Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all the questions, thanks Jepson Electronic Center began July with 90 units of merchandise inventory that cost $70 each. During July, the store

Please answer all the questions, thanks

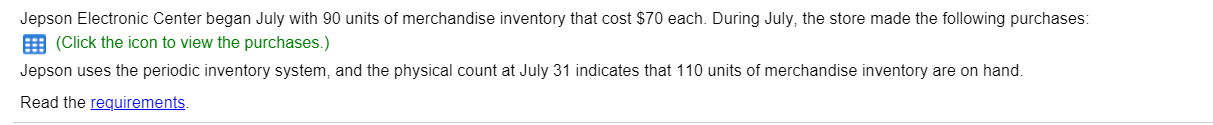

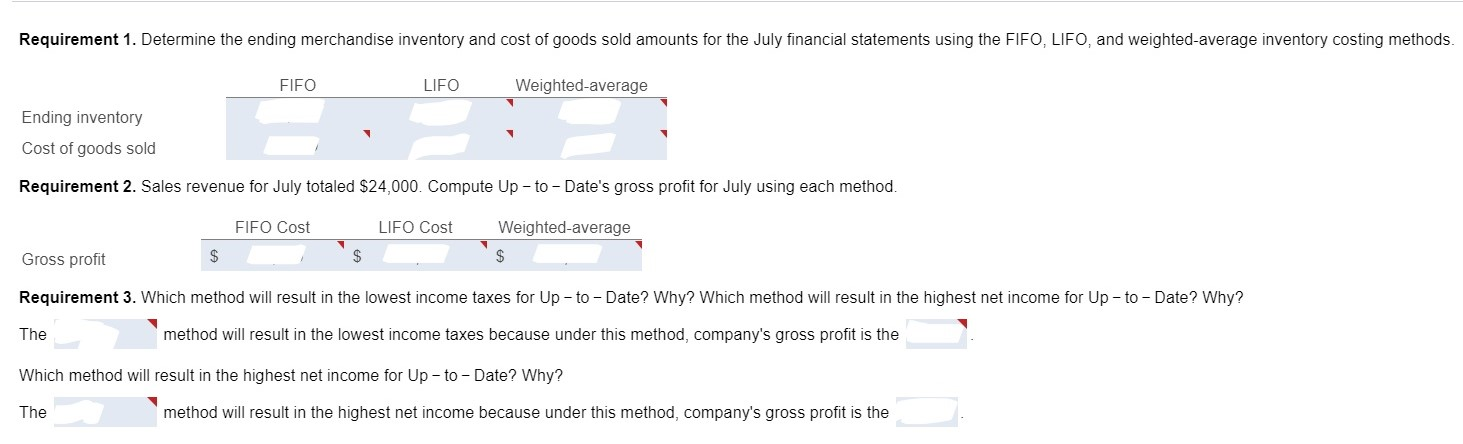

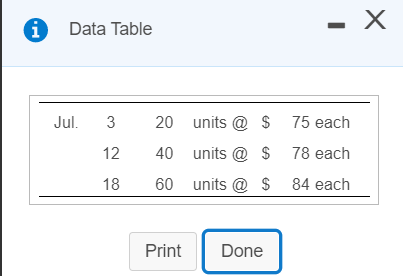

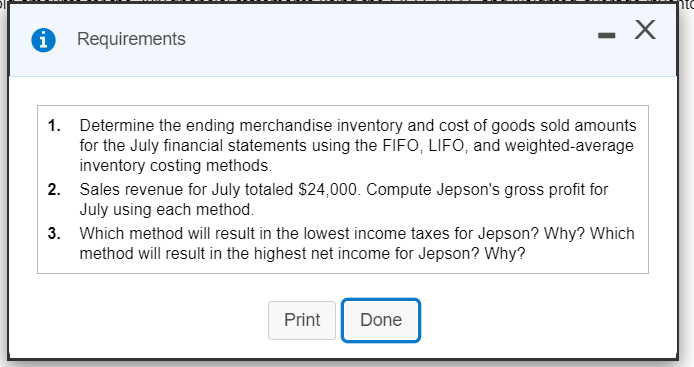

Jepson Electronic Center began July with 90 units of merchandise inventory that cost $70 each. During July, the store made the following purchases E: (Click the icon to view the purchases.) Jepson uses the periodic inventory system, and the physical count at July 31 indicates that 110 units of merchandise inventory are on hand. Read the requirements Requirement 1. Determine the ending merchandise inventory and cost of goods sold amounts for the July financial statements using the FIFO, LIFO, and weighted average inventory costing methods FIFO LIFO Weighted average Ending inventory Cost of goods sold Requirement 2. Sales revenue for July totaled $24,000. Compute Up-to-Date's gross profit for July using each method. FIFO Cost LIFO Cost Weighted average Gross profit $ Requirement 3. Which method will result in the lowest income taxes for Up-to-Date? Why? Which method will result in the highest net income for Up-to-Date? Why? The method will result in the lowest income taxes because under this method, company's gross profit is the Which method will result in the highest net income for Up-to-Date? Why? The method will result in the highest net income because under this method, company's gross profit is the i Data Table X Jul. 3 12 20 units @ $ 75 each 40 units @ $ 78 each 60 units @ $ 84 each 18 Print Done nte Requirements i 1. Determine the ending merchandise inventory and cost of goods sold amounts for the July financial statements using the FIFO, LIFO, and weighted average inventory costing methods. 2. Sales revenue for July totaled $24,000. Compute Jepson's gross profit for July using each method. 3. Which method will result in the lowest income taxes for Jepson? Why? Which method will result in the highest net income for Jepson? Why? Print DoneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started