Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all questions, thay go togthwr Thank you!!! Question 17 (1 point) What is the price of a Dexitrim put with six months until

please answer all questions, thay go togthwr Thank you!!!

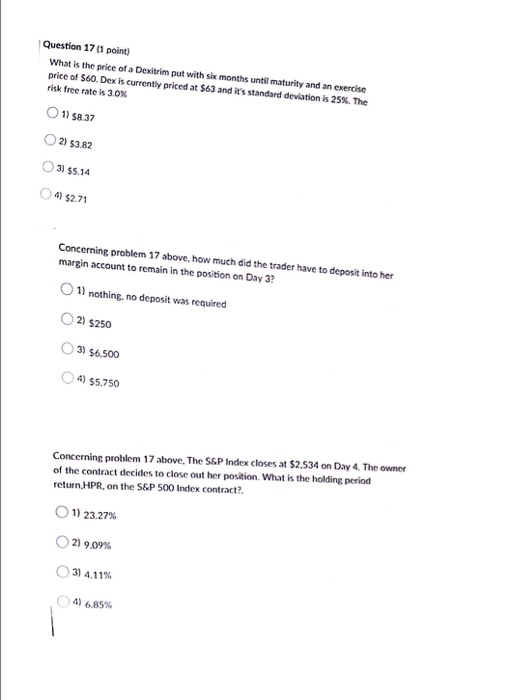

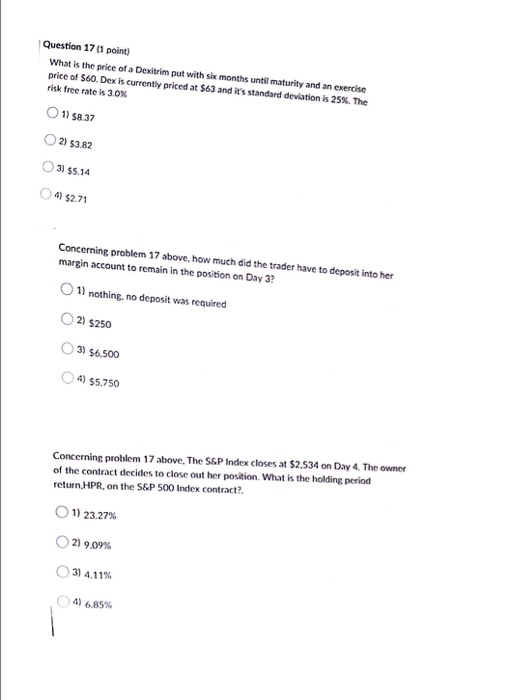

Question 17 (1 point) What is the price of a Dexitrim put with six months until maturity and an exercise price of $60. Dex is currently priced at $63 and it's standard deviation is 25%. The risk free rate is 3.0% O 11 58.37 O2) $3.82 3) $5.14 4) $2.71 Concerning problem 17 above, how much did the trader have to deposit into her margin account to remain in the position on Day 3? 1) nothing. no deposit was required 2) $250 3) $6.500 4) 55.750 Concerning problem 17 above, The S&P Index closes at $2,534 on Day 4. The owner of the contract decides to close out her position. What is the holding period return.HPR, on the S&P 500 Index contract? 11 23.27% 219.09% 31 4.11% 4) 6.85% Question 17 (1 point) What is the price of a Dexitrim put with six months until maturity and an exercise price of $60. Dex is currently priced at $63 and it's standard deviation is 25%. The risk free rate is 3.0% O 11 58.37 O2) $3.82 3) $5.14 4) $2.71 Concerning problem 17 above, how much did the trader have to deposit into her margin account to remain in the position on Day 3? 1) nothing. no deposit was required 2) $250 3) $6.500 4) 55.750 Concerning problem 17 above, The S&P Index closes at $2,534 on Day 4. The owner of the contract decides to close out her position. What is the holding period return.HPR, on the S&P 500 Index contract? 11 23.27% 219.09% 31 4.11% 4) 6.85%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started