Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Presented below are two independent situations. Situation A: Vaughn Co. reports revenues of $202,000 and operating expenses of $109,000 in its first year of operations,

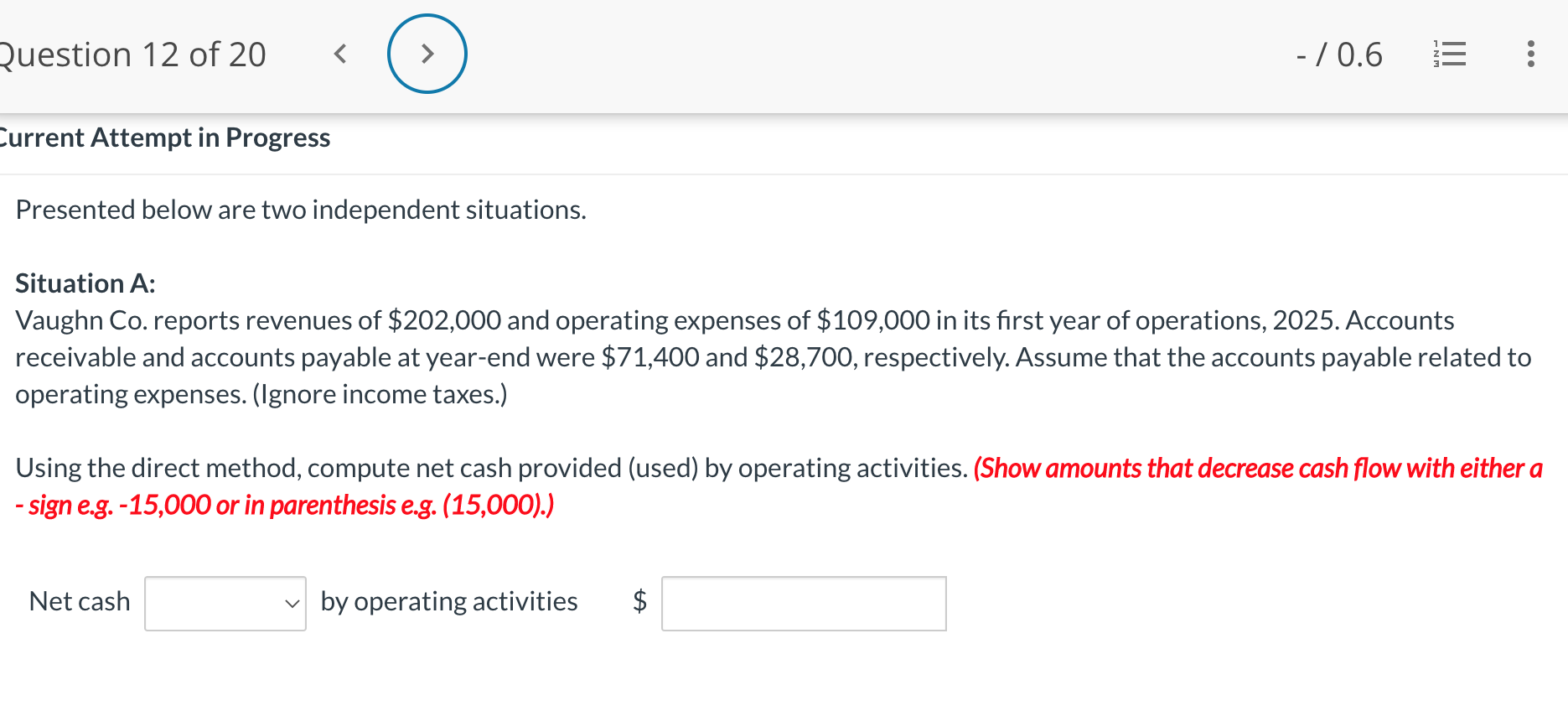

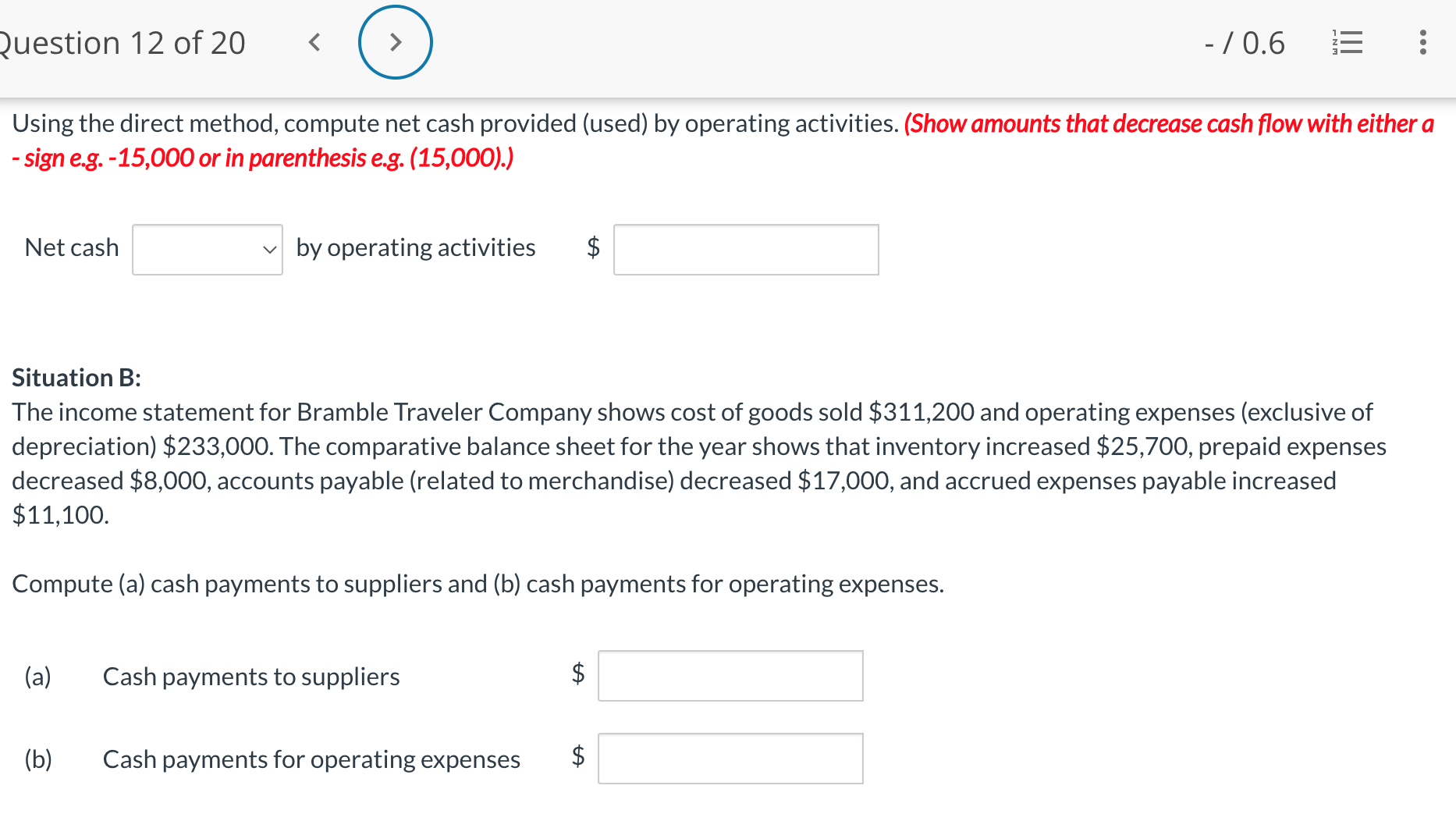

Presented below are two independent situations. Situation A: Vaughn Co. reports revenues of $202,000 and operating expenses of $109,000 in its first year of operations, 2025. Accounts receivable and accounts payable at year-end were $71,400 and $28,700, respectively. Assume that the accounts payable related to operating expenses. (Ignore income taxes.) Using the direct method, compute net cash provided (used) by operating activities. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Net cash by operating activities $ Using the direct method, compute net cash provided (used) by operating activities. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Net cash by operating activities $ Situation B : The income statement for Bramble Traveler Company shows cost of goods sold $311,200 and operating expenses (exclusive of depreciation) $233,000. The comparative balance sheet for the year shows that inventory increased $25,700, prepaid expenses decreased $8,000, accounts payable (related to merchandise) decreased $17,000, and accrued expenses payable increased $11,100. Compute (a) cash payments to suppliers and (b) cash payments for operating expenses. (a) Cash payments to suppliers $ (b) Cash payments for operating expenses $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started