Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER ALL QUESTIONS THAT ARE PROVIDED THANK YOU 4. Which of this is not an advantage of accural-based accounting? a. It is simple and

PLEASE ANSWER ALL QUESTIONS THAT ARE PROVIDED THANK YOU

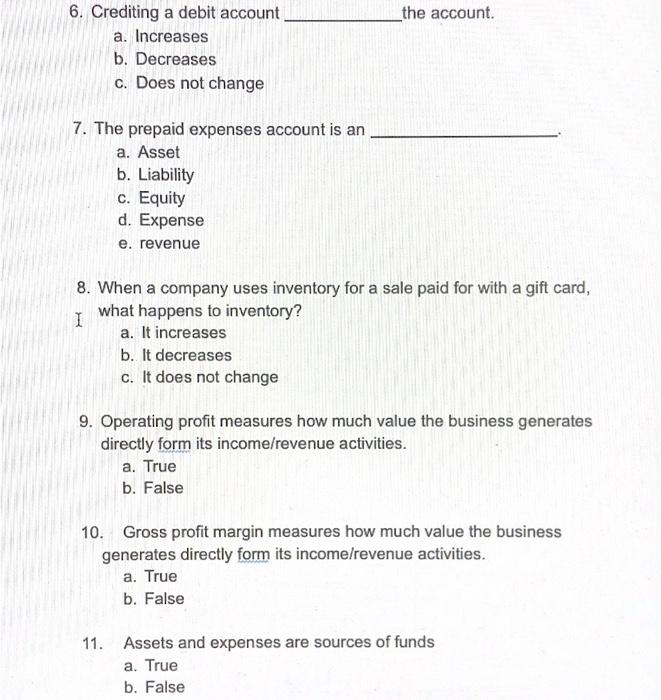

4. Which of this is not an advantage of accural-based accounting? a. It is simple and easy b. It is used by large, publicly-traded corporations c. Is reports revenue when an invoice is issued d. It reflects the value a firm creates when it is created 5. When a company received cash from a customer for a gift card, which financial statements change? a. Balance sheet only b. Income statement only c Balance sheet and income statement _the account. 6. Crediting a debit account a. Increases b. Decreases c. Does not change 7. The prepaid expenses account is an a. Asset b. Liability c. Equity d. Expense e. revenue 8. When a company uses inventory for a sale paid for with a gift card, what happens to inventory? I a. It increases b. It decreases c. It does not change 9. Operating profit measures how much value the business generates directly form its income/revenue activities. a. True b. False 10. Gross profit margin measures how much value the business generates directly form its income/revenue activities. a. True b. False 11. Assets and expenses are sources of funds a. True b. False 12. Liabilities obligate a company's assets to its creditors. a. True b. False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started