Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 11. If the exchange is with commercial substance * (1 Point) O Only gain must be recognized Gain

please answer all the questions immediately thankyou

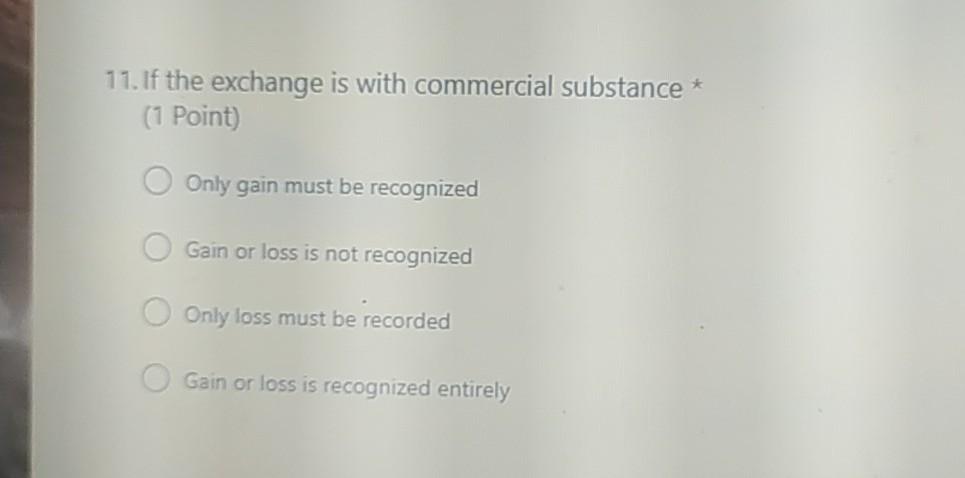

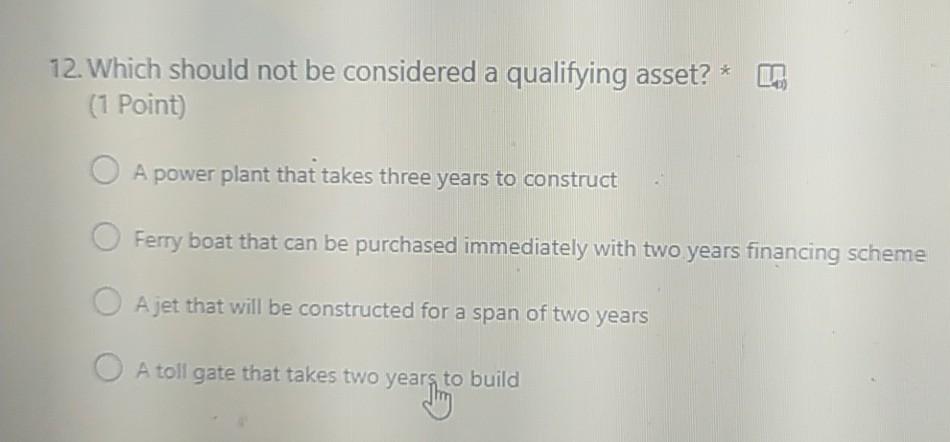

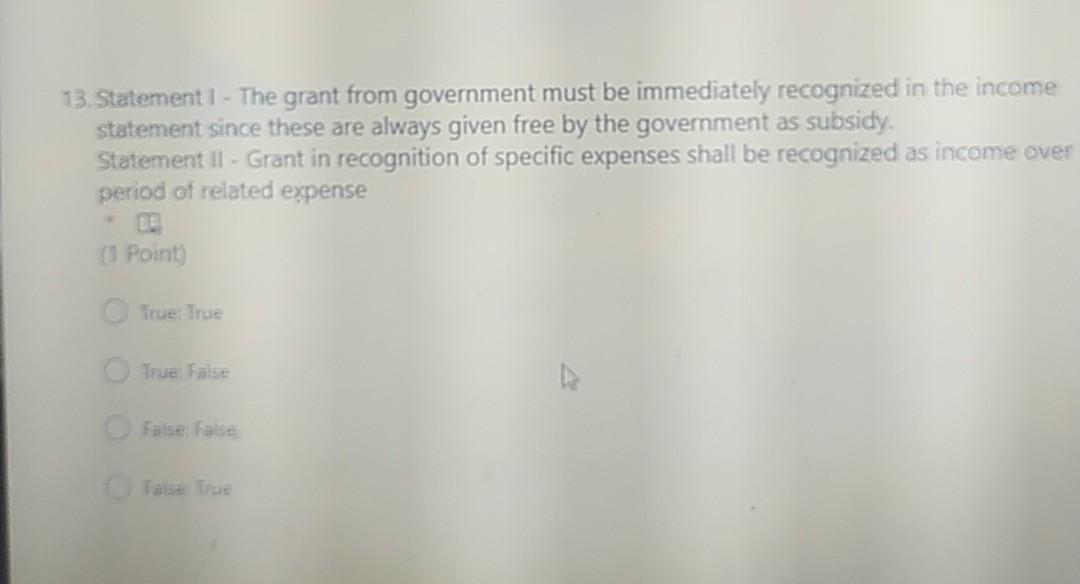

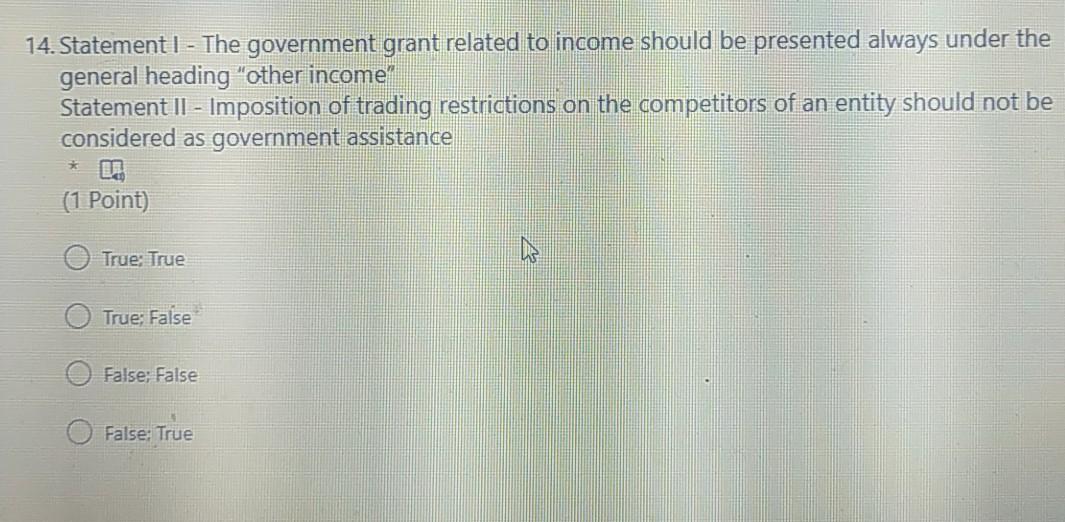

11. If the exchange is with commercial substance * (1 Point) O Only gain must be recognized Gain or loss is not recognized Only loss must be recorded Gain or loss is recognized entirely 12. Which should not be considered a qualifying asset? * On (1 Point) O A power plant that takes three years to construct O Ferry boat that can be purchased immediately with two years financing scheme O A jet that will be constructed for a span of two years O A toll gate that takes two years to build 13. Statement 1 - The grant from government must be immediately recognized in the income statement since these are always given free by the government as subsidy. Statement II - Grant in recognition of specific expenses shall be recognized as income over period of related expense (1 Point) True True True False False false Faisa True 14. Statement 1 - The government grant related to income should be presented always under the general heading "other income Statement ll - Imposition of trading restrictions on the competitors of an entity should not be considered as government assistance (1 Point) True: True True: False False; False False: TrueStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started