Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer as much as you can! Appliance Fixation, Inc. went into business as a corporation in early 2018 . For the first few years,

Please answer as much as you can!

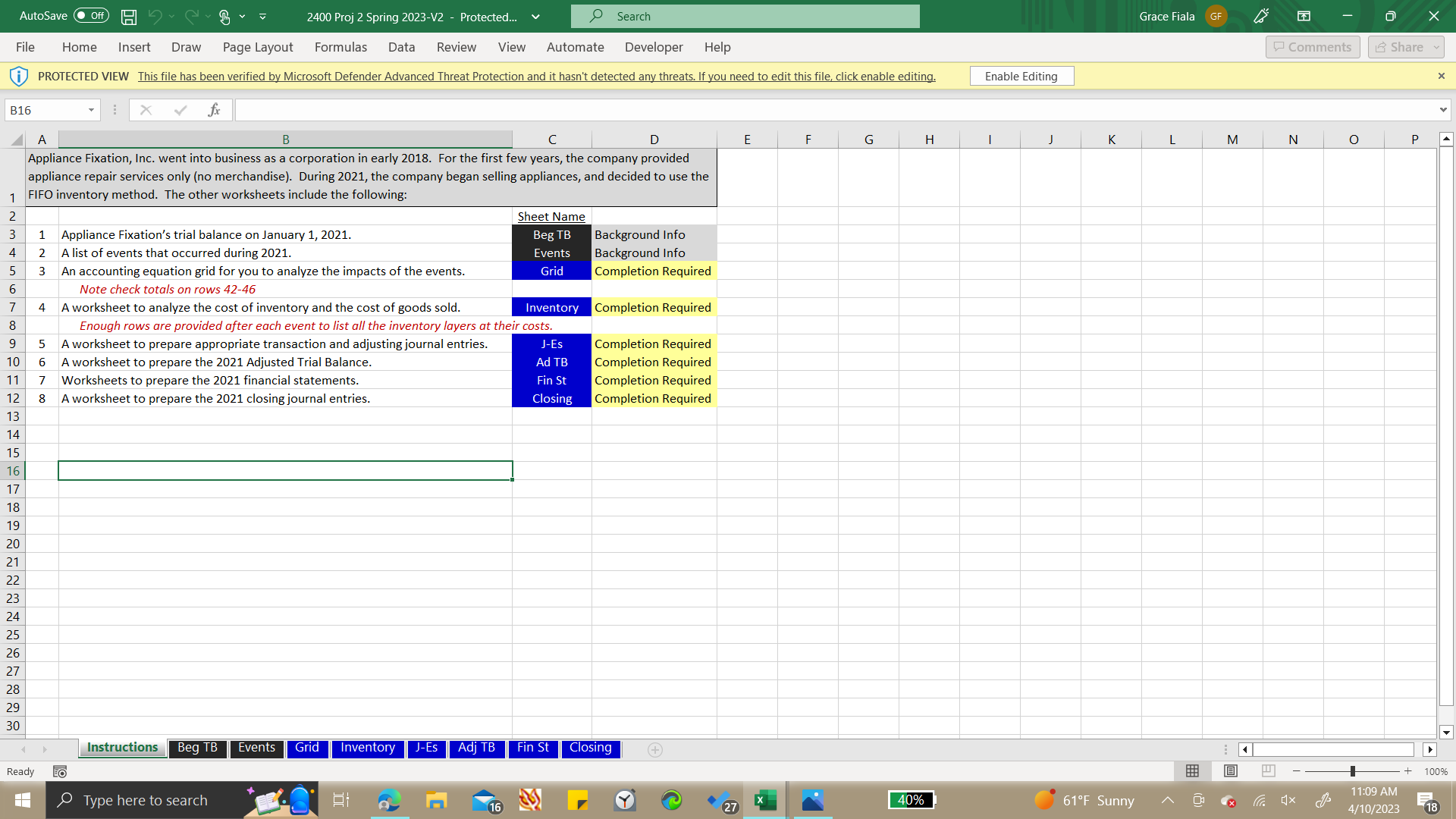

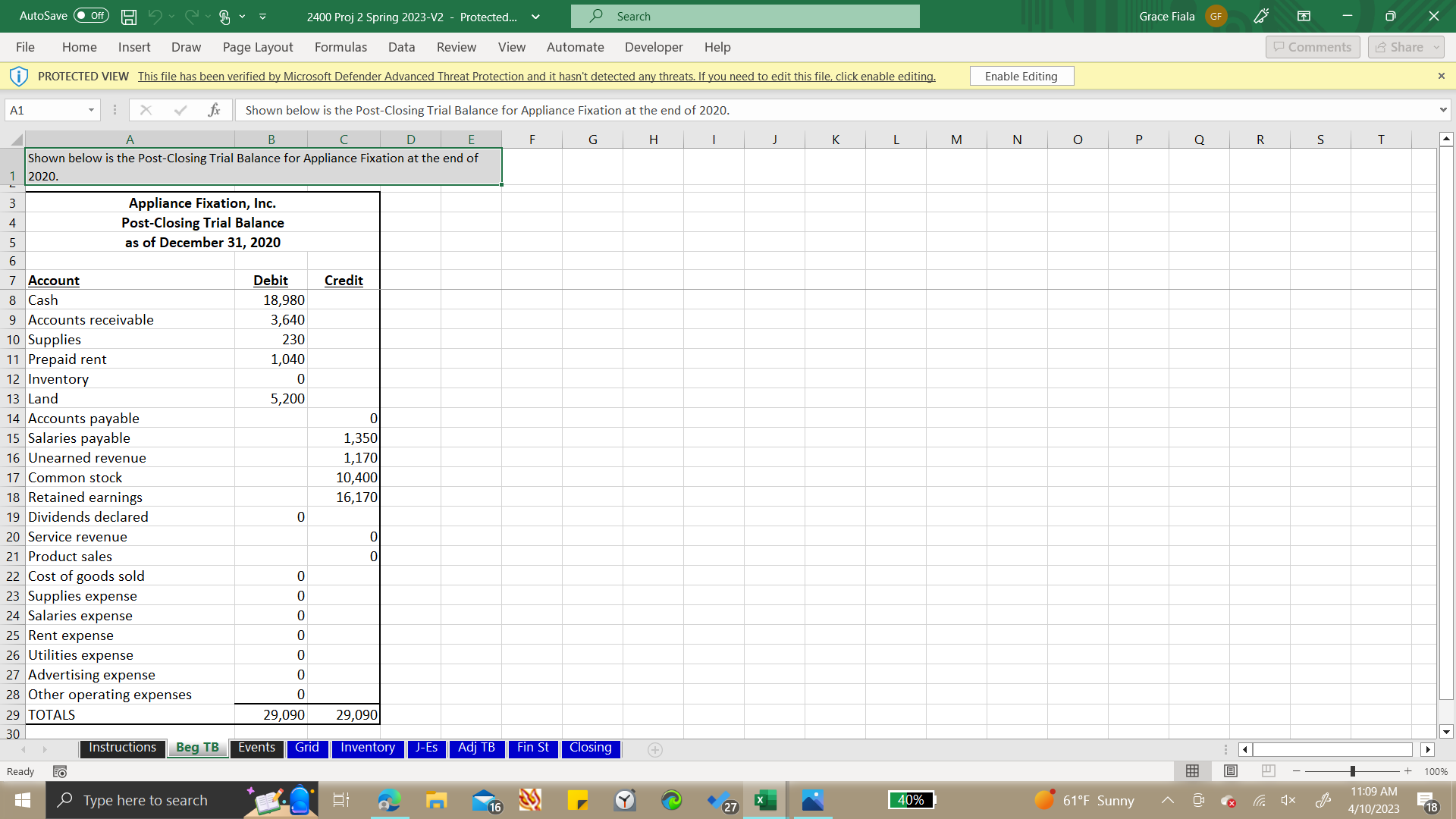

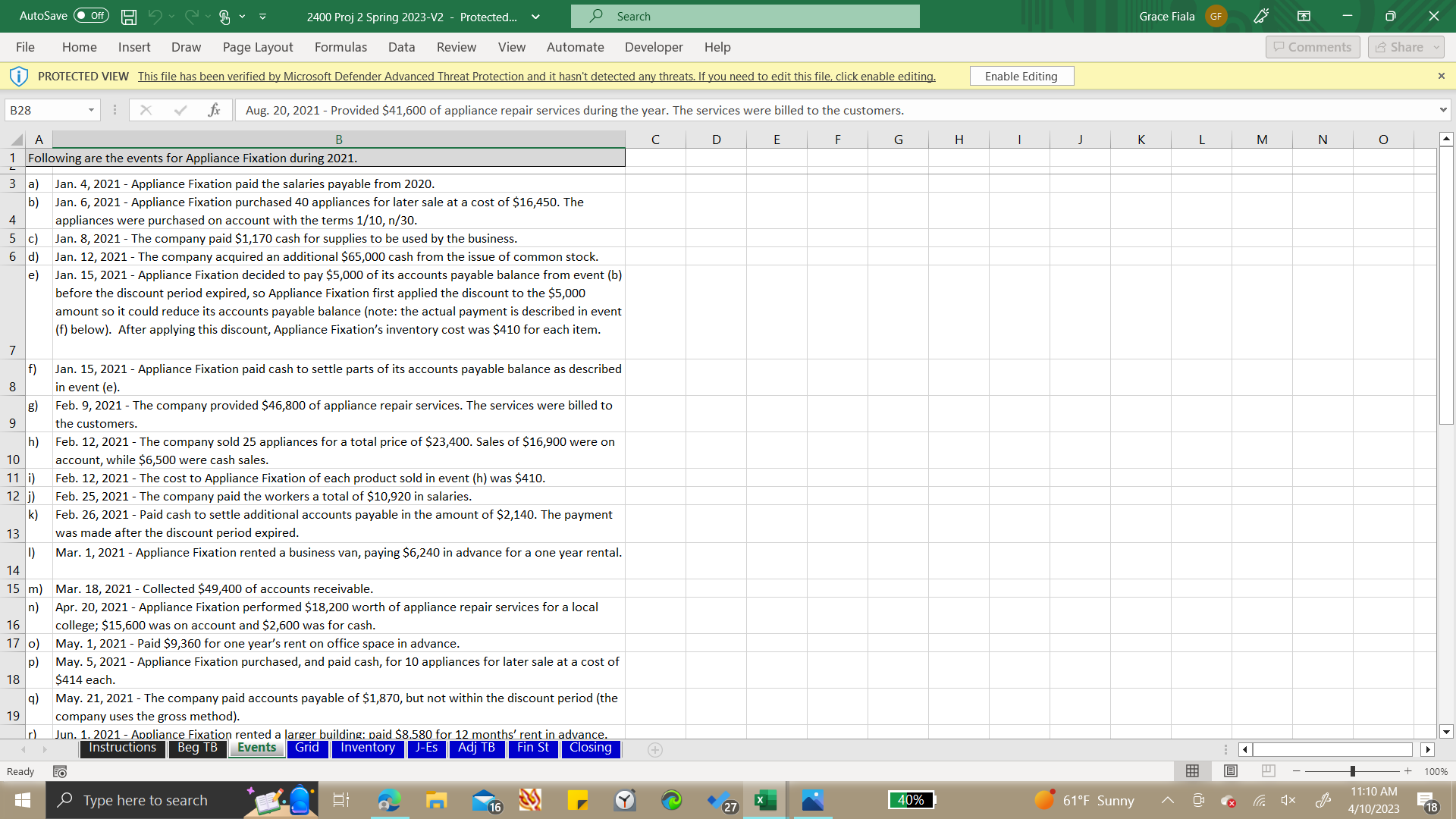

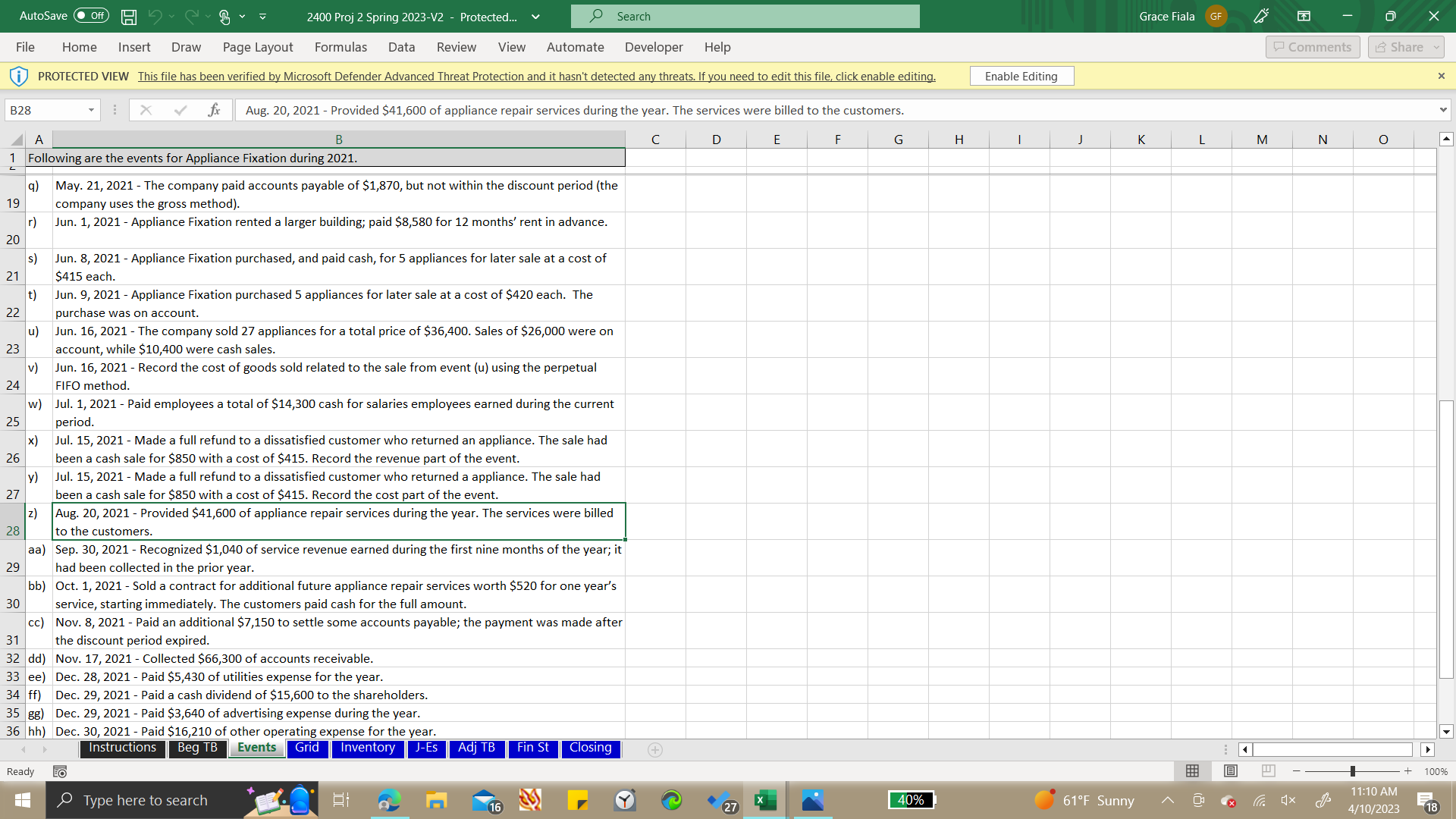

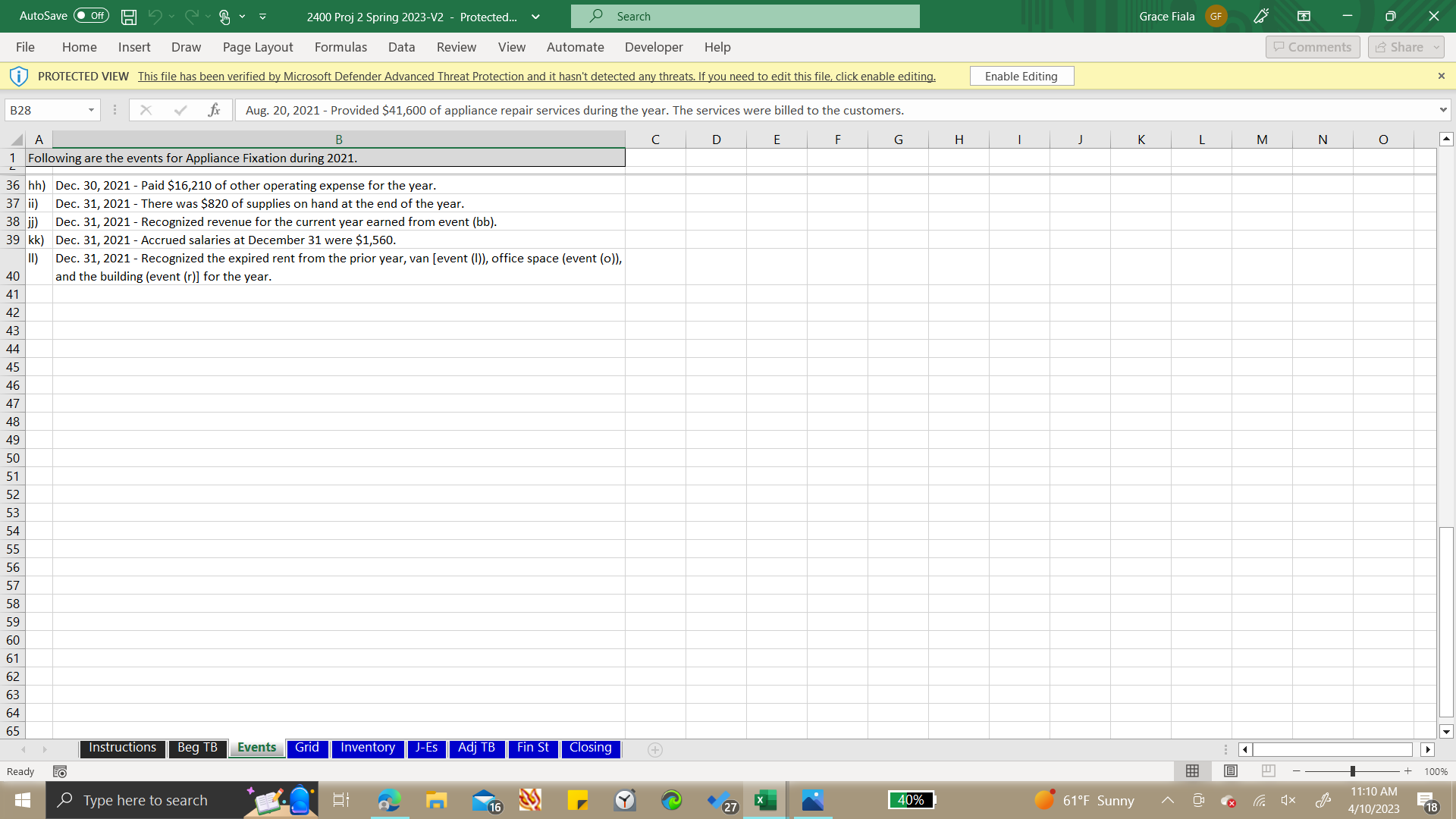

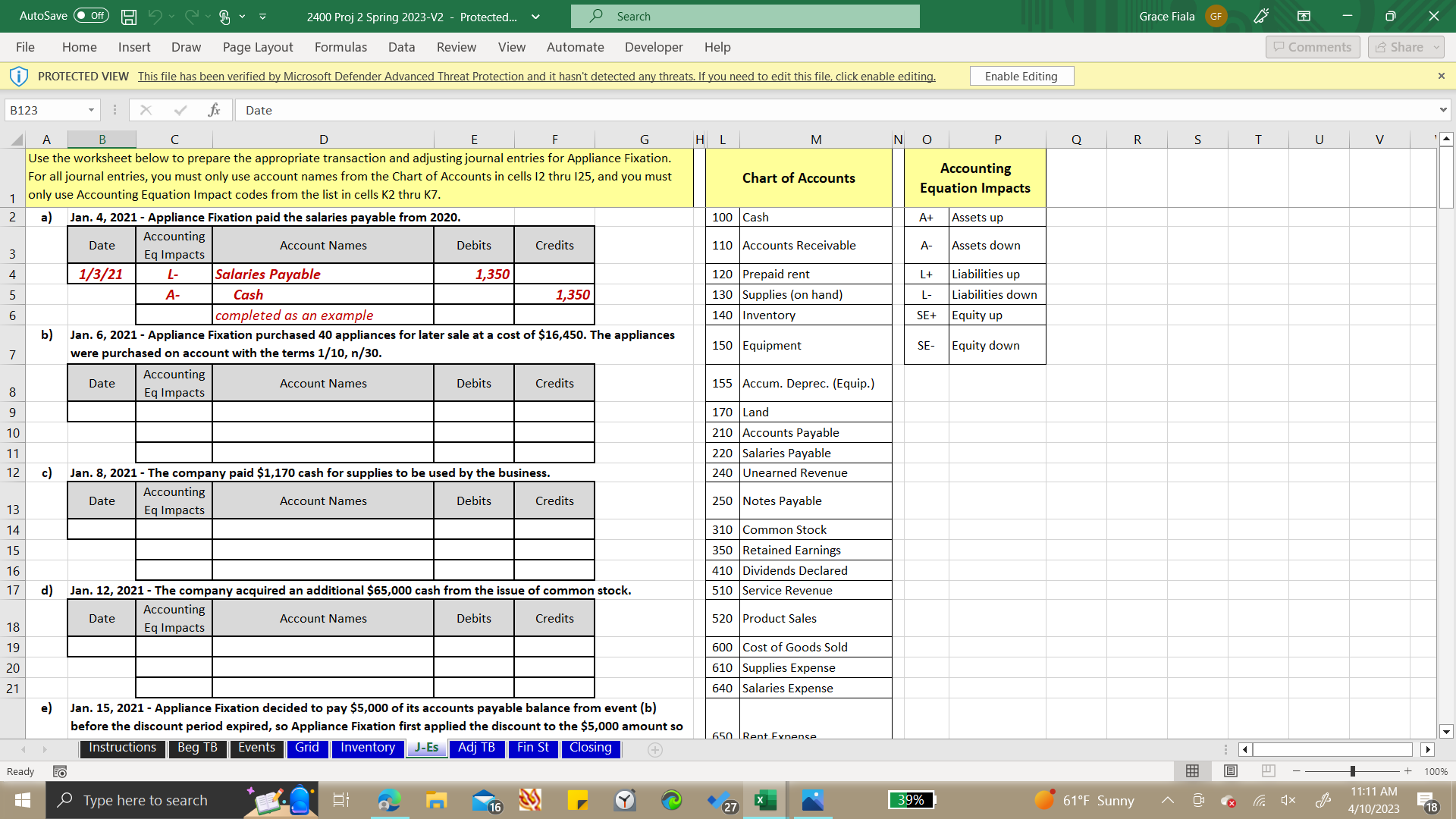

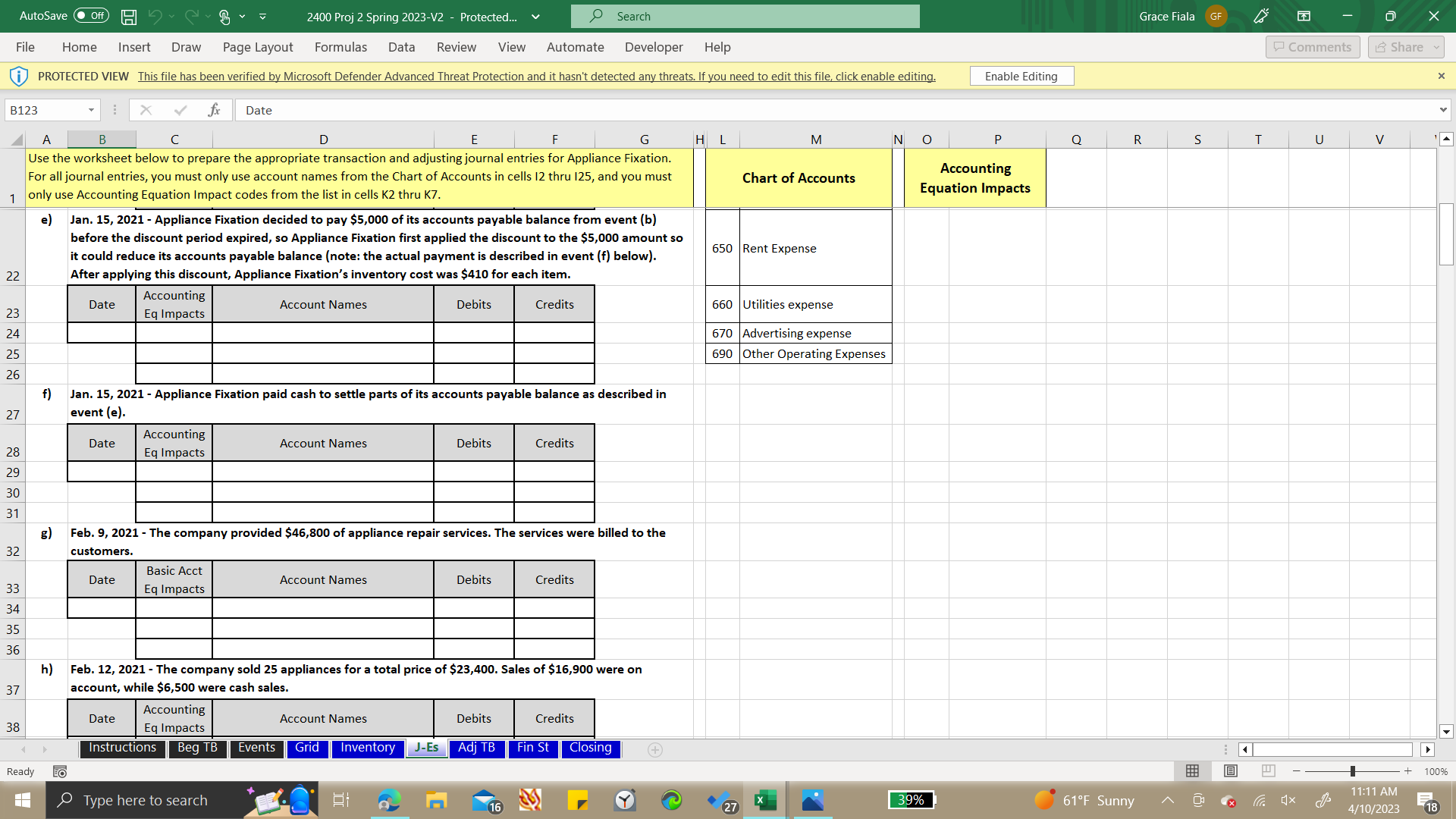

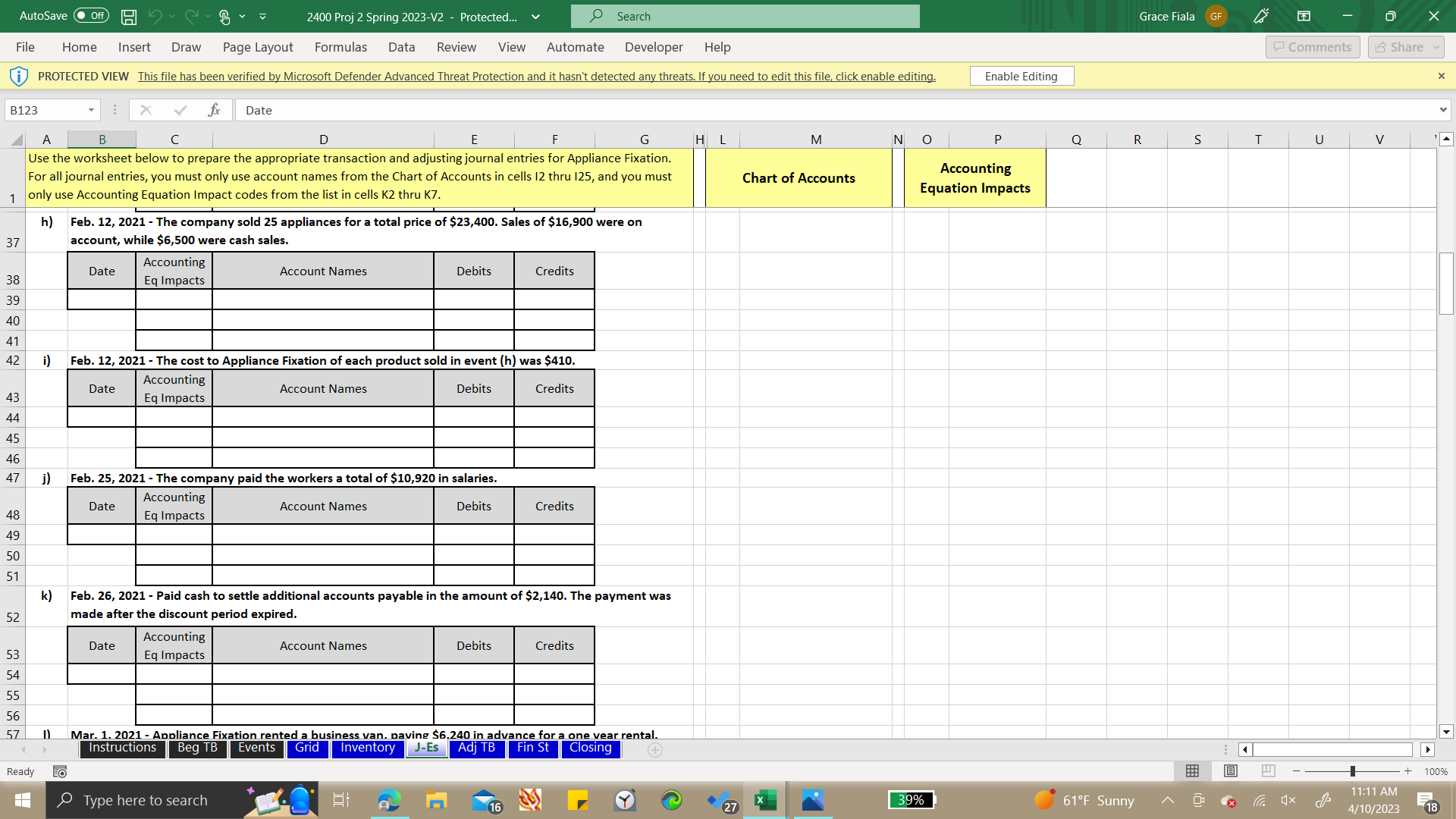

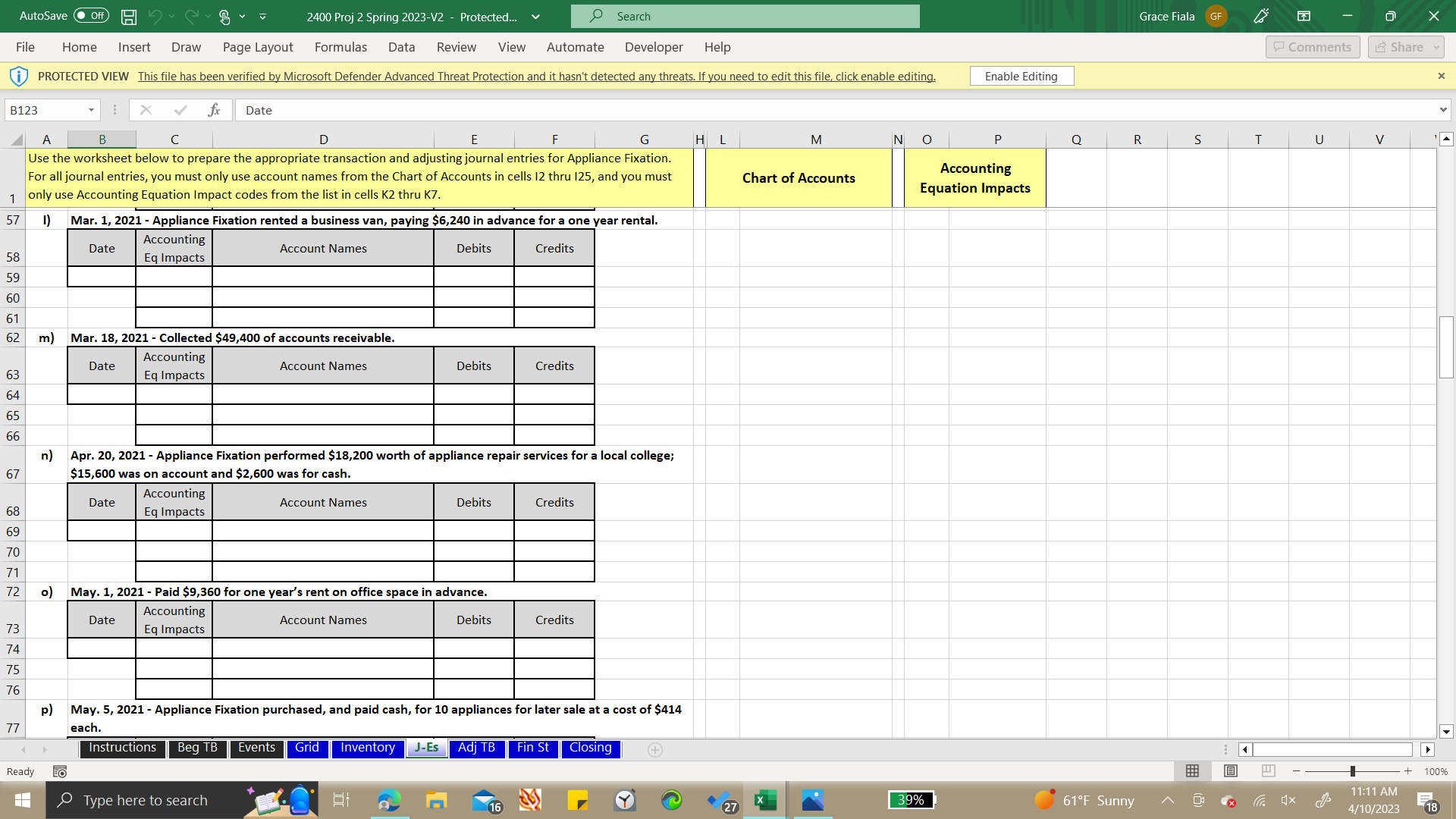

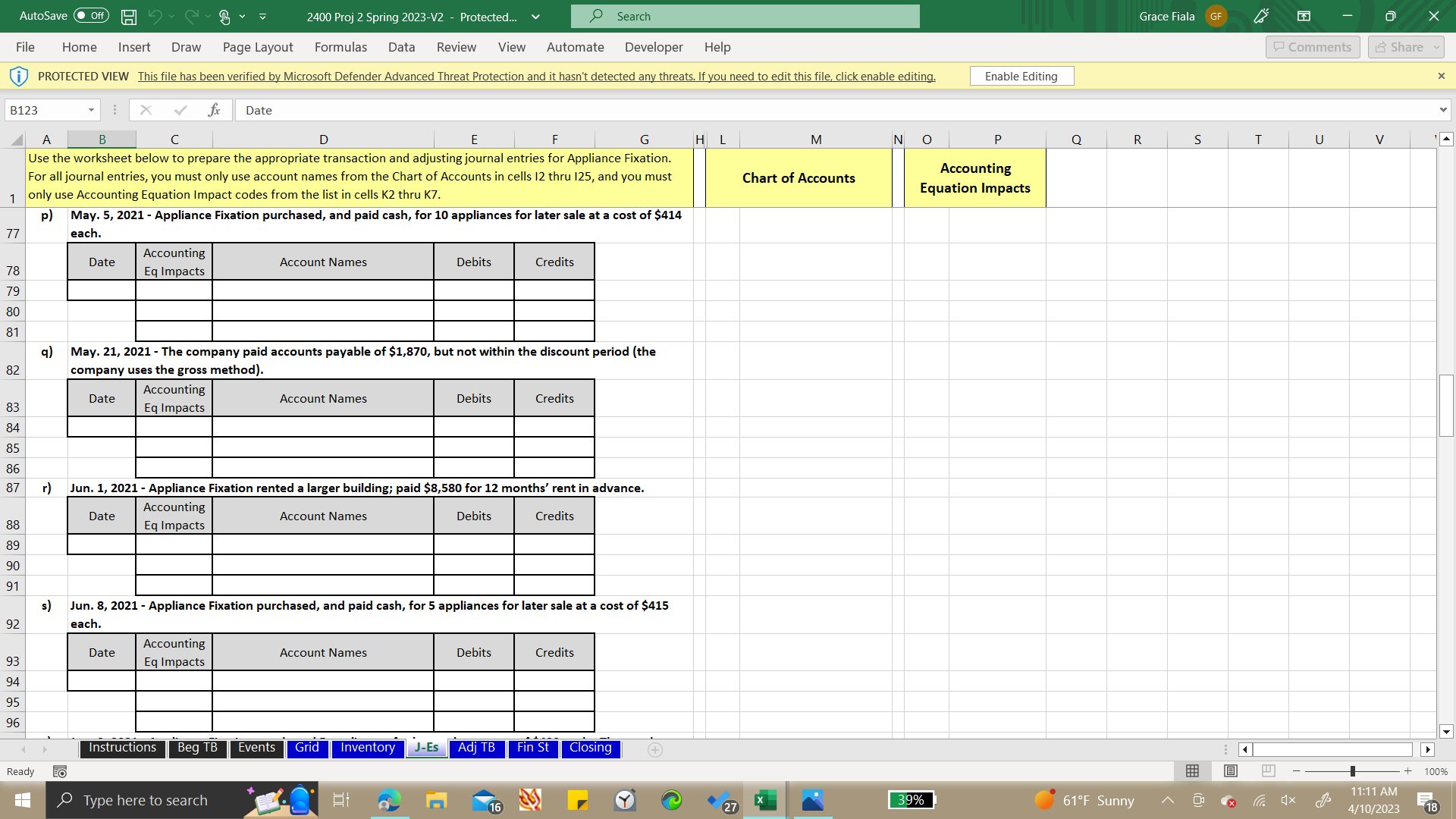

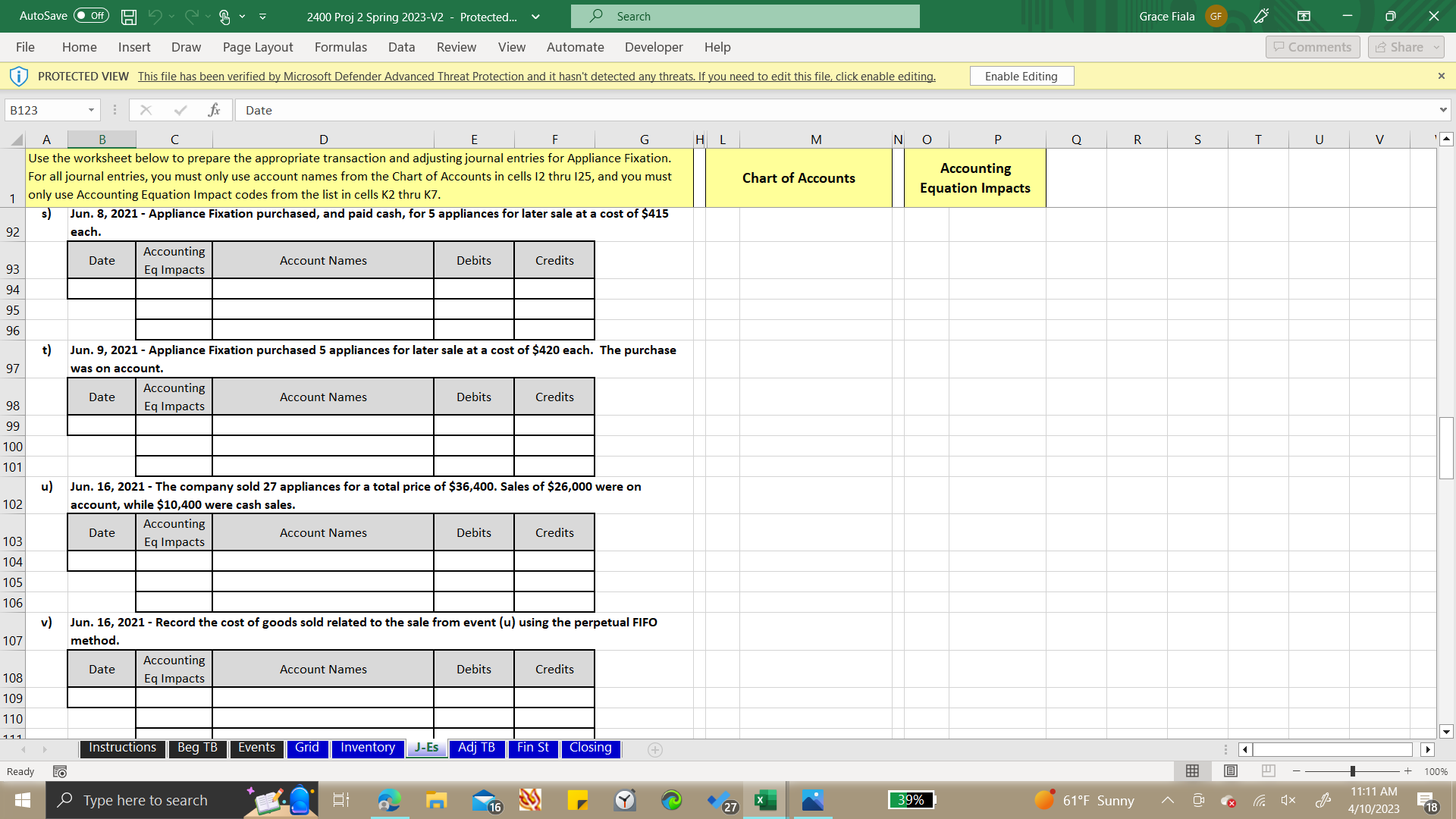

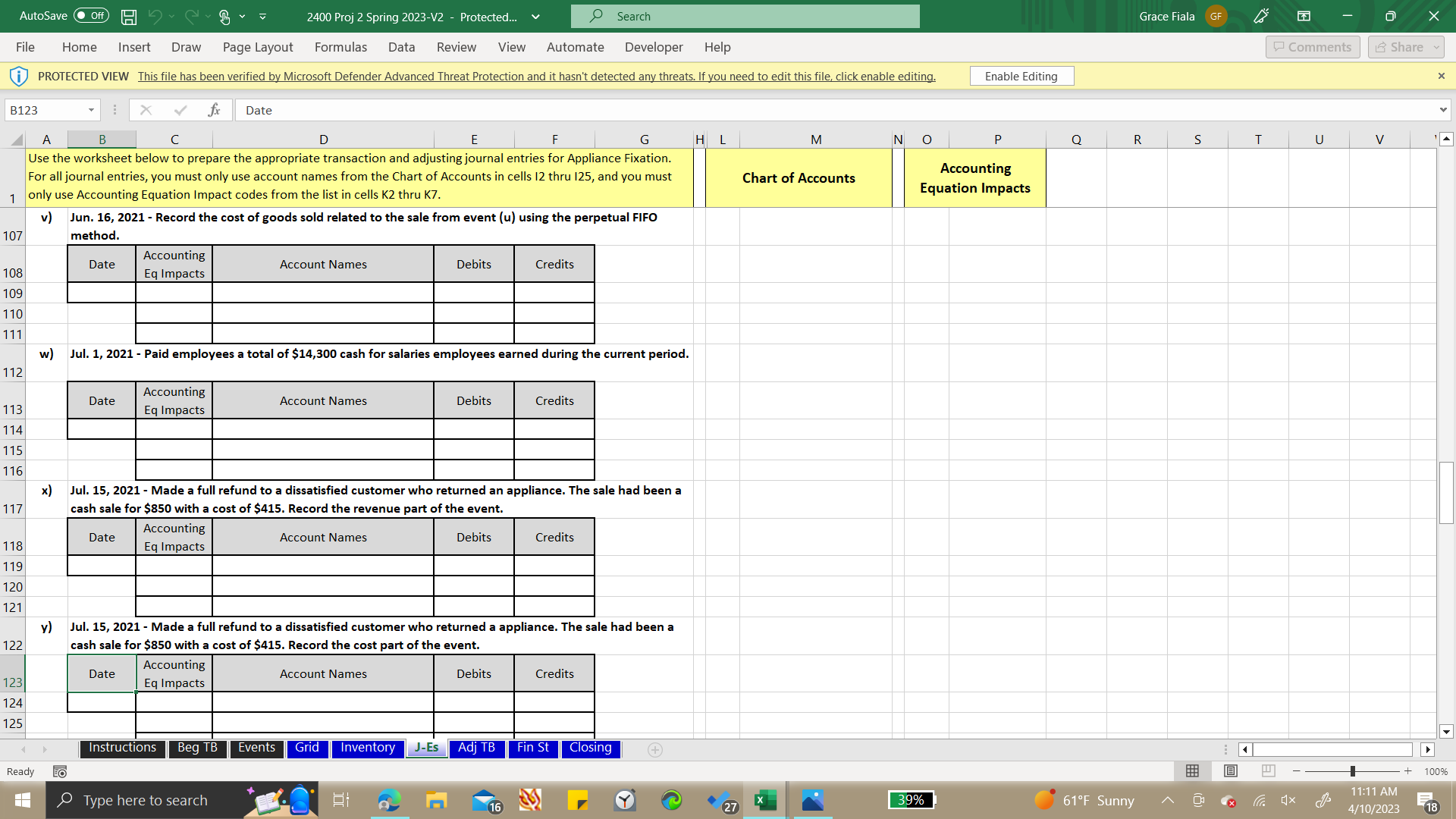

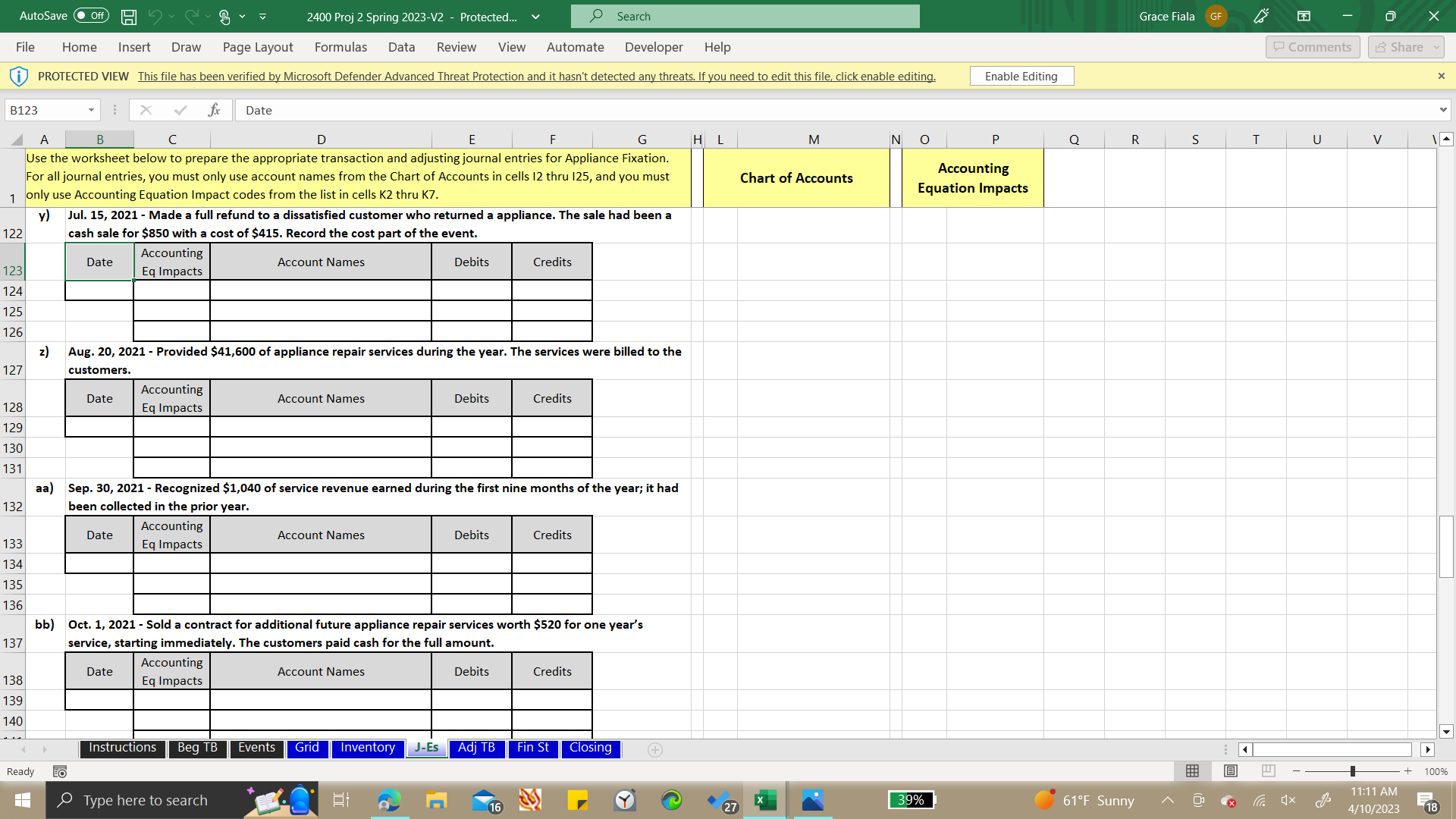

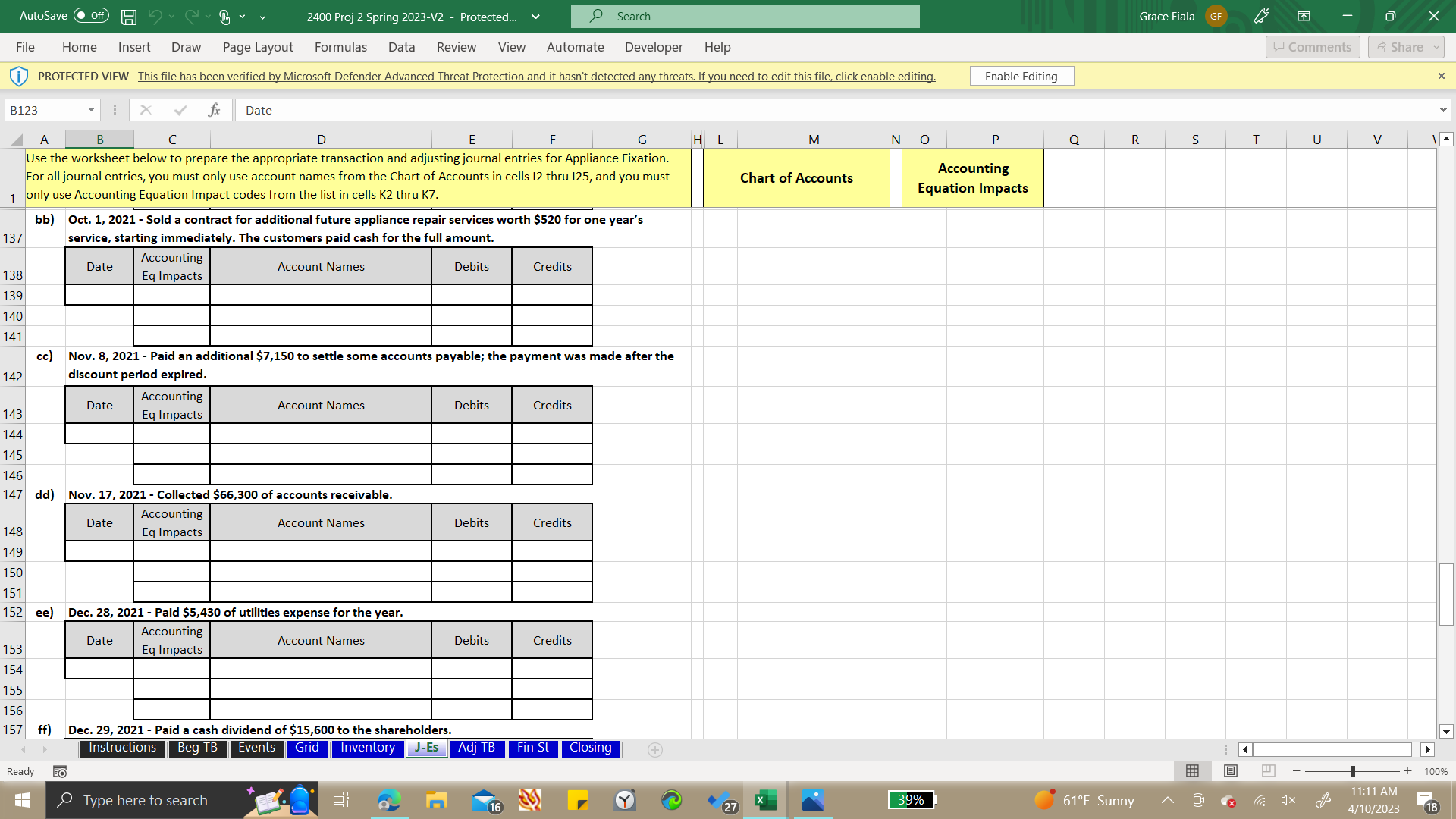

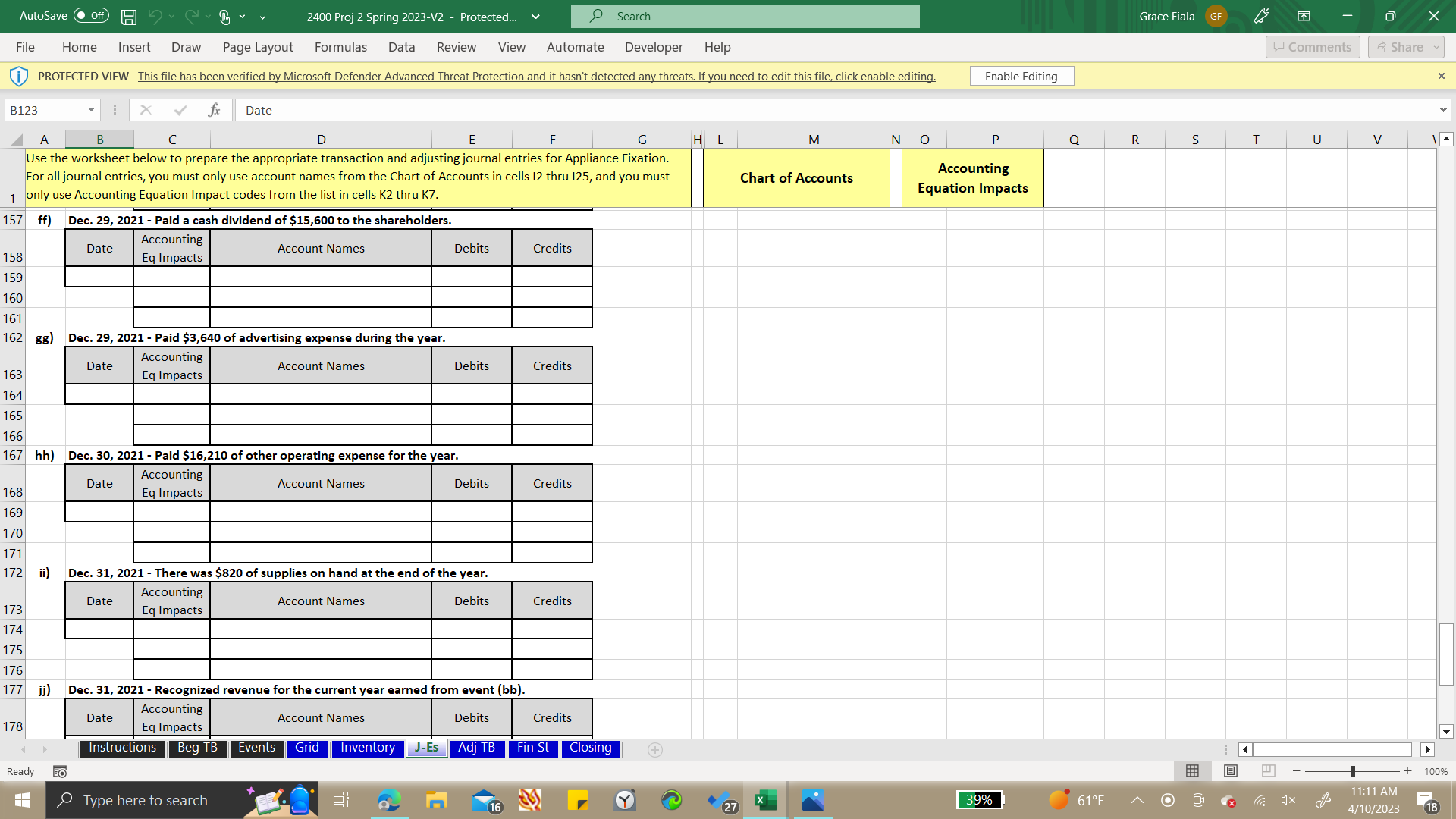

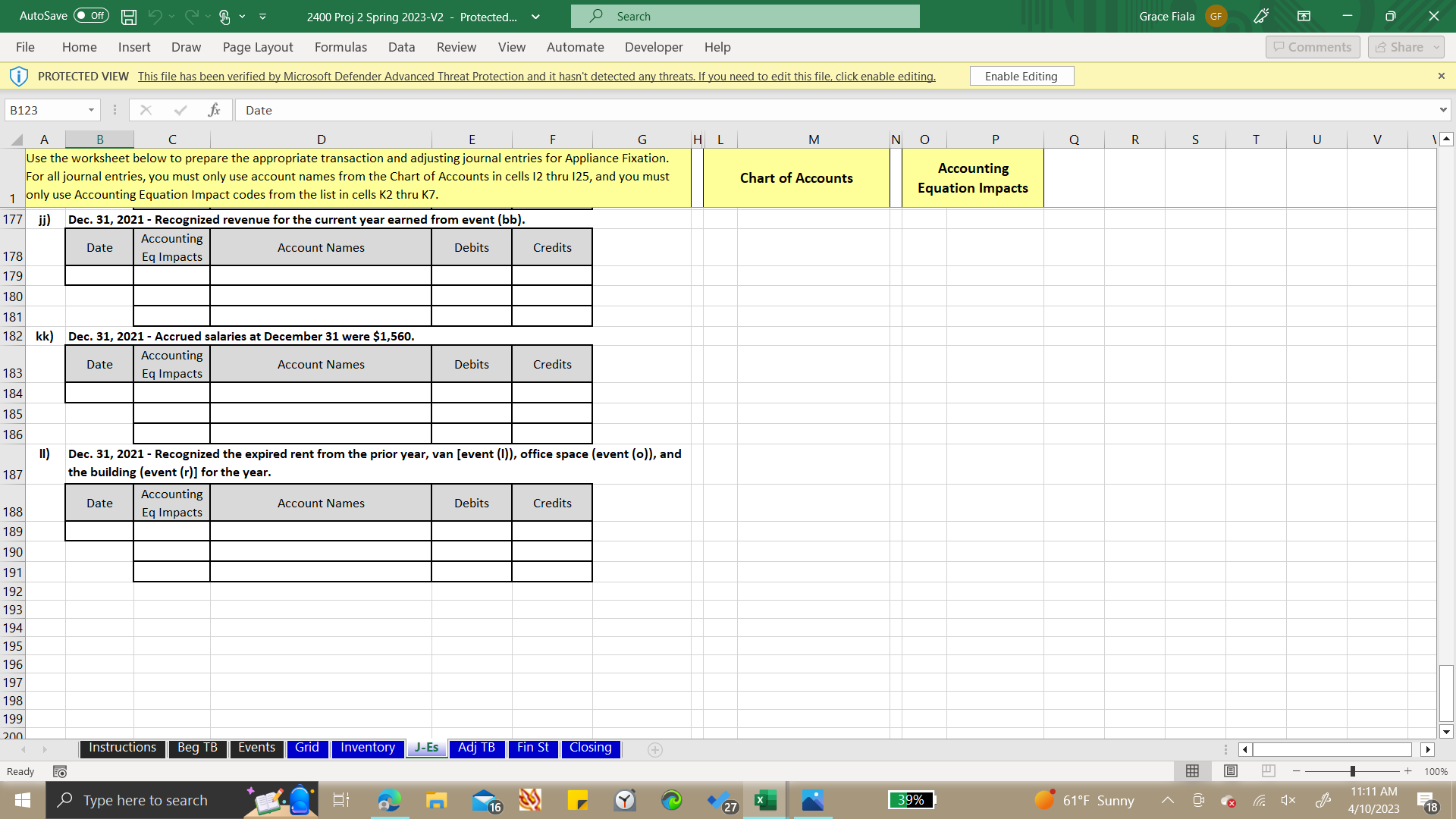

Appliance Fixation, Inc. went into business as a corporation in early 2018 . For the first few years, the company provided appliance repair services only (no merchandise). During 2021, the company began selling appliances, and decided to use the FIFO inventory method. The other worksheets include the following: q) May. 21, 2021 - The company paid accounts payable of $1,870, but not within the discount period (the company uses the gross method). 87 r) Jun. 1, 2021 - Appliance Fixation rented a larger building; paid $8,580 for 12 months' rent in advance. s) Jun. 8, 2021 - Appliance Fixation purchased, and paid cash, for 5 appliances for later sale at a cost of $415 each. \begin{tabular}{|l|l|l|l|l|l|} \hline 93 & Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline 94 \\ \hline 95 \\ \hline & & & & & \\ \hline 96 & & & & & \\ \hline \end{tabular} t) Jun. 9, 2021 - Appliance Fixation purchased 5 appliances for later sale at a cost of $420 each. The purchase 97 was on account. u) Jun. 16, 2021 - The company sold 27 appliances for a total price of $36,400. Sales of $26,000 were on account, while $10,400 were cash sales. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} v) Jun. 16, 2021 - Record the cost of goods sold related to the sale from event (u) using the perpetual FIFO method. w) Jul. 1, 2021 - Paid employees a total of $14,300 cash for salaries employees earned during the current period. x) Jul. 15, 2021 - Made a full refund to a dissatisfied customer who returned an appliance. The sale had been a cash sale for $850 with a cost of $415. Record the revenue part of the event. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} y) Jul. 15, 2021 - Made a full refund to a dissatisfied customer who returned a appliance. The sale had been a cash sale for $850 with a cost of $415. Record the cost part of the event. z) Aug. 20, 2021 - Provided $41,600 of appliance repair services during the year. The services were billed to the customers. \begin{tabular}{|c|c|c|c|c|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} aa) Sep. 30, 2021 - Recognized $1,040 of service revenue earned during the first nine months of the year; it had been collected in the prior year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} bb) Oct. 1, 2021 - Sold a contract for additional future appliance repair services worth $520 for one year's 137 service, starting immediately. The customers paid cash for the full amount. gg) Dec. 29, 2021 - Paid $3,640 of advertising expense during the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} hh) Dec. 30, 2021 - Paid $16,210 of other operating expense for the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} ii) Dec. 31, 2021 - There was $820 of supplies on hand at the end of the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} jj) Dec. 31, 2021 - Recognized revenue for the current year earned from event (bb). 182 kk) Dec. 31, 2021 - Accrued salaries at December 31 were $1,560. \begin{tabular}{|l|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} II) Dec. 31, 2021 - Recognized the expired rent from the prior year, van [event (I)), office space (event (o)), and the building (event (r)] for the year. \begin{tabular}{|l|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} Appliance Fixation, Inc. went into business as a corporation in early 2018 . For the first few years, the company provided appliance repair services only (no merchandise). During 2021, the company began selling appliances, and decided to use the FIFO inventory method. The other worksheets include the following: q) May. 21, 2021 - The company paid accounts payable of $1,870, but not within the discount period (the company uses the gross method). 87 r) Jun. 1, 2021 - Appliance Fixation rented a larger building; paid $8,580 for 12 months' rent in advance. s) Jun. 8, 2021 - Appliance Fixation purchased, and paid cash, for 5 appliances for later sale at a cost of $415 each. \begin{tabular}{|l|l|l|l|l|l|} \hline 93 & Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline 94 \\ \hline 95 \\ \hline & & & & & \\ \hline 96 & & & & & \\ \hline \end{tabular} t) Jun. 9, 2021 - Appliance Fixation purchased 5 appliances for later sale at a cost of $420 each. The purchase 97 was on account. u) Jun. 16, 2021 - The company sold 27 appliances for a total price of $36,400. Sales of $26,000 were on account, while $10,400 were cash sales. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} v) Jun. 16, 2021 - Record the cost of goods sold related to the sale from event (u) using the perpetual FIFO method. w) Jul. 1, 2021 - Paid employees a total of $14,300 cash for salaries employees earned during the current period. x) Jul. 15, 2021 - Made a full refund to a dissatisfied customer who returned an appliance. The sale had been a cash sale for $850 with a cost of $415. Record the revenue part of the event. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} y) Jul. 15, 2021 - Made a full refund to a dissatisfied customer who returned a appliance. The sale had been a cash sale for $850 with a cost of $415. Record the cost part of the event. z) Aug. 20, 2021 - Provided $41,600 of appliance repair services during the year. The services were billed to the customers. \begin{tabular}{|c|c|c|c|c|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} aa) Sep. 30, 2021 - Recognized $1,040 of service revenue earned during the first nine months of the year; it had been collected in the prior year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} bb) Oct. 1, 2021 - Sold a contract for additional future appliance repair services worth $520 for one year's 137 service, starting immediately. The customers paid cash for the full amount. gg) Dec. 29, 2021 - Paid $3,640 of advertising expense during the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} hh) Dec. 30, 2021 - Paid $16,210 of other operating expense for the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} ii) Dec. 31, 2021 - There was $820 of supplies on hand at the end of the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} jj) Dec. 31, 2021 - Recognized revenue for the current year earned from event (bb). 182 kk) Dec. 31, 2021 - Accrued salaries at December 31 were $1,560. \begin{tabular}{|l|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} II) Dec. 31, 2021 - Recognized the expired rent from the prior year, van [event (I)), office space (event (o)), and the building (event (r)] for the year. \begin{tabular}{|l|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular}

Appliance Fixation, Inc. went into business as a corporation in early 2018 . For the first few years, the company provided appliance repair services only (no merchandise). During 2021, the company began selling appliances, and decided to use the FIFO inventory method. The other worksheets include the following: q) May. 21, 2021 - The company paid accounts payable of $1,870, but not within the discount period (the company uses the gross method). 87 r) Jun. 1, 2021 - Appliance Fixation rented a larger building; paid $8,580 for 12 months' rent in advance. s) Jun. 8, 2021 - Appliance Fixation purchased, and paid cash, for 5 appliances for later sale at a cost of $415 each. \begin{tabular}{|l|l|l|l|l|l|} \hline 93 & Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline 94 \\ \hline 95 \\ \hline & & & & & \\ \hline 96 & & & & & \\ \hline \end{tabular} t) Jun. 9, 2021 - Appliance Fixation purchased 5 appliances for later sale at a cost of $420 each. The purchase 97 was on account. u) Jun. 16, 2021 - The company sold 27 appliances for a total price of $36,400. Sales of $26,000 were on account, while $10,400 were cash sales. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} v) Jun. 16, 2021 - Record the cost of goods sold related to the sale from event (u) using the perpetual FIFO method. w) Jul. 1, 2021 - Paid employees a total of $14,300 cash for salaries employees earned during the current period. x) Jul. 15, 2021 - Made a full refund to a dissatisfied customer who returned an appliance. The sale had been a cash sale for $850 with a cost of $415. Record the revenue part of the event. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} y) Jul. 15, 2021 - Made a full refund to a dissatisfied customer who returned a appliance. The sale had been a cash sale for $850 with a cost of $415. Record the cost part of the event. z) Aug. 20, 2021 - Provided $41,600 of appliance repair services during the year. The services were billed to the customers. \begin{tabular}{|c|c|c|c|c|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} aa) Sep. 30, 2021 - Recognized $1,040 of service revenue earned during the first nine months of the year; it had been collected in the prior year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} bb) Oct. 1, 2021 - Sold a contract for additional future appliance repair services worth $520 for one year's 137 service, starting immediately. The customers paid cash for the full amount. gg) Dec. 29, 2021 - Paid $3,640 of advertising expense during the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} hh) Dec. 30, 2021 - Paid $16,210 of other operating expense for the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} ii) Dec. 31, 2021 - There was $820 of supplies on hand at the end of the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} jj) Dec. 31, 2021 - Recognized revenue for the current year earned from event (bb). 182 kk) Dec. 31, 2021 - Accrued salaries at December 31 were $1,560. \begin{tabular}{|l|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} II) Dec. 31, 2021 - Recognized the expired rent from the prior year, van [event (I)), office space (event (o)), and the building (event (r)] for the year. \begin{tabular}{|l|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} Appliance Fixation, Inc. went into business as a corporation in early 2018 . For the first few years, the company provided appliance repair services only (no merchandise). During 2021, the company began selling appliances, and decided to use the FIFO inventory method. The other worksheets include the following: q) May. 21, 2021 - The company paid accounts payable of $1,870, but not within the discount period (the company uses the gross method). 87 r) Jun. 1, 2021 - Appliance Fixation rented a larger building; paid $8,580 for 12 months' rent in advance. s) Jun. 8, 2021 - Appliance Fixation purchased, and paid cash, for 5 appliances for later sale at a cost of $415 each. \begin{tabular}{|l|l|l|l|l|l|} \hline 93 & Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline 94 \\ \hline 95 \\ \hline & & & & & \\ \hline 96 & & & & & \\ \hline \end{tabular} t) Jun. 9, 2021 - Appliance Fixation purchased 5 appliances for later sale at a cost of $420 each. The purchase 97 was on account. u) Jun. 16, 2021 - The company sold 27 appliances for a total price of $36,400. Sales of $26,000 were on account, while $10,400 were cash sales. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} v) Jun. 16, 2021 - Record the cost of goods sold related to the sale from event (u) using the perpetual FIFO method. w) Jul. 1, 2021 - Paid employees a total of $14,300 cash for salaries employees earned during the current period. x) Jul. 15, 2021 - Made a full refund to a dissatisfied customer who returned an appliance. The sale had been a cash sale for $850 with a cost of $415. Record the revenue part of the event. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} y) Jul. 15, 2021 - Made a full refund to a dissatisfied customer who returned a appliance. The sale had been a cash sale for $850 with a cost of $415. Record the cost part of the event. z) Aug. 20, 2021 - Provided $41,600 of appliance repair services during the year. The services were billed to the customers. \begin{tabular}{|c|c|c|c|c|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} aa) Sep. 30, 2021 - Recognized $1,040 of service revenue earned during the first nine months of the year; it had been collected in the prior year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} bb) Oct. 1, 2021 - Sold a contract for additional future appliance repair services worth $520 for one year's 137 service, starting immediately. The customers paid cash for the full amount. gg) Dec. 29, 2021 - Paid $3,640 of advertising expense during the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} hh) Dec. 30, 2021 - Paid $16,210 of other operating expense for the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} ii) Dec. 31, 2021 - There was $820 of supplies on hand at the end of the year. \begin{tabular}{|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & Credits \\ \hline & & & & \\ \hline & & & & \\ \hline \end{tabular} jj) Dec. 31, 2021 - Recognized revenue for the current year earned from event (bb). 182 kk) Dec. 31, 2021 - Accrued salaries at December 31 were $1,560. \begin{tabular}{|l|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} II) Dec. 31, 2021 - Recognized the expired rent from the prior year, van [event (I)), office space (event (o)), and the building (event (r)] for the year. \begin{tabular}{|l|l|l|l|l|l|} \hline Date & AccountingEqImpacts & Account Names & Debits & \\ \hline & & & & & \\ \hline & & & & & \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started