Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer and explain 8. Sam and Hy Corporations have filed consolidated tax returns for several calendar years. At the close of business on August

please answer and explain

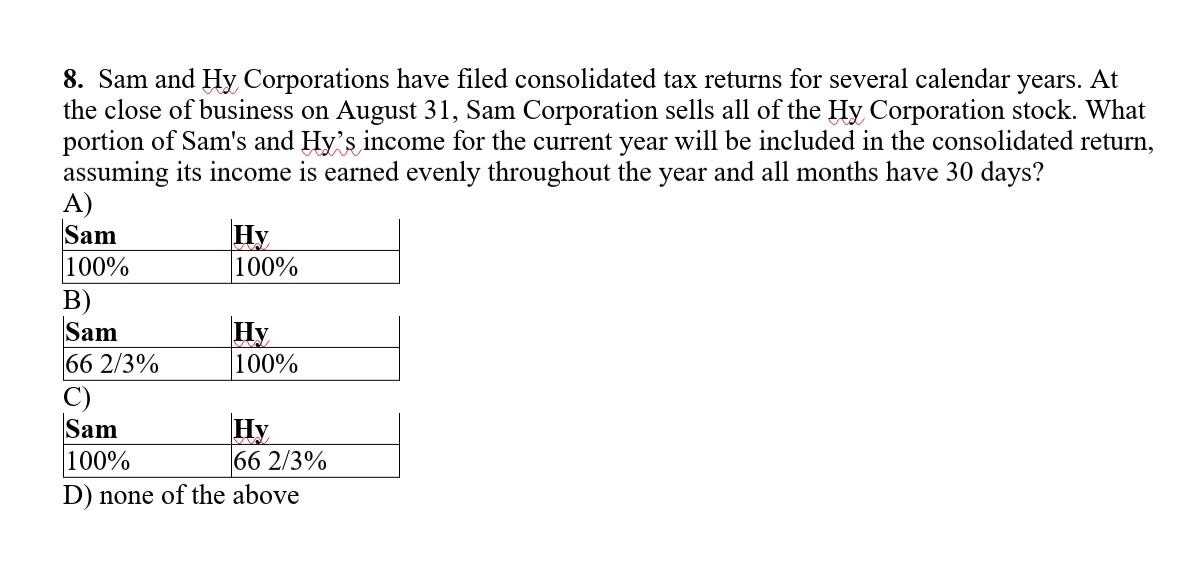

8. Sam and Hy Corporations have filed consolidated tax returns for several calendar years. At the close of business on August 31, Sam Corporation sells all of the Hy Corporation stock. What portion of Sam's and Hy's income for the current year will be included in the consolidated return, assuming its income is earned evenly throughout the year and all months have 30 days? A) Sam . 100% 100% B) Sam Hy 66 2/3% 100% C) Sam Hy 100% 66 2/3% D) none of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started