Answered step by step

Verified Expert Solution

Question

1 Approved Answer

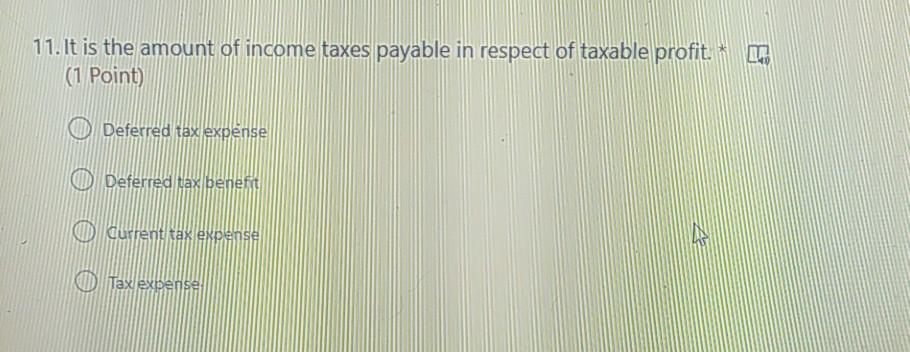

please answer all the questions immediately thankyou 11. It is the amount of income taxes payable in respect of taxable profit * (1 Point) Deferred

please answer all the questions immediately thankyou

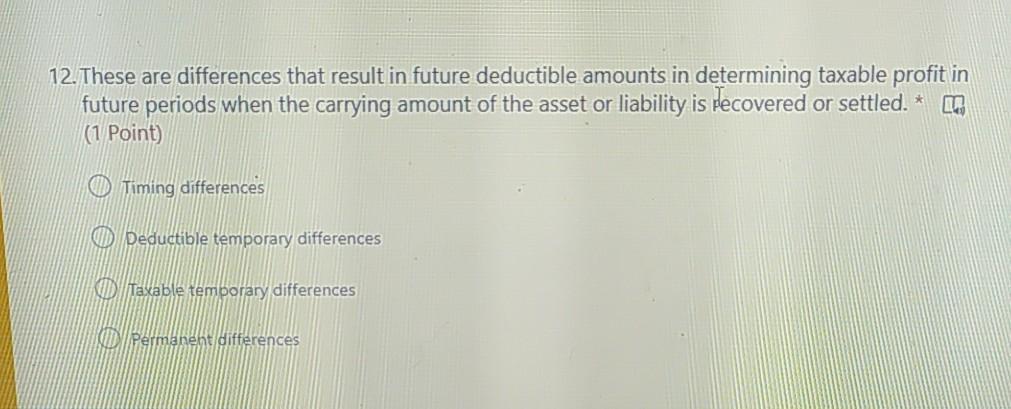

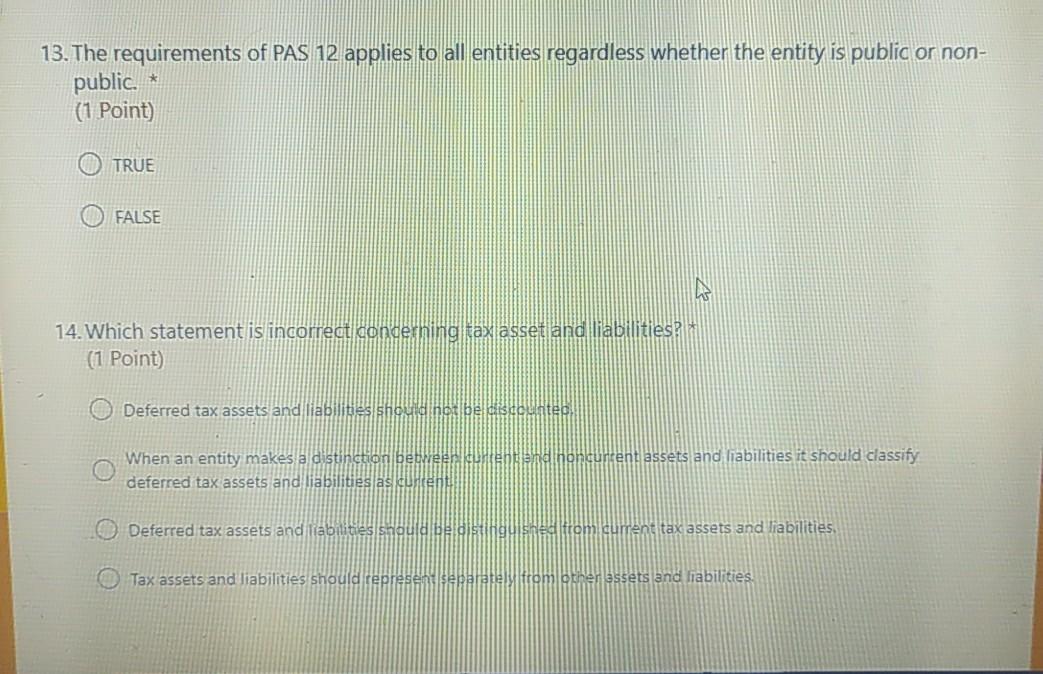

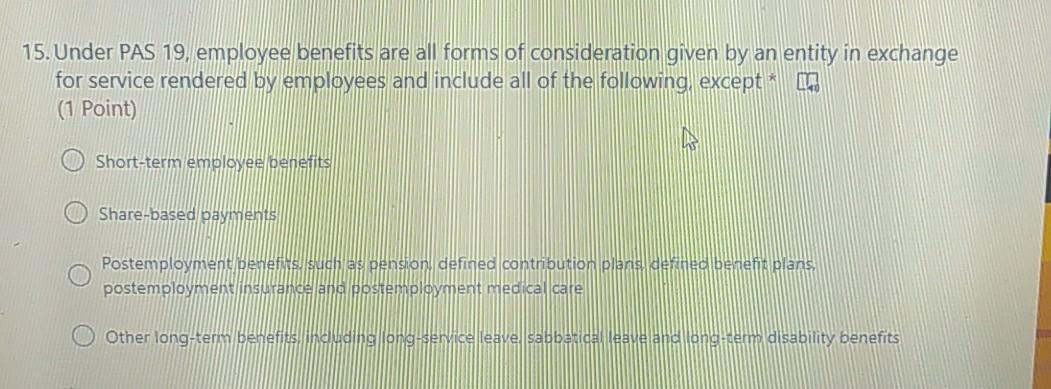

11. It is the amount of income taxes payable in respect of taxable profit * (1 Point) Deferred tax expense Deferred tax benefit Current tax expense Z Tax expense 12. These are differences that result in future deductible amounts in determining taxable profit in future periods when the carrying amount of the asset or liability is recovered or settled. * (1 Point) Timing differences O Deductible temporary differences Taxable temporary differences Permanent differences 13. The requirements of PAS 12 applies to all entities regardless whether the entity is public or non- public (1 Point) TRUE FALSE 14. Which statement is incorrect concerning tax asset and liabilities (1 Point) Deferred tax assets and liabilities should not be distentes When an entity makes a distinction between cuentendihoncurrent assets and liabilities it should classify deferred tax assets and liabilities as content Deferred tax assets and liabilities should be distinguished from current tax assets and liabilities Tax assets and liabilities should represente separately from other assets and liabilities 15. Under PAS 19, employee benefits are all forms of consideration given by an entity in exchange for service rendered by employees and include all of the following except (1 Point) IN Short-term employee benefits Share-based payments Postemployment benefits, such as pension, defined contribution plans denned benefit plans, postemployment insurance and postemployment medical care Other long-term benefits, including long-service leave sabbasical leave and long-term disability benefitsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started