Answered step by step

Verified Expert Solution

Question

1 Approved Answer

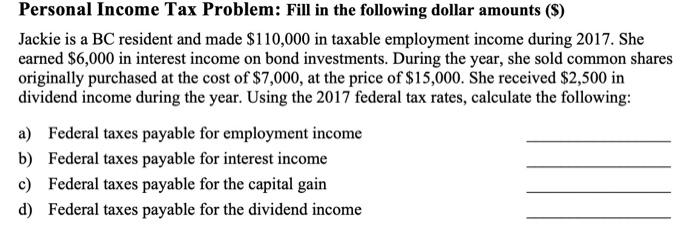

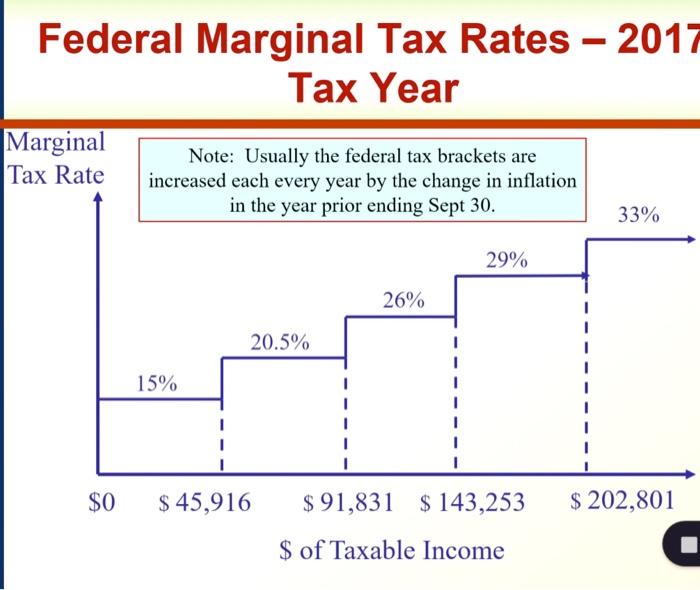

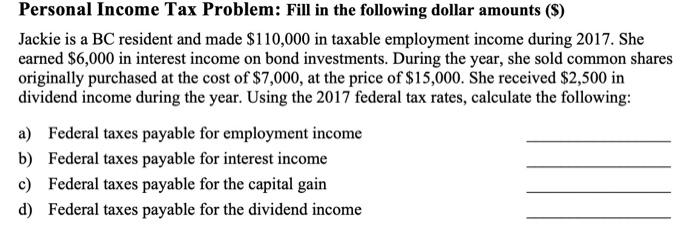

please answer all the parts and show calculations. federal tax rates are given in second picture. Personal Income Tax Problem: Fill in the following dollar

please answer all the parts and show calculations.

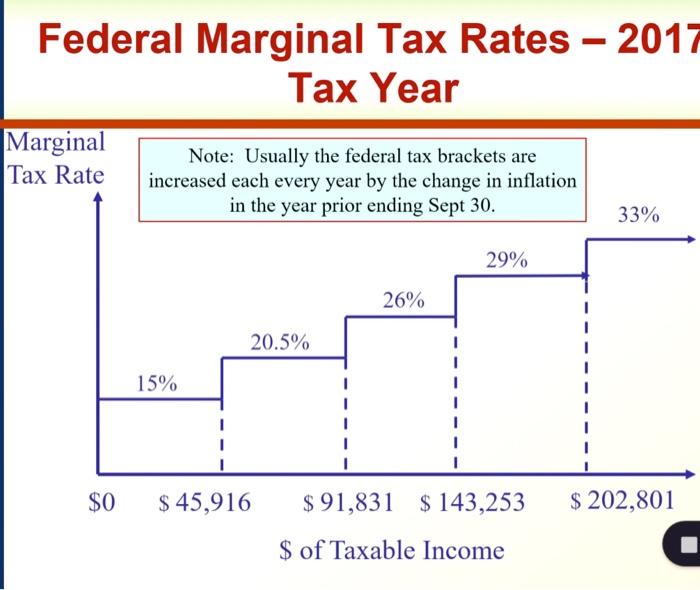

Personal Income Tax Problem: Fill in the following dollar amounts ($) Jackie is a BC resident and made $110,000 in taxable employment income during 2017. She earned $6,000 in interest income on bond investments. During the year, she sold common shares originally purchased at the cost of $7,000, at the price of $15,000. She received $2,500 in dividend income during the year. Using the 2017 federal tax rates, calculate the following: a) Federal taxes payable for employment income b) Federal taxes payable for interest income c) Federal taxes payable for the capital gain d) Federal taxes payable for the dividend income Federal Marginal Tax Rates - 2017 Tax Year Marginal Tax Rate Note: Usually the federal tax brackets are increased each every year by the change in inflation in the year prior ending Sept 30. 33% 29% 26% 20.5% 1 15% 1 1 1 1 1 1 $0 $ 45,916 $ 91,831 $ 143,253 $ 202,801 $ of Taxable Income federal tax rates are given in second picture.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started