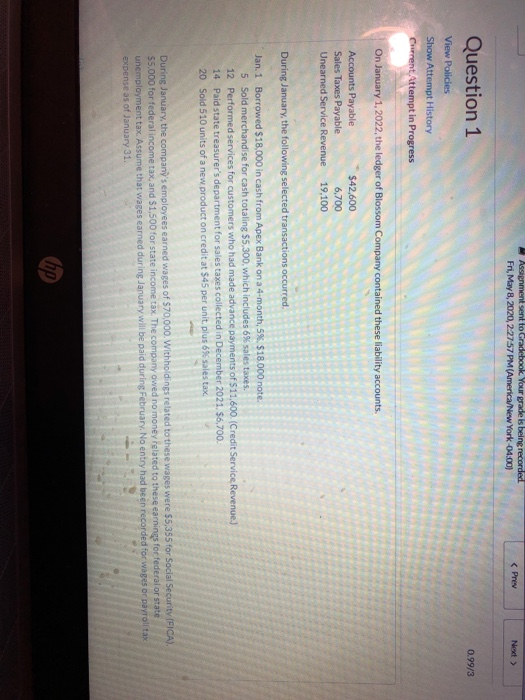

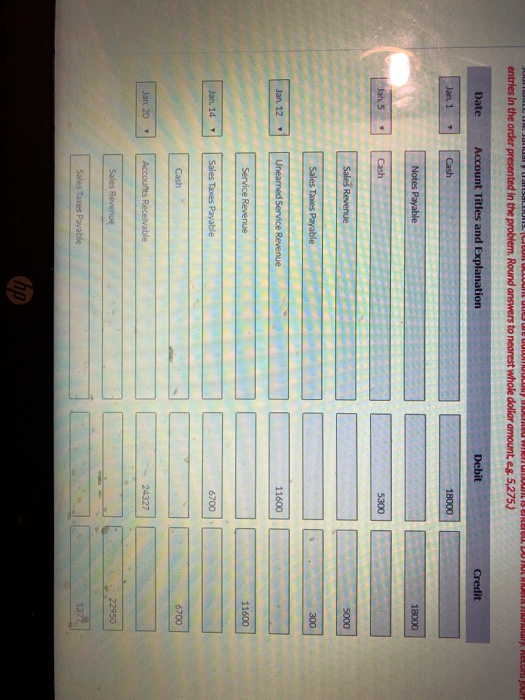

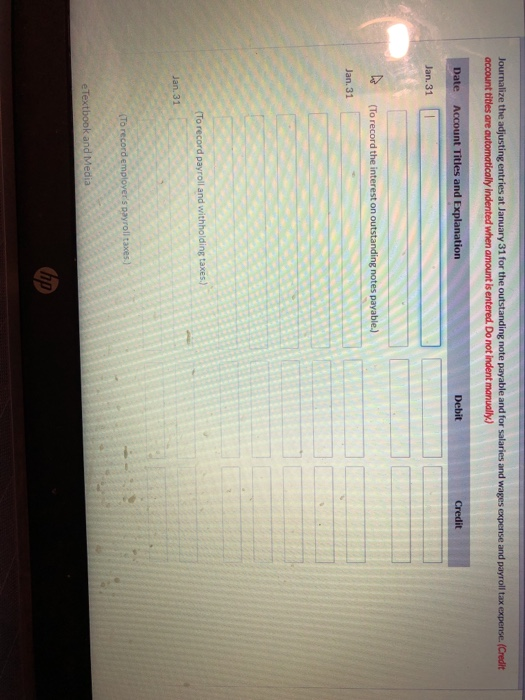

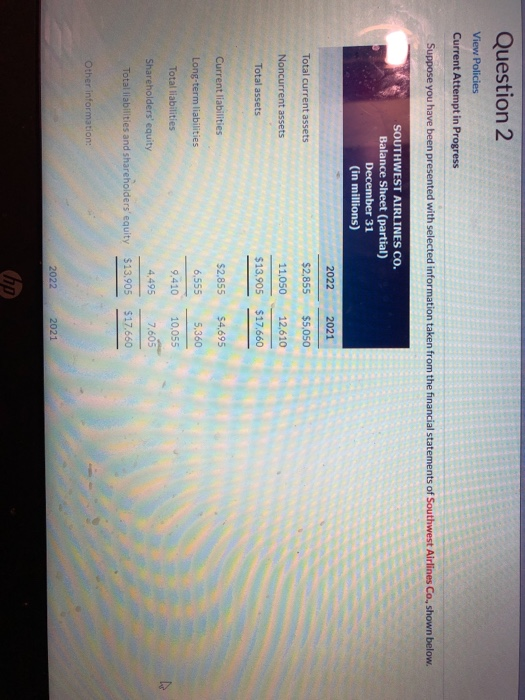

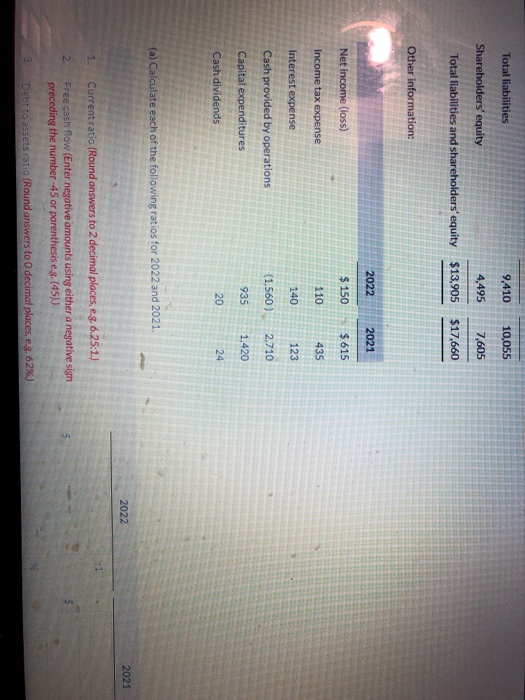

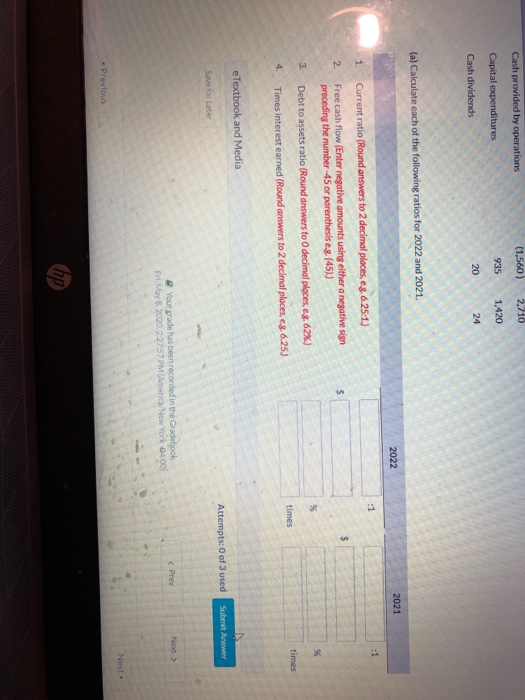

Assignment sent to Gradebook Your grade is being recorded Fri, May 8, 2020, 2.2757 PM (America/New York-04:00) 0.99/3 Question 1 View Policies Show Attempt History Current Attempt in Progress On January 1, 2022, the ledger of Blossom Company contained these liability accounts. Accounts Payable Sales Taxes Payable Unearned Service Revenue $42.000 6,700 19,100 During January, the following selected transactions occurred. Jan. 1 Borrowed $18,000 in cash from Apex Bank on a 4-month, 5%. $18.000 note. 5 Sold merchandise for cash totaling $5,300, which includes 6% sales taxes. 12 Performed services for customers who had made advance payments of $11,600. (Credit Service Revenue.) 14 Paid state treasurer's department for sales taxes collected in December 2021. 56,700. 20 Sold 510 units of a new product on credit at $45 per unit plus 6% sales tax. During January, the company's employees earned wages of $70,000. Withholdings related to these wages were $5,355 for Social Security (ICA). $5,000 for federal income tax, and $1,500 for state income tax. The company owed no money related to these earnings for federal or state unemployment tax. Assume that wages earned during January will be paid during February. No entry had been recorded for wages or payroll tax expense as of January 31. wo entries in the order presented in the problem. Round answers to nearest whole dollar amount es 5,275.) Date Account Titles and Explanation Debit Credit Jan 1 . Cash 18000 Notes Payable 18000 son 5 Cash 5300 Sales Revenue 5000 300 Sales Tres Payable Jan. 12 Unearned Service Revenue 11600 11600 Service Revenue Sales Taxes Payable 6700 Cash Accounts Receivable Sales Revenue Sales Payable Journalize the adjusting entries at January 31 for the outstanding note payable and for salaries and wages expense and payroll tax expense. (Credit account titles are automatically Indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Jan. 31 1 (To record the interest on outstanding notes payable.) Jan. 31 (To record payroll and withholding taxes.) Jan. 31 (To record employer's payroll taxes. e Textbook and Media Question 2 View Policies Current Attempt in Progress Suppose you have been presented with selected information taken from the financial statements of Southwest Airlines Co, shown below. SOUTHWEST AIRLINES CO. Balance Sheet (partial) December 31 (in millions) 2022 2022 2021 2021 Total current assets $2,855 $5,050 Noncurrent assets 11,050 $13,905 12,610 $17.660 Total assets Current liabilities Long-term liabilities Total liabilities Shareholders' equity Total liabilities and shareholders' equity $2,855 6,555 9.410 4,495 $13,905 $4,695 5,360 10,055 7.605 $17.660 Other information: 2022 2021 hp Total liabilities Shareholders' equity 9,410 4,495 $13,905 10,055 7,605 $17,660 Total liabilities and shareholders'equity Other information: 2022 2021 Net income (loss) $ 150 $ 615 Income tax expense 110 435 Interest expense 140 123 Cash provided by operations (1.560 ) 2.710 1,420 Capital expenditures 935 Cash dividends 20 24 (a) Calculate each of the following ratios for 2022 and 2021. 2022 2021 1. Current ratio (Round answers to 2 decimal places, e.g. 6.25:1.) Free cash flow (Enter negative amounts using either a negative sign preceding the number -45 or parenthesis e.g. (45).) 3. Debt to assets ratio (Round answers to decimal places, e.g. 62%.) Cash provided by operations (1,560) Capital expenditures 935 1420 Cash dividends 20 (a) Calculate each of the following ratios for 2022 and 2021 2022 2021 1. Current ratio (Round answers to 2 decimal places, e.g. 6.25:1.) 2. Free cash flow (Enter negative amounts using either a negative sign preceding the number -45 or parenthesis e...(45)) 3. Debt to assets ratio (Round answers to decimal places, 28.62%) times times 4. Times interest earned (Round answers to 2 decimal places, eg. 6.25) e Textbook and Media Attempts: 0 of 3 used Submit Answer Save for Later NE Your grade has been recorded in the Gradebook Fri May.2020 2:27:57 PM America New York 04.00) Previous