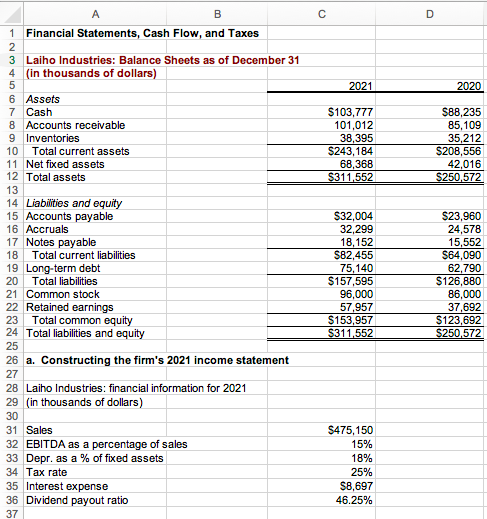

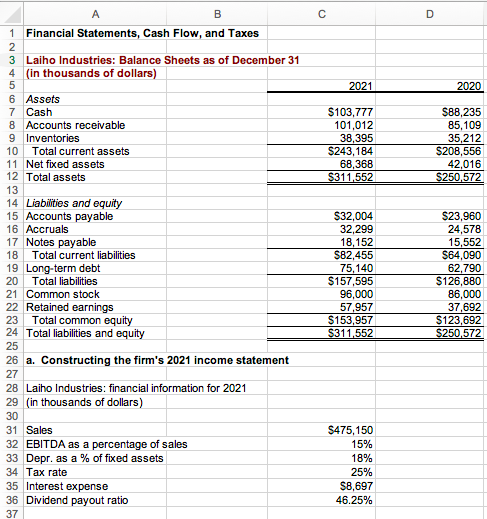

Please help by answering rows 41-107 based on the data provided. Thanks!

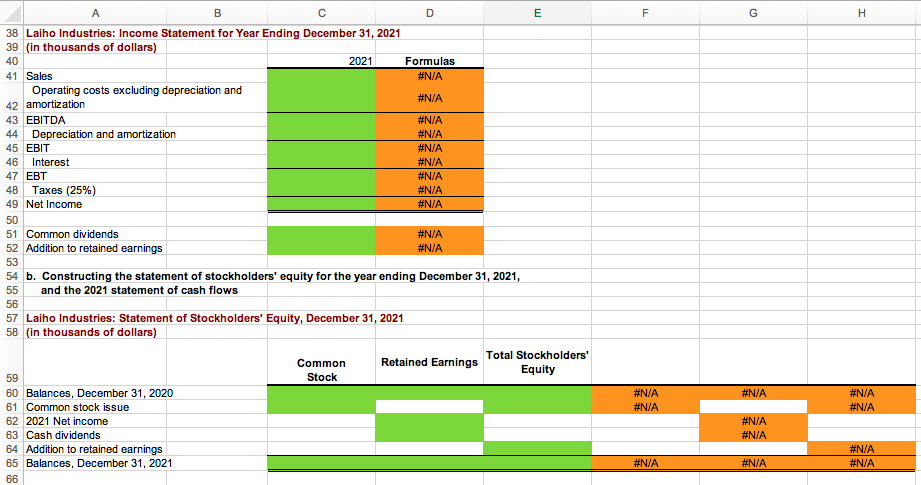

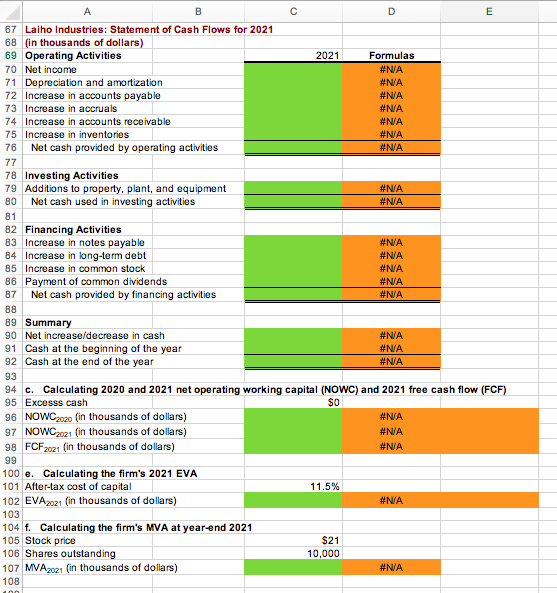

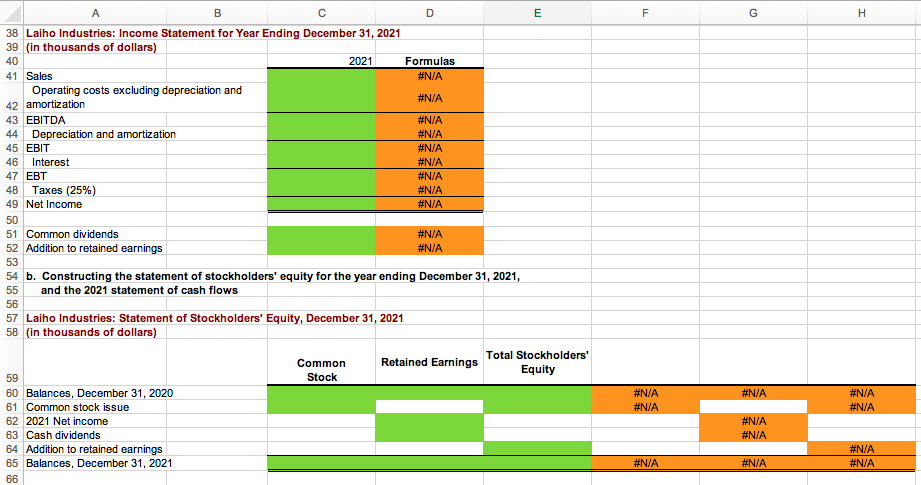

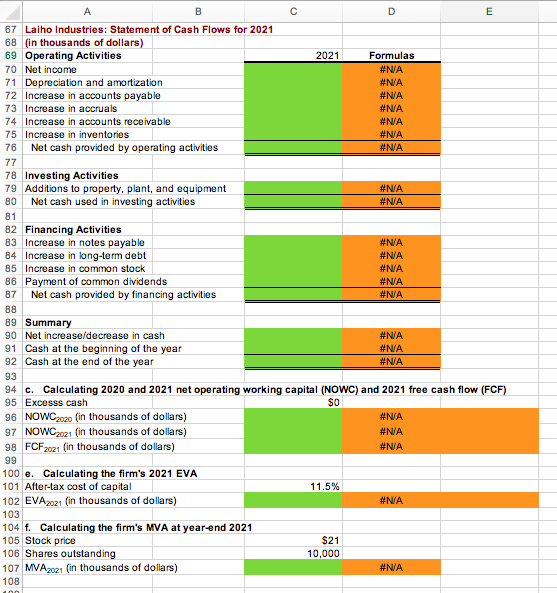

A B C D E F G H 38 Laiho Industries: Income Statement for Year Ending December 31, 2021 39 (in thousands of dollars) 40 Operating costs excluding depreciation and 42 amortization 43 EBITDA 44 Depreciation and amortization 45 EBIT 46 Interest 47 EBT 48 Taxes (25\%) Net Income \begin{tabular}{lc} 2021 & Formulas \\ \hline & #N/A \\ & \#N/A \\ & \#N/A \\ & \#N/A \\ & \#N/A \\ & \#N/A \\ & \#N/A \\ & \#N/A \\ \hline & \#N/ \\ \hline \hline \end{tabular} Common dividends \#N/A Addition to retained earnings \#N/A b. Constructing the statement of stockholders' equity for the year ending December 31,2021 , and the 2021 statement of cash flows Laiho Industries: Statement of Stockholders' Equity, December 31, 2021 58 (in thousands of dollars) Common 59 Retained Earnings Total Stockholders' Equity 60 Balances, December 31, 2020 61 Common stock issue 622021 Net income 63 Cash dividends 64 Addition to retained earnings 65 Balances, December 31, 2021 A B C D E 67 Laiho Industries: Statement of Cash Flows for 2021 68 (in thousands of dollars) 69 Operating Activities 70 Net income 71 Depreciation and amortization 72 Increase in accounts payable 73 Increase in accruals 74 Increase in accounts receivable 75 Increase in inventories 76 Net cash provided by operating activities \begin{tabular}{cc} \hline 2021 & Formulas \\ \hline \#N/A \\ & \#/A \\ & \#N/A \\ \#N/A \\ & \#/A \\ \#N/A \\ \hline \#N/A \\ \hline \hline \end{tabular} 77 78 Investing Activities 79 Additions to property, plant, and equipment 80 Net cash used in investing activities #N/A#N/A 81 82 Financing Activities 83 Increase in notes payable 84 Increase in long-term debt 85 Increase in common stock 86 Payment of common dividends 87 Net cash provided by financing activities 88 89 Summary 90 Net increase/decrease in cash 91 Cash at the beginning of the year 92 Cash at the end of the year \begin{tabular}{ll} & \#N/A \\ \#N/A \\ \#N/A \\ \#N/A \\ \hline \#N/A \\ \hline \hline & \\ \#N/A \\ \#N/A \\ \hline \#N/A \\ \hline \hline \end{tabular} 93 94 c. Calculating 2020 and 2021 net operating working capital (NOWC) and 2021 free cash flow (FCF) 95 Excesss cash $0 96 NOWC 2020 (in thousands of dollars) HN/A 97 NOWC 2021 (in thousands of dollars) HN/A 98 FCF 2021 (in thousands of dollars) HN/A 99 100 e. Calculating the firm's 2021 EVA 101 After-tax cost of capital 11.5% 102 EVA 2021 (in thousands of dollars) 103 104 f. Calculating the firm's MVA at year-end 2021 105 Stock price 106 Shares outstanding 107MVA2021 (in thousands of dollars) 108