Answered step by step

Verified Expert Solution

Question

1 Approved Answer

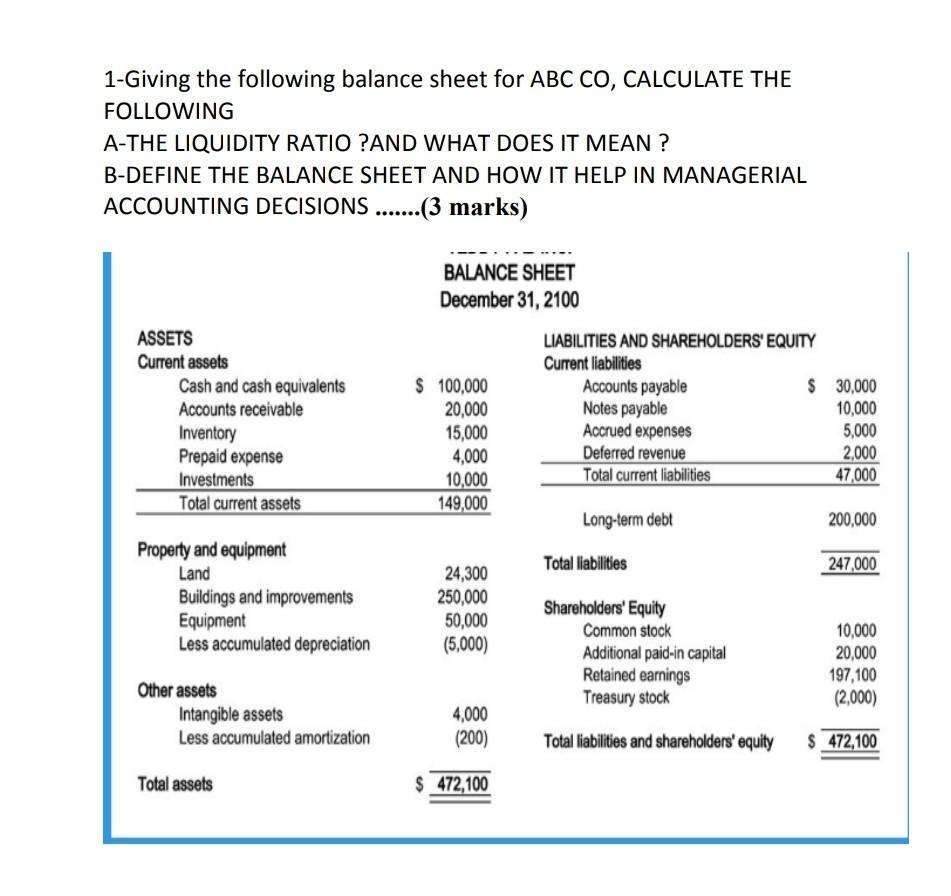

please answer all the questions 1-Giving the following balance sheet for ABC CO, CALCULATE THE FOLLOWING A-THE LIQUIDITY RATIO ?AND WHAT DOES IT MEAN ?

please answer all the questions

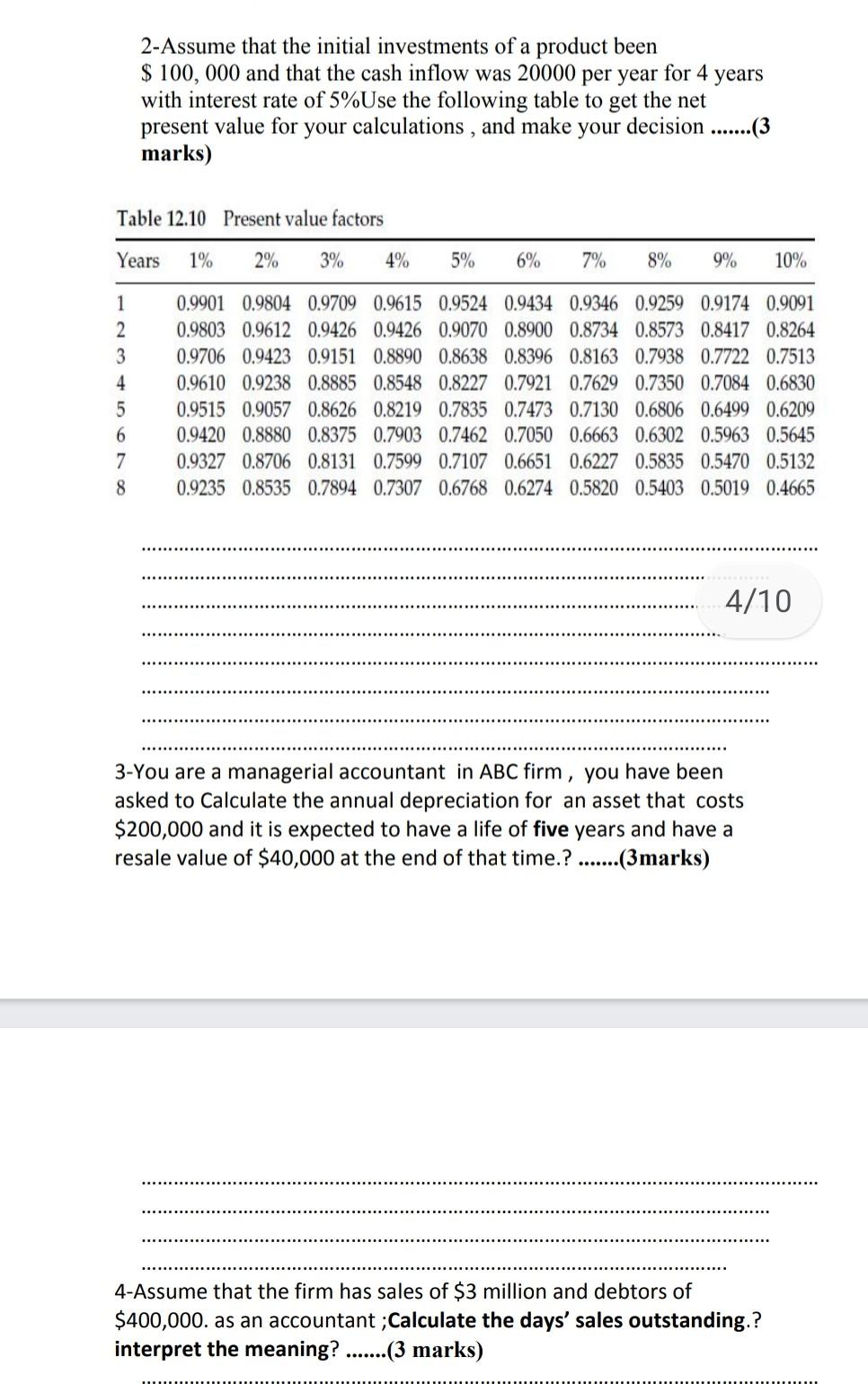

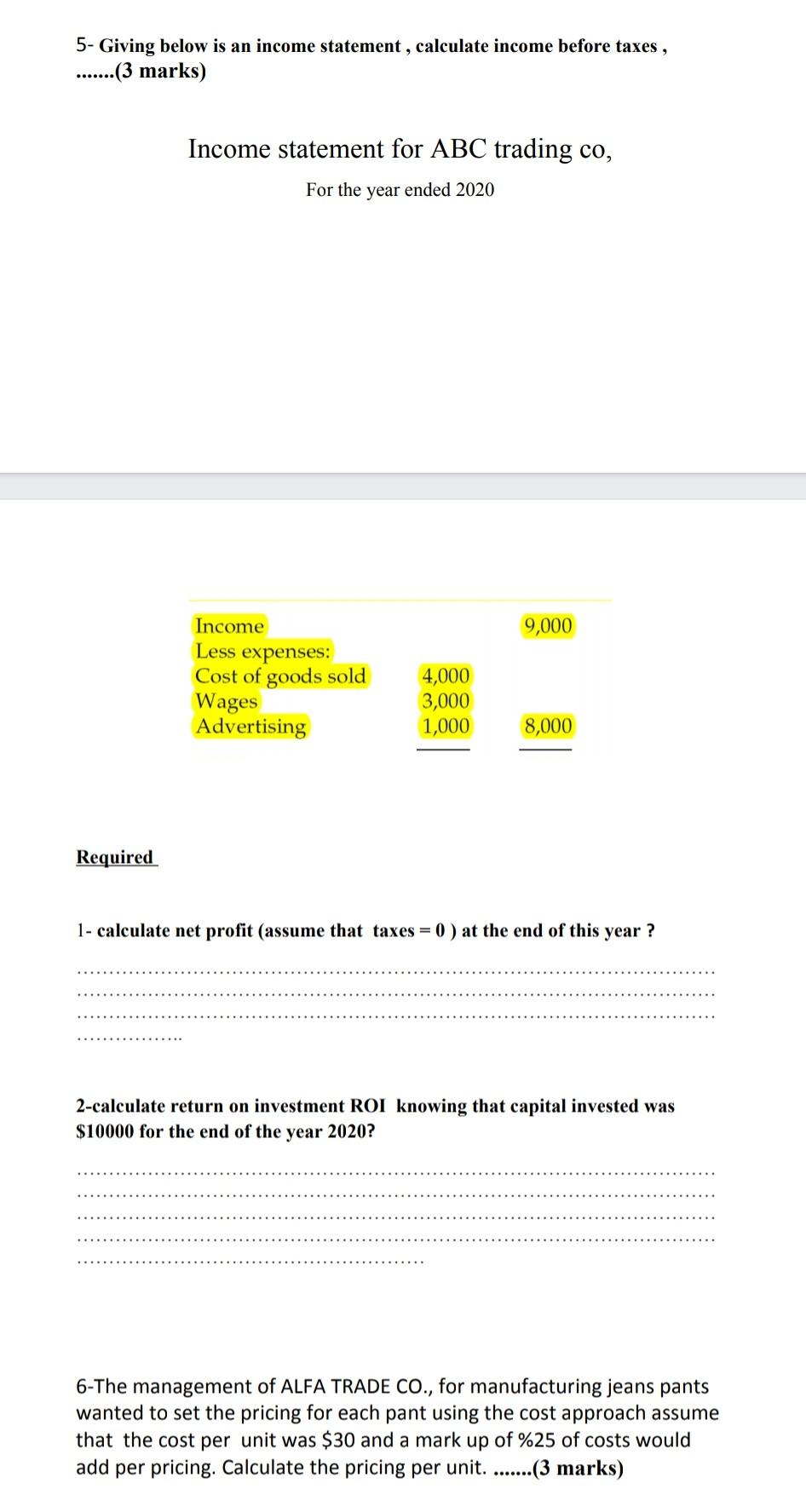

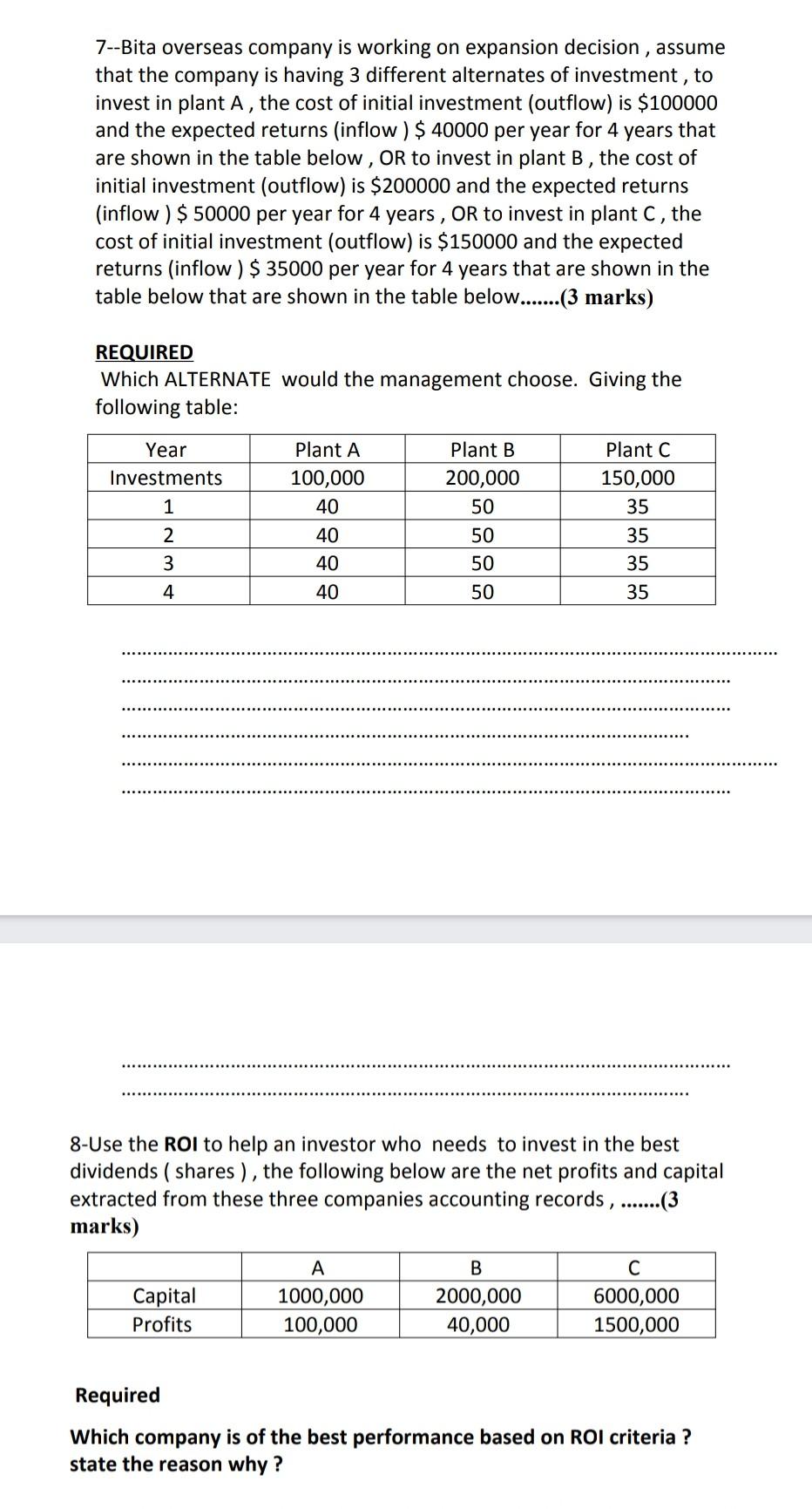

1-Giving the following balance sheet for ABC CO, CALCULATE THE FOLLOWING A-THE LIQUIDITY RATIO ?AND WHAT DOES IT MEAN ? B-DEFINE THE BALANCE SHEET AND HOW IT HELP IN MANAGERIAL ACCOUNTING DECISIONS .......(3 marks) BALANCE SHEET December 31, 2100 ASSETS Current assets Cash and cash equivalents Accounts receivable Inventory Prepaid expense Investments Total current assets $ 100,000 20,000 15,000 4,000 10,000 149,000 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable $ 30,000 Notes payable 10,000 Accrued expenses 5,000 Deferred revenue 2,000 Total current liabilities 47,000 Long-term debt 200,000 Total liabilities 247,000 Property and equipment Land Buildings and improvements Equipment Less accumulated depreciation 24,300 250,000 50,000 (5,000) Shareholders' Equity Common stock Additional paid-in capital Retained earnings Treasury stock 10,000 20,000 197,100 (2,000) Other assets Intangible assets Less accumulated amortization 4,000 (200) Total liabilities and shareholders' equity $ 472,100 Total assets $ 472,100 2-Assume that the initial investments of a product been $ 100,000 and that the cash inflow was 20000 per year for 4 years with interest rate of 5%Use the following table to get the net present value for your calculations, and make your decision .......(3 marks) Table 12.10 Present value factors Years 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 2 3 4 5 6 7 0.9901 0.9804 0.9709 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9803 0.9612 0.9426 0.9426 0.9070 0.8900 0.8734 0.8573 0.8417 0.8264 0.9706 0.9423 0.9151 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.9610 0.9238 0.8885 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.9515 0.9057 0.8626 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.9420 0.8880 0.8375 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.9327 0.8706 0.8131 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.9235 0.8535 0.7894 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 8 4/10 3-You are a managerial accountant in ABC firm, you have been asked to Calculate the annual depreciation for an asset that costs $200,000 and it is expected to have a life of five years and have a resale value of $40,000 at the end of that time.? .......(3marks) 4-Assume that the firm has sales of $3 million and debtors of $400,000. as an accountant; Calculate the days' sales outstanding.? interpret the meaning? ....... (3 marks) 5- Giving below is an income statement, calculate income before taxes, .......(3 marks) Income statement for ABC trading co, For the year ended 2020 9,000 Income Less expenses: Cost of goods sold Wages Advertising 4,000 3,000 1,000 8,000 Required 1- calculate net profit (assume that taxes = 0 ) at the end of this year ? 2-calculate return on investment ROI knowing that capital invested was $10000 for the end of the year 2020? 6-The management of ALFA TRADE CO., for manufacturing jeans pants wanted to set the pricing for each pant using the cost approach assume that the cost per unit was $30 and a mark up of %25 of costs would add per pricing. Calculate the pricing per unit. .......(3 marks) 7--Bita overseas company is working on expansion decision, assume that the company is having 3 different alternates of investment, to invest in plant A, the cost of initial investment (outflow) is $100000 and the expected returns (inflow ) $ 40000 per year for 4 years that are shown in the table below , OR to invest in plant B, the cost of initial investment (outflow) is $200000 and the expected returns (inflow ) $ 50000 per year for 4 years , OR to invest in plant C, the cost of initial investment (outflow) is $150000 and the expected returns (inflow ) $ 35000 per year for 4 years that are shown in the table below that are shown in the table below.......(3 marks) REQUIRED Which ALTERNATE would the management choose. Giving the following table: Year Investments 1 Plant A 100,000 40 40 40 Plant B 200,000 50 50 50 50 Plant C 150,000 35 35 35 2 3 4 40 35 8-Use the ROI to help an investor who needs to invest in the best dividends ( shares ), the following below are the net profits and capital extracted from these three companies accounting records , .......(3 marks) B Capital Profits A 1000,000 100,000 2000,000 40,000 C 6000,000 1500,000 Required Which company is of the best performance based on ROI criteria ? state the reason whyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started