Please answer all the question except question (a)

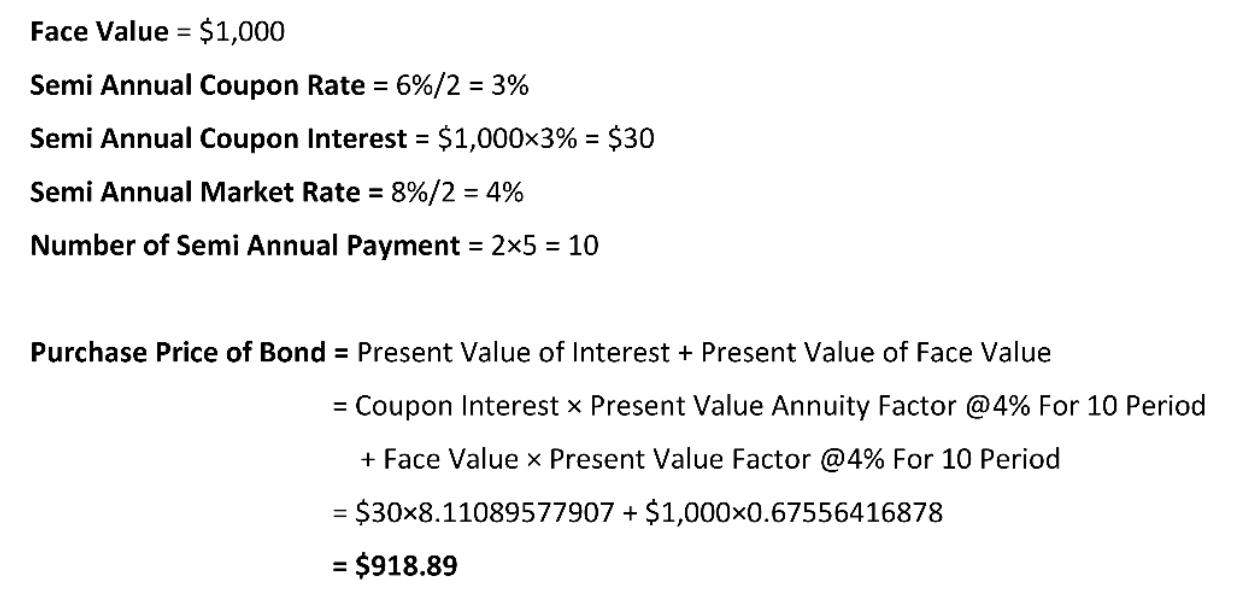

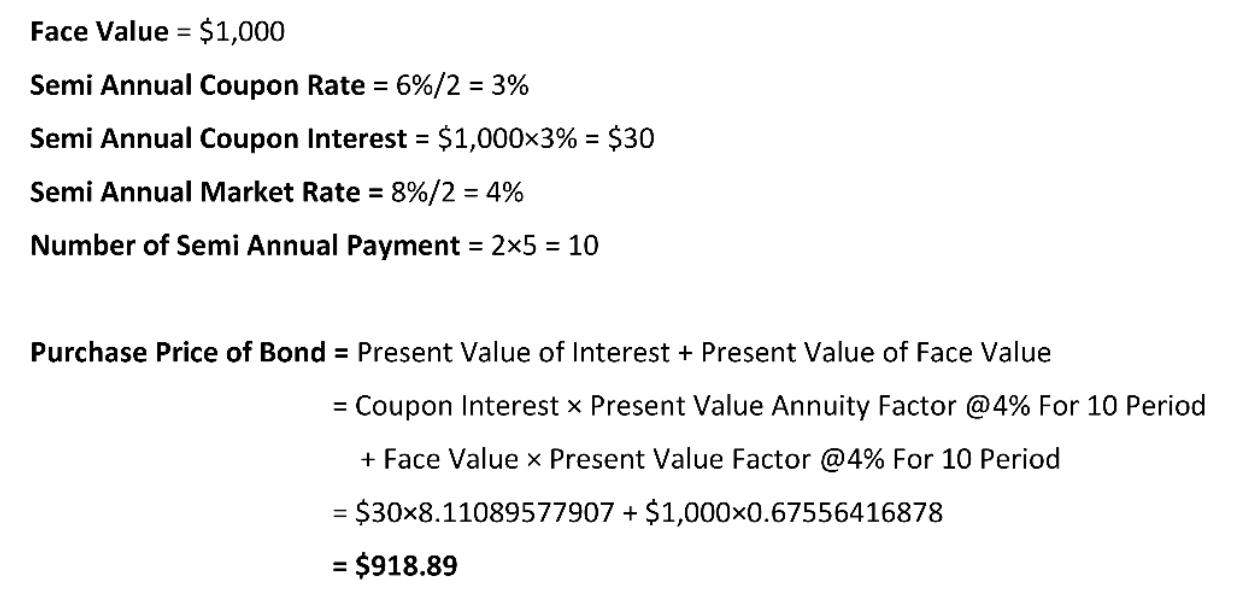

the answer of question (a) is in picture 2

Question(a):

(a) A 1,000 par value bond with a term of 5 years and a coupon rate of 6% payable semi-annually is purchased to yield 8% convertible semi-annually. Find the purchase price using Equation 4.2 (from the lecture notes). Round your answer to the nearest cent. [4] (b) Find the purchase price for the bond in part (a) using the premium-discount formula (Equation 4.3). Round your answer to the nearest cent. [3] (c) Construct the bond amortization schedule for the bond in part (a) using Example 4.6 as a reference. If you are using a spreadsheet software, you may take a screenshot of your answer and paste it together with your answers. You do not need to perform any rounding if using software. If computing by hand, you may decide how many decimal places you would like to retain. [8] (d) Find the amount of discount amortized in the 4th coupon period for the bond in part (a). Use an appropriate formula based on the bond amortization schedule in Section 4.2, and compare your answer with that from the amortization schedule. They should be the same. [3] (e) In your own words, explain how Equations 4.5 and 4.6 are obtained. Draw time diagram(s) if necessary. [6] Face Value = $1,000 Semi Annual Coupon Rate = 6%/2 = 3% Semi Annual Coupon Interest = $1,0003% = $30 Semi Annual Market Rate = 8%/2 = 4% Number of Semi Annual Payment = 2x5 = 10 Purchase Price of Bond = Present Value of Interest + Present Value of Face Value Coupon Interest x Present Value Annuity Factor @4% For 10 Period + Face Value x Present Value Factor @4% For 10 Period = $308.11089577907 + $1,000x0.67556416878 = $918.89 = (a) A 1,000 par value bond with a term of 5 years and a coupon rate of 6% payable semi-annually is purchased to yield 8% convertible semi-annually. Find the purchase price using Equation 4.2 (from the lecture notes). Round your answer to the nearest cent. [4] (b) Find the purchase price for the bond in part (a) using the premium-discount formula (Equation 4.3). Round your answer to the nearest cent. [3] (c) Construct the bond amortization schedule for the bond in part (a) using Example 4.6 as a reference. If you are using a spreadsheet software, you may take a screenshot of your answer and paste it together with your answers. You do not need to perform any rounding if using software. If computing by hand, you may decide how many decimal places you would like to retain. [8] (d) Find the amount of discount amortized in the 4th coupon period for the bond in part (a). Use an appropriate formula based on the bond amortization schedule in Section 4.2, and compare your answer with that from the amortization schedule. They should be the same. [3] (e) In your own words, explain how Equations 4.5 and 4.6 are obtained. Draw time diagram(s) if necessary. [6] Face Value = $1,000 Semi Annual Coupon Rate = 6%/2 = 3% Semi Annual Coupon Interest = $1,0003% = $30 Semi Annual Market Rate = 8%/2 = 4% Number of Semi Annual Payment = 2x5 = 10 Purchase Price of Bond = Present Value of Interest + Present Value of Face Value Coupon Interest x Present Value Annuity Factor @4% For 10 Period + Face Value x Present Value Factor @4% For 10 Period = $308.11089577907 + $1,000x0.67556416878 = $918.89 =