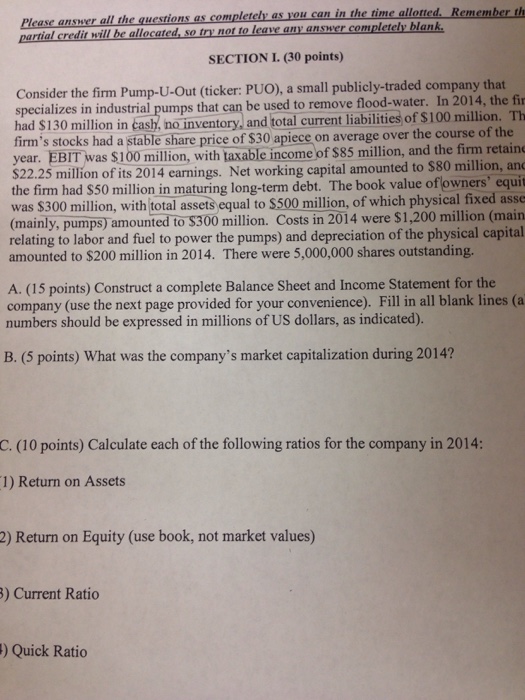

Please answer all the questions as completely as you can in the time allotted. Remember the partial credit will be allocated, so try not to leave any answer completely blank. Consider the firm Pump-U-Out (ticker: PUO). a small publicly-traded company that specializes in industrial pumps that can be used to remove flood-water. In 2014, the firm had Si30 million in cash, no inventory, and total current liabilities of $100 million. The firm's stocks had a stable share price of $30 apiece on average over the course of the year. EBIT was $100 million, with taxable income of $85 million, and the firm retain $22.25 million of its 2014 earnings. Net working capital amounted to S80 million, ant the firm had $50 million in maturing long-term debt. The book value of owners was $300 million, with total assets equal to $500 million, of which physical fixed assets (mainly, pumps) amounted to S300 million. Costs in 2014 were $1,200 million (main relating to labor and fuel to power the pumps) and depreciation of the physical capital amounted to $200 million in 2014. There were 5,000,000 shares outstanding. Construct a complete Balance Sheet and Income Statement for the company (use the next page provided for your convenience). Fill in all blank lines (a numbers should be expressed in millions of US dollars, as indicated). What was the company's market capitalization during 2014? Calculate each of the following ratios for the company in 2014: Return on Assets Return on Equity (use book, not market values) Current Ratio Quick Ratio Please answer all the questions as completely as you can in the time allotted. Remember the partial credit will be allocated, so try not to leave any answer completely blank. Consider the firm Pump-U-Out (ticker: PUO). a small publicly-traded company that specializes in industrial pumps that can be used to remove flood-water. In 2014, the firm had Si30 million in cash, no inventory, and total current liabilities of $100 million. The firm's stocks had a stable share price of $30 apiece on average over the course of the year. EBIT was $100 million, with taxable income of $85 million, and the firm retain $22.25 million of its 2014 earnings. Net working capital amounted to S80 million, ant the firm had $50 million in maturing long-term debt. The book value of owners was $300 million, with total assets equal to $500 million, of which physical fixed assets (mainly, pumps) amounted to S300 million. Costs in 2014 were $1,200 million (main relating to labor and fuel to power the pumps) and depreciation of the physical capital amounted to $200 million in 2014. There were 5,000,000 shares outstanding. Construct a complete Balance Sheet and Income Statement for the company (use the next page provided for your convenience). Fill in all blank lines (a numbers should be expressed in millions of US dollars, as indicated). What was the company's market capitalization during 2014? Calculate each of the following ratios for the company in 2014: Return on Assets Return on Equity (use book, not market values) Current Ratio Quick Ratio