Answered step by step

Verified Expert Solution

Question

1 Approved Answer

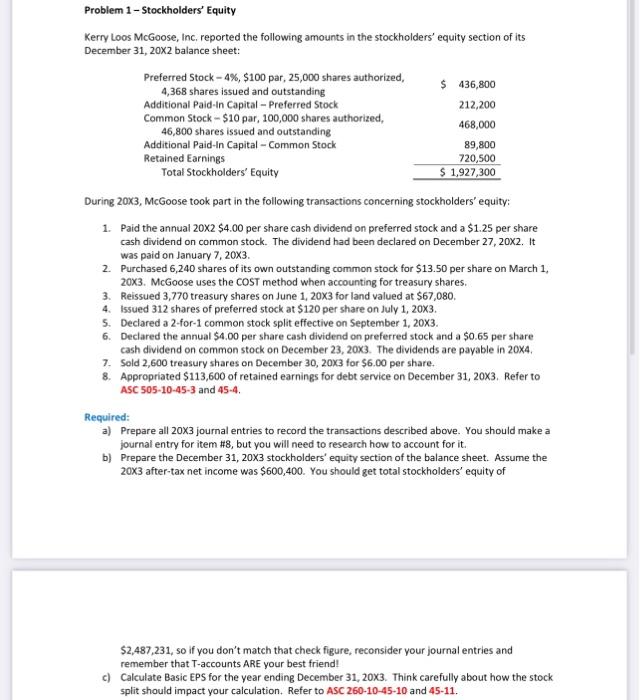

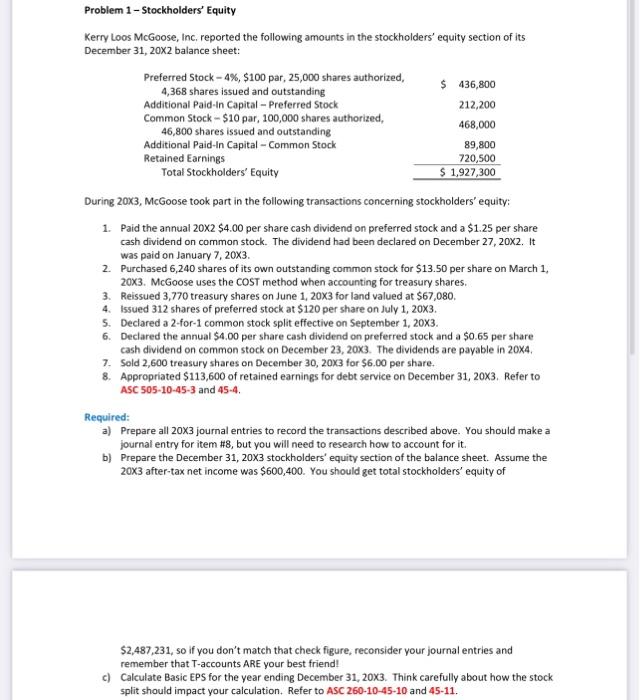

Please answer all questions with calculations! Problem 1 - Stockholders' Equity Kerry Loos McGoose, Inc. reported the following amounts in the stockholders' equity section of

Please answer all questions with calculations!

Problem 1 - Stockholders' Equity Kerry Loos McGoose, Inc. reported the following amounts in the stockholders' equity section of its December 31, 20x2 balance sheet: Preferred Stock - 4%, $100 par, 25,000 shares authorized, 4,368 shares issued and outstanding $ 436,800 Additional Paid-in Capital - Preferred Stock 212,200 Common Stock - $10 par, 100,000 shares authorized, 46,800 shares issued and outstanding 468,000 Additional Paid in Capital - Common Stock 89,800 Retained Earnings 720,500 Total Stockholders' Equity $ 1,927,300 During 20X3, McGoose took part in the following transactions concerning stockholders' equity: 1. Paid the annual 20x2 $4.00 per share cash dividend on preferred stock and a $1.25 per share cash dividend on common stock. The dividend had been declared on December 27, 20x2. It was paid on January 7, 20X3. 2. Purchased 6,240 shares of its own outstanding common stock for $13.50 per share on March 1, 20X3. McGoose uses the COST method when accounting for treasury shares. 3. Reissued 3,770 treasury shares on June 1, 20x3 for land valued at $67,080. 4. Issued 312 shares of preferred stock at $120 per share on July 1, 20x3. 5. Declared a 2-for-1 common stock split effective on September 1, 20x3. 6. Declared the annual $4.00 per share cash dividend on preferred stock and a $0.65 per share cash dividend on common stock on December 23, 20X3. The dividends are payable in 20x4. 7. Sold 2,600 treasury shares on December 30, 20X3 for $6.00 per share. 8. Appropriated $113,600 of retained earnings for debt service on December 31, 20X3. Refer to ASC 505-10-45-3 and 45-4. Required: a) Prepare all 20x3 journal entries to record the transactions described above. You should make a journal entry for item #8, but you will need to research how to account for it. b) Prepare the December 31, 20X3 stockholders' equity section of the balance sheet. Assume the 20x3 after-tax net income was $600,400. You should get total stockholders' equity of $2,487,231, so if you don't match that check figure, reconsider your journal entries and remember that T-accounts ARE your best friend! c) Calculate Basic EPS for the year ending December 31, 20X3. Think carefully about how the stock split should impact your calculation. Refer to ASC 260-10-45-10 and 45-11. Problem 1 - Stockholders' Equity Kerry Loos McGoose, Inc. reported the following amounts in the stockholders' equity section of its December 31, 20x2 balance sheet: Preferred Stock - 4%, $100 par, 25,000 shares authorized, 4,368 shares issued and outstanding $ 436,800 Additional Paid-in Capital - Preferred Stock 212,200 Common Stock - $10 par, 100,000 shares authorized, 46,800 shares issued and outstanding 468,000 Additional Paid in Capital - Common Stock 89,800 Retained Earnings 720,500 Total Stockholders' Equity $ 1,927,300 During 20X3, McGoose took part in the following transactions concerning stockholders' equity: 1. Paid the annual 20x2 $4.00 per share cash dividend on preferred stock and a $1.25 per share cash dividend on common stock. The dividend had been declared on December 27, 20x2. It was paid on January 7, 20X3. 2. Purchased 6,240 shares of its own outstanding common stock for $13.50 per share on March 1, 20X3. McGoose uses the COST method when accounting for treasury shares. 3. Reissued 3,770 treasury shares on June 1, 20x3 for land valued at $67,080. 4. Issued 312 shares of preferred stock at $120 per share on July 1, 20x3. 5. Declared a 2-for-1 common stock split effective on September 1, 20x3. 6. Declared the annual $4.00 per share cash dividend on preferred stock and a $0.65 per share cash dividend on common stock on December 23, 20X3. The dividends are payable in 20x4. 7. Sold 2,600 treasury shares on December 30, 20X3 for $6.00 per share. 8. Appropriated $113,600 of retained earnings for debt service on December 31, 20X3. Refer to ASC 505-10-45-3 and 45-4. Required: a) Prepare all 20x3 journal entries to record the transactions described above. You should make a journal entry for item #8, but you will need to research how to account for it. b) Prepare the December 31, 20X3 stockholders' equity section of the balance sheet. Assume the 20x3 after-tax net income was $600,400. You should get total stockholders' equity of $2,487,231, so if you don't match that check figure, reconsider your journal entries and remember that T-accounts ARE your best friend! c) Calculate Basic EPS for the year ending December 31, 20X3. Think carefully about how the stock split should impact your calculation. Refer to ASC 260-10-45-10 and 45-11

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started