Answered step by step

Verified Expert Solution

Question

1 Approved Answer

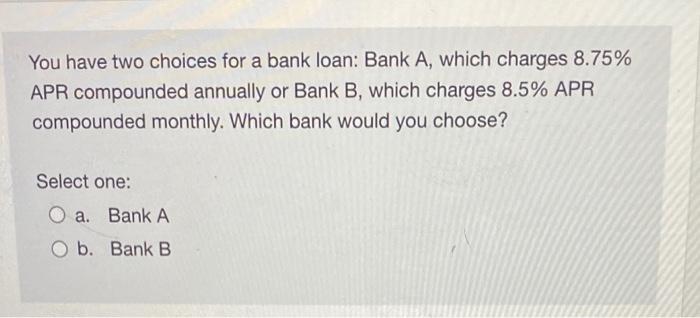

please answer all thanks You have two choices for a bank loan: Bank A, which charges 8.75% APR compounded annually or Bank B, which charges

please answer all thanks

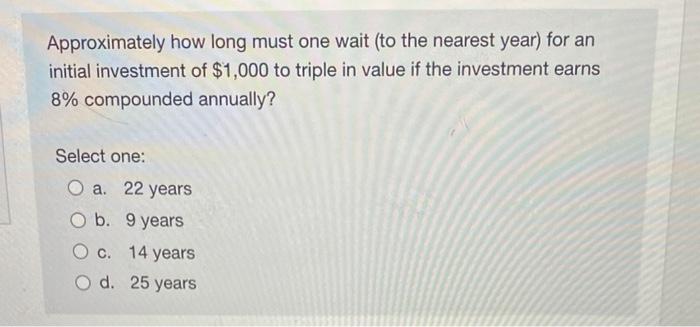

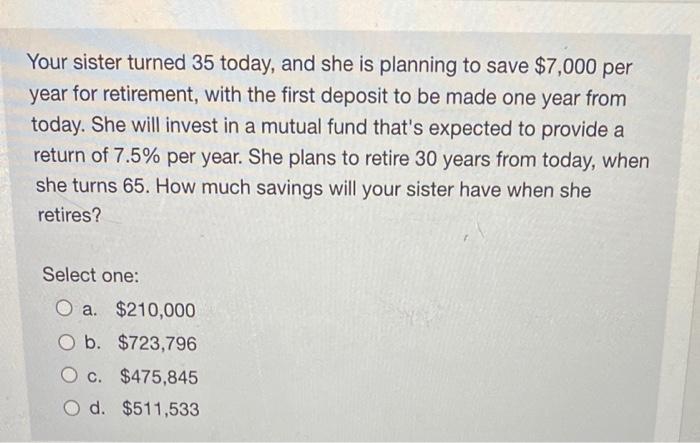

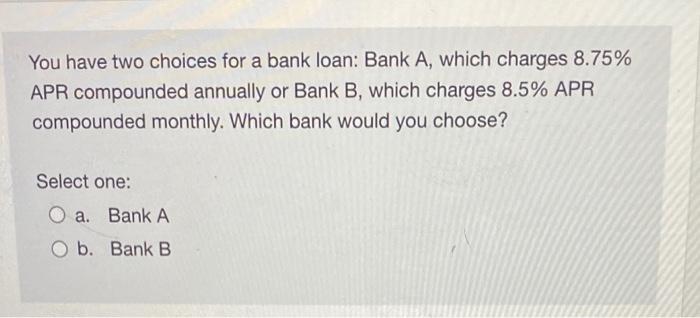

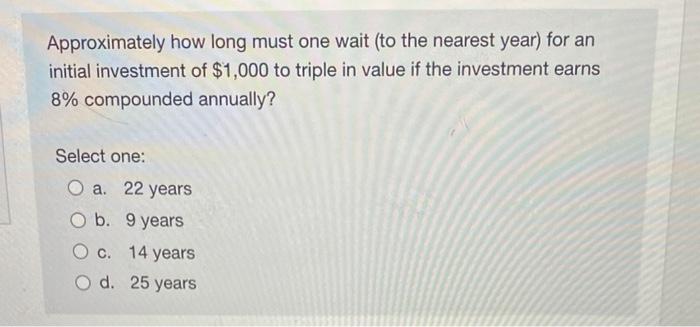

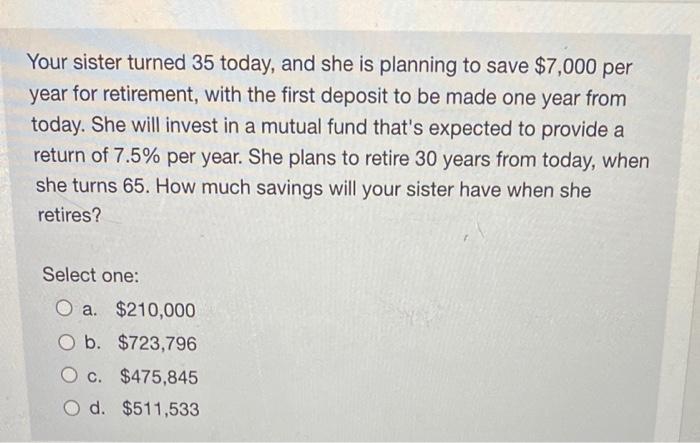

You have two choices for a bank loan: Bank A, which charges 8.75% APR compounded annually or Bank B, which charges 8.5% APR compounded monthly. Which bank would you choose? Select one: O a Bank A O b. Bank B Approximately how long must one wait (to the nearest year) for an initial investment of $1,000 to triple in value if the investment earns 8% compounded annually? Select one: O a. 22 years O b. 9 years O c. 14 years O d. 25 years Your sister turned 35 today, and she is planning to save $7,000 per year for retirement, with the first deposit to be made one year from today. She will invest in a mutual fund that's expected to provide a return of 7.5% per year. She plans to retire 30 years from today, when she turns 65. How much savings will your sister have when she retires? Select one: O a. $210,000 O b. $723,796 O c. $475,845 O d. $511,533

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started