Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer all these questions and explain why Secret Trails received payment in full within the credit period for horse boarding for $1,300 plus 4%

Please answer all these questions and explain why

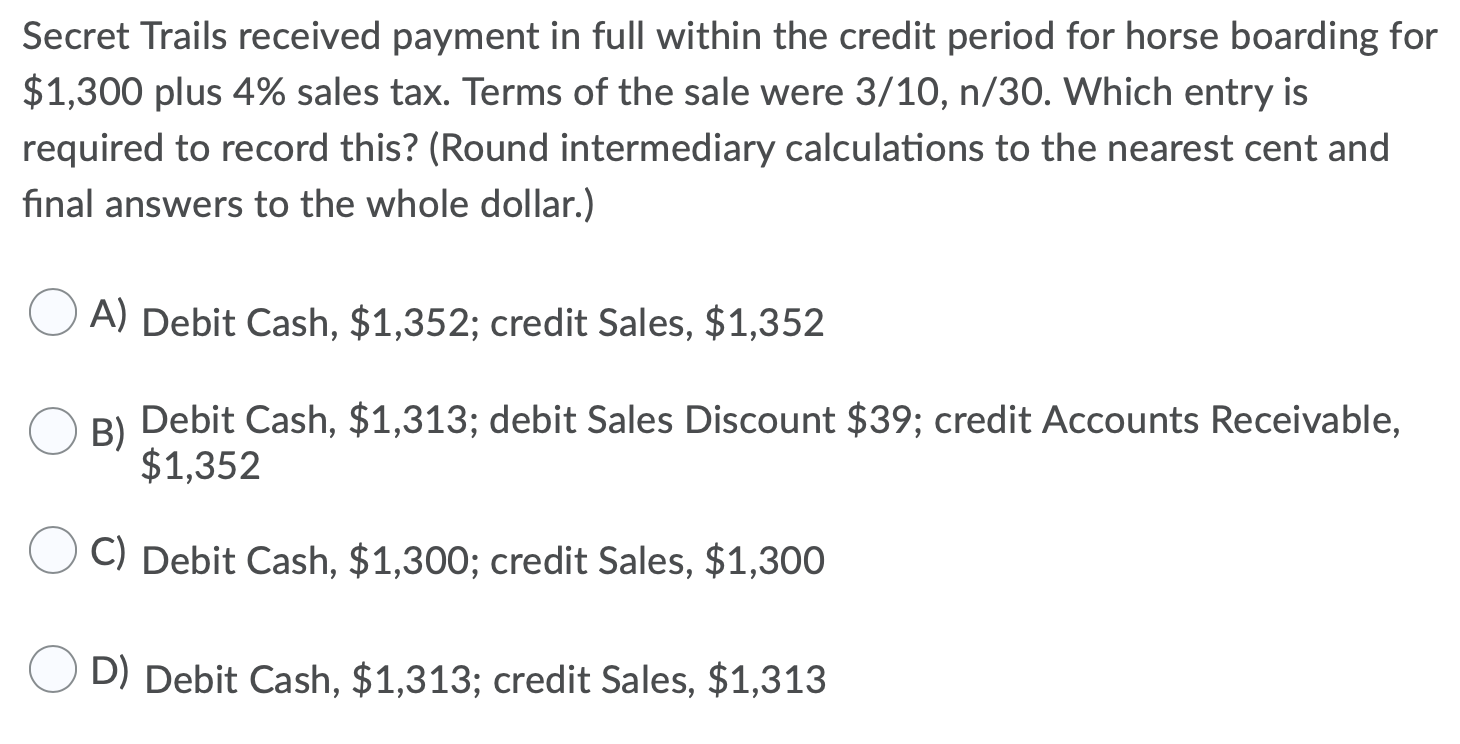

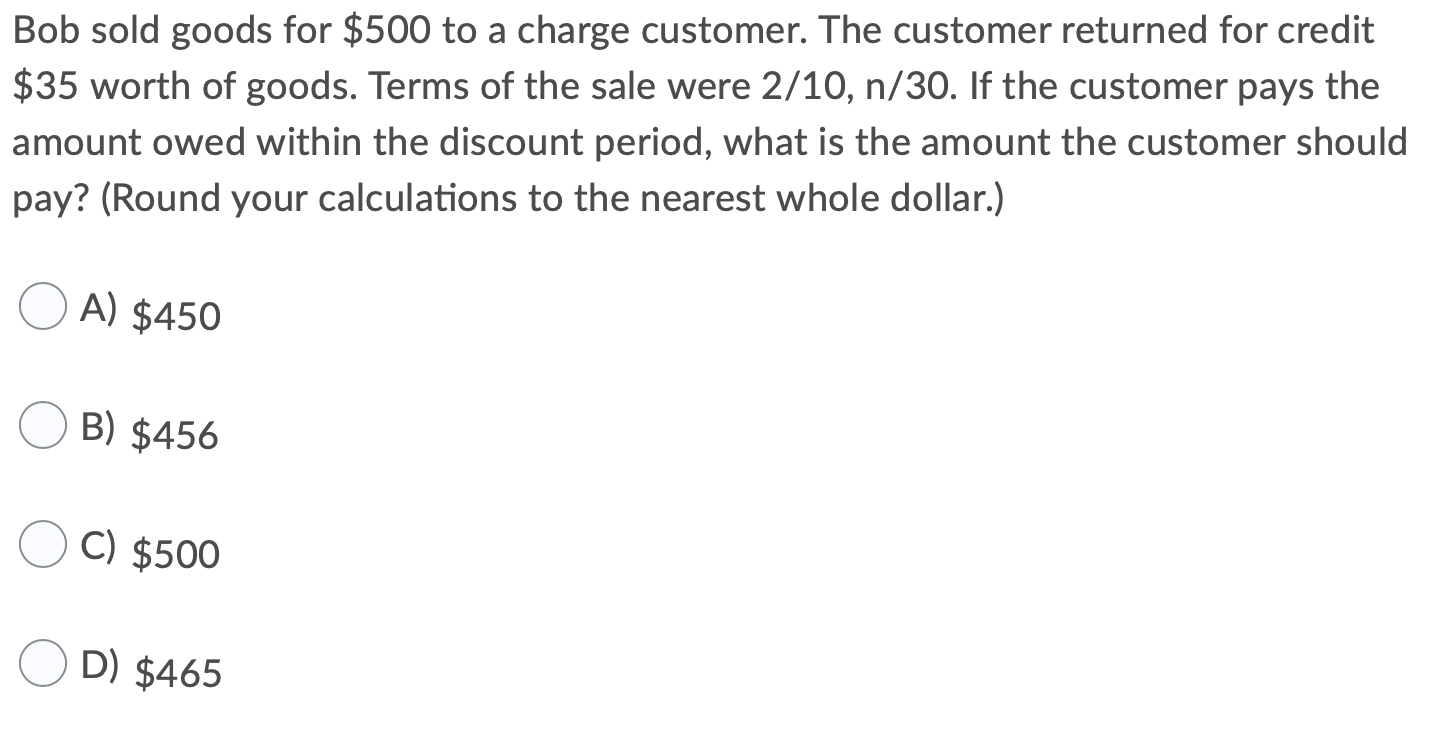

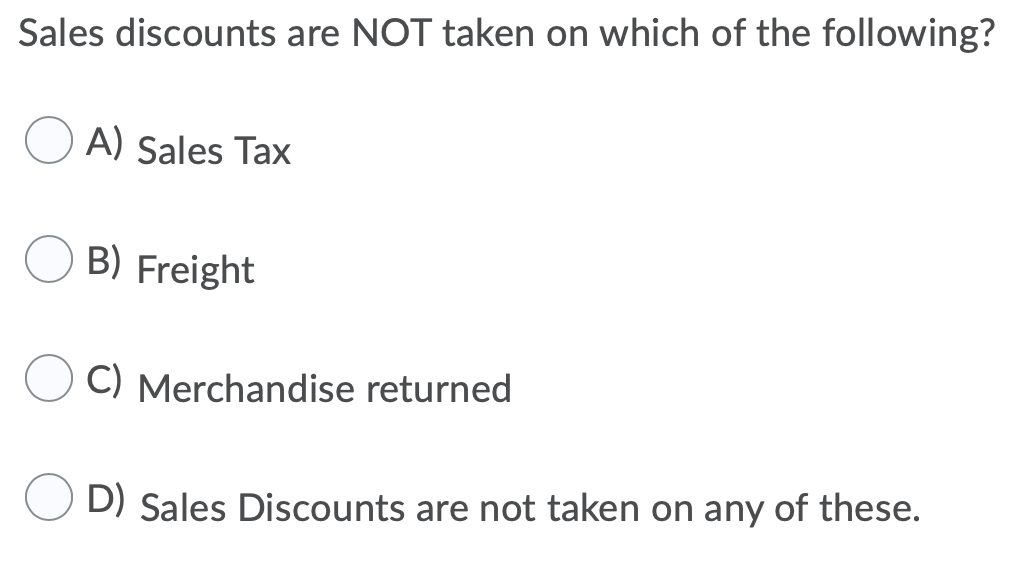

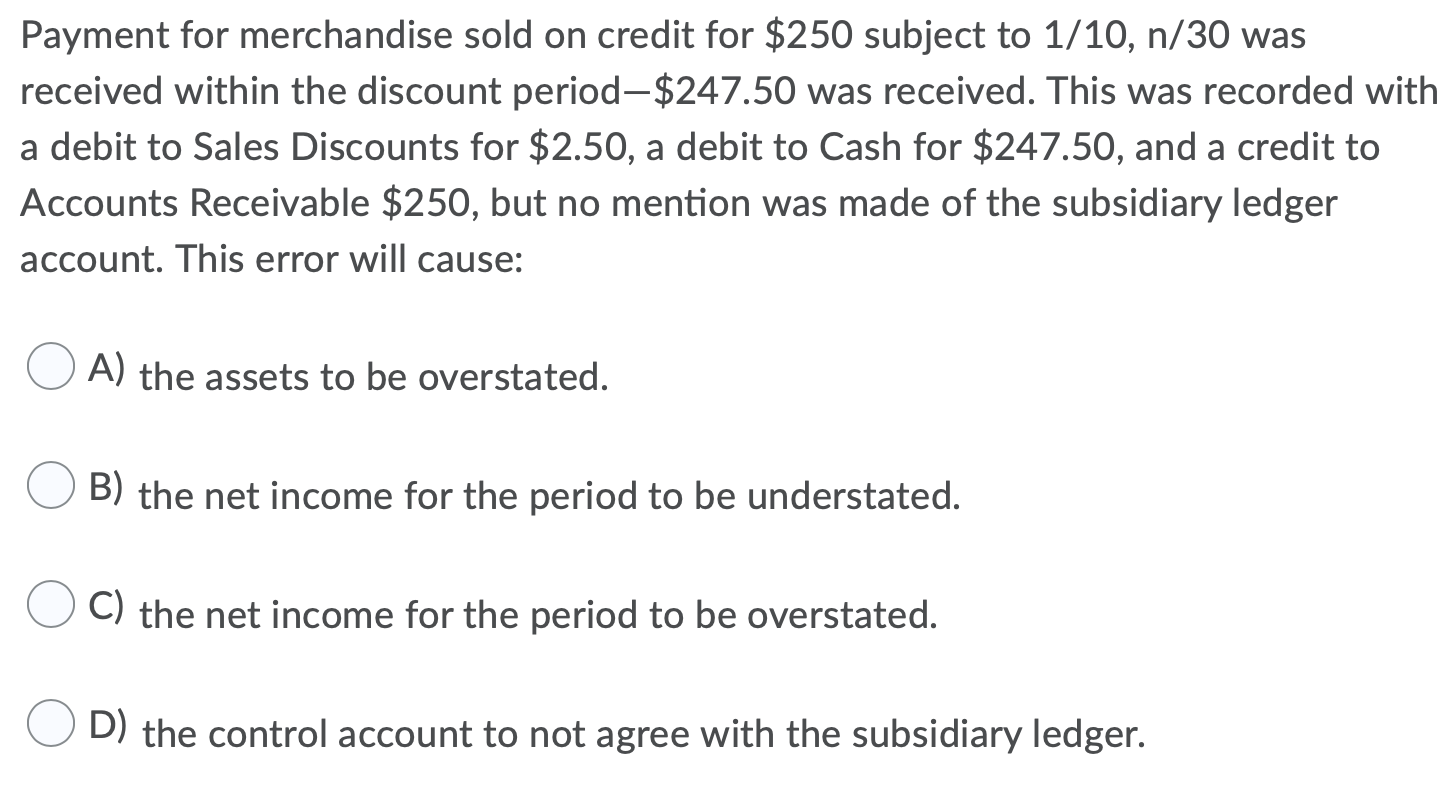

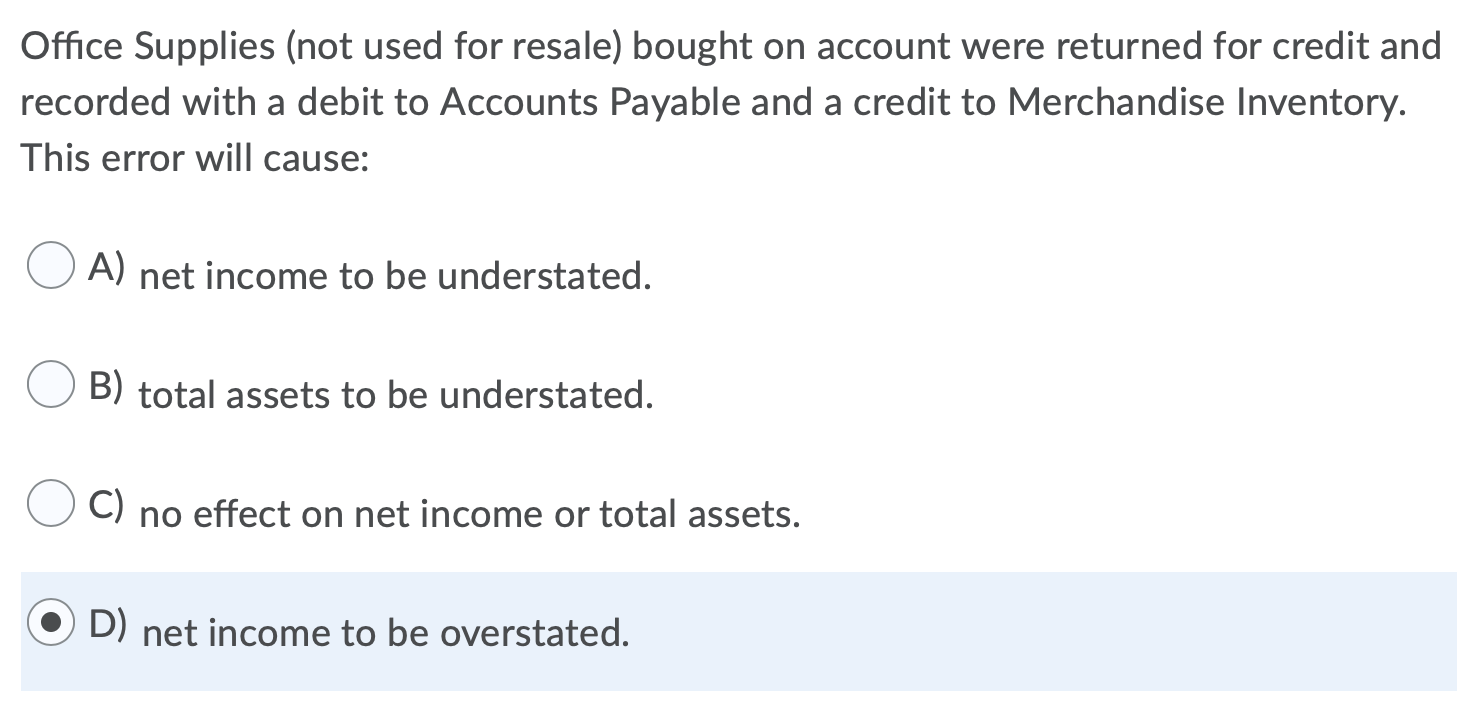

Secret Trails received payment in full within the credit period for horse boarding for $1,300 plus 4% sales tax. Terms of the sale were 3/10, n/30. Which entry is required to record this? (Round intermediary calculations to the nearest cent and final answers to the whole dollar.) OA) Debit Cash, $1,352; credit Sales, $1,352 B) Debit Cash, $1,313; debit Sales Discount $39; credit Accounts Receivable, $1,352 O C) Debit Cash, $1,300; credit Sales, $1,300 OD) Debit Cash, $1,313; credit Sales, $1,313 Bob sold goods for $500 to a charge customer. The customer returned for credit $35 worth of goods. Terms of the sale were 2/10, n/30. If the customer pays the amount owed within the discount period, what is the amount the customer should pay? (Round your calculations to the nearest whole dollar.) O A) $450 OB) $456 OC) $500 OD) $465 Sales discounts are NOT taken on which of the following? O A) Sales Tax OB) Freight O C) Merchandise returned OD) Sales Discounts are not taken on any of these. Payment for merchandise sold on credit for $250 subject to 1/10, n/30 was received within the discount period-$247.50 was received. This was recorded with a debit to Sales Discounts for $2.50, a debit to Cash for $247.50, and a credit to Accounts Receivable $250, but no mention was made of the subsidiary ledger account. This error will cause: OA) the assets to be overstated. OB) the net income for the period to be understated. OC) the net income for the period to be overstated. OD) the control account to not agree with the subsidiary ledger. Office Supplies (not used for resale) bought on account were returned for credit and recorded with a debit to Accounts Payable and a credit to Merchandise Inventory. This error will cause: O A) net income to be understated. OB) total assets to be understated. UC) no effect on net income or total assets. OD) net income to be overstatedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started