Answered step by step

Verified Expert Solution

Question

1 Approved Answer

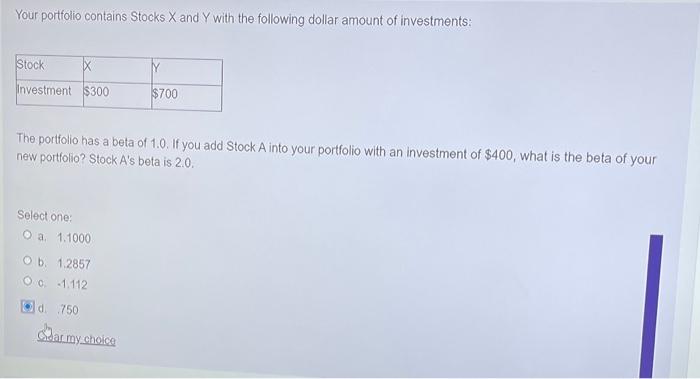

please answer all questions Your portfolio contains Stocks X and Y with the following dollar amount of investments: Stock K Investment $300 $700 The portfolio

please answer all questions

Your portfolio contains Stocks X and Y with the following dollar amount of investments: Stock K Investment $300 $700 The portfolio has a beta of 1.0. If you add Stock A into your portfolio with an investment of $400, what is the beta of your new portfolio? Stock A's beta is 2.0. Select one: O a 1.1000 Ob 1.2857 0.0 1.112 d. 750 army choice "If an asset is situated below the security market line (SML), it is overpriced." Select one: O a False Ob True "Regression technique can be used to estimate the beta of a stock. In the regression, the X variable is the historical stock return and the Y variable is the historical stock index return." True or false? Select one: O a False O b. True

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started