Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer all the questions immediately thankyou 13 On March 1, 2019 the total partnership capital is To input answers, kindly follow the sample format

please answer all the questions immediately thankyou

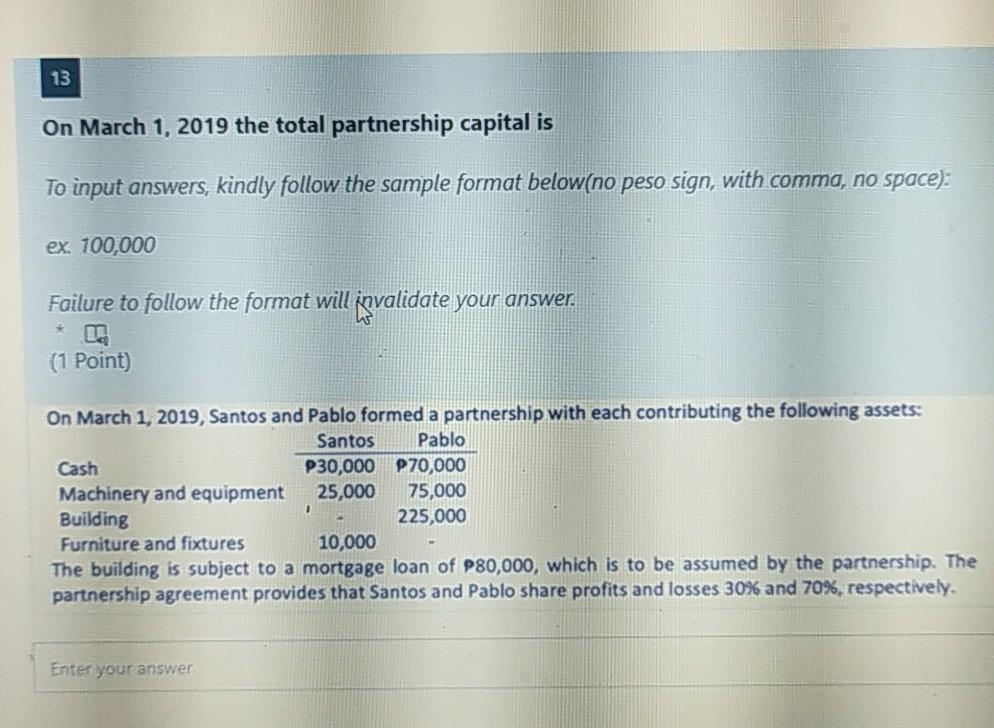

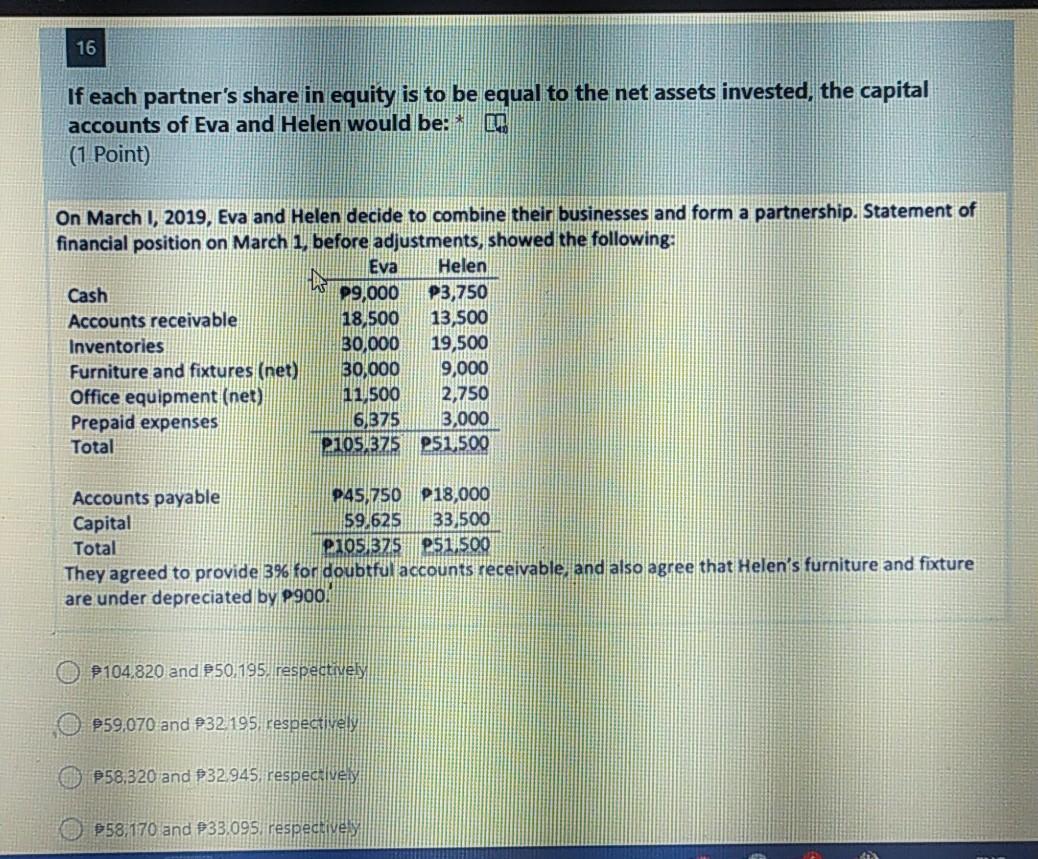

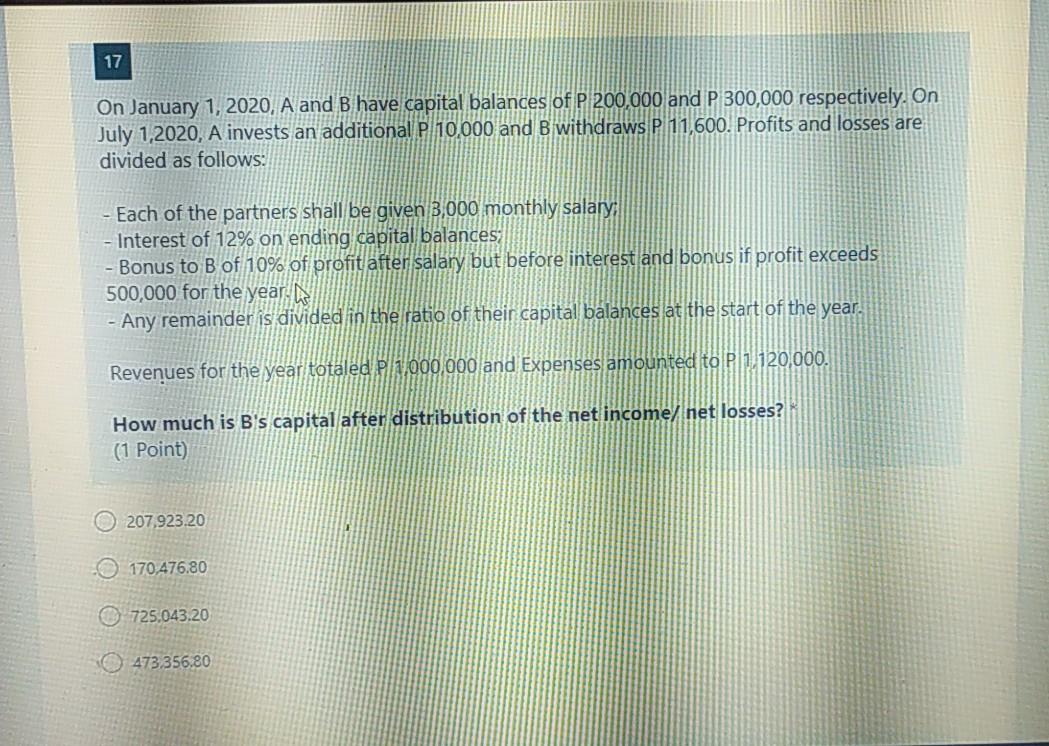

13 On March 1, 2019 the total partnership capital is To input answers, kindly follow the sample format below(no peso sign, with comma, no space): ex. 700,000 Failure to follow the format will invalidate your answer . (1 Point) On March 1, 2019, Santos and Pablo formed a partnership with each contributing the following assets: Santos Pablo Cash P30,000 P70,000 Machinery and equipment 25,000 75,000 Building 225,000 Furniture and fixtures 10,000 The building is subject to a mortgage loan of P80,000, which is to be assumed by the partnership. The partnership agreement provides that Santos and Pablo share profits and losses 30% and 70%, respectively. . Enter your answer 16 If each partner's share in equity is to be equal to the net assets invested, the capital accounts of Eva and Helen would be: (1 Point) On March 1, 2019, Eva and Helen decide to combine their businesses and form a partnership. Statement of financial position on March 1, before adjustments, showed the following: Eva Helen Cash 29,000 P3,750 Accounts receivable 18,500 13,500 Inventories 30,000 19,500 Furniture and fixtures (net) 30,000 9,000 Office equipment (net) 11.500 2,750 Prepaid expenses 6,375 3,000 Total 2105_375 251.500 Accounts payable 945,750 P18,000 Capital 59,625 33,500 Total P1051375 25 1,500 They agreed to provide 3% for doubtful accounts receivable and also agree that Helen's furniture and fixture are under depreciated by P900 104,820 and 250, 195, respectively 259,070 and 32 195, respectively 258.320 and $32.945 respectively 58,170 and P33.095 respective 17 On January 1, 2020, A and B have capital balances of P 200,000 and P 300,000 respectively. On July 1,2020, A invests an additional P 10,000 and B withdraws P 11,600. Profits and losses are divided as follows: - Each of the partners shall be given 3,000 monthly salary, - Interest of 12% on ending capital balances - Bonus to B of 10% of profit after salary but before interest and bonus if profit exceeds 500,000 for the year: - Any remainder is divided in the ratio of their capital balances at the start of the year. Revenues for the year totaled P1,000,000 and Expenses amounted to P 1.120,000. How much is B's capital after distribution of the net income, net losses? (1 Point) 207,923.20 170,476.80 725.043.20 473,356,80Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started