Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer as quickly as possible and correctly and I will give a thumbs up all steps do NOT have to be shown as long

Please answer as quickly as possible and correctly and I will give a thumbs up all steps do NOT have to be shown as long as the final answer is correct, thank you.

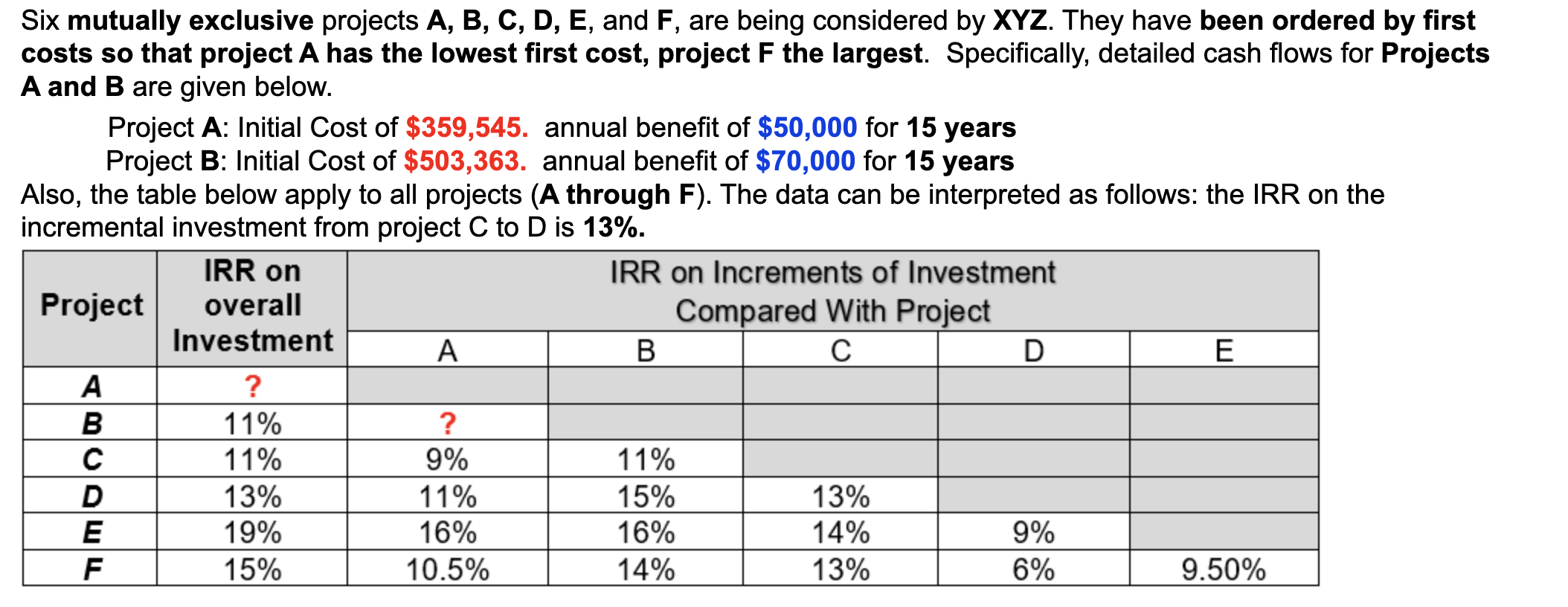

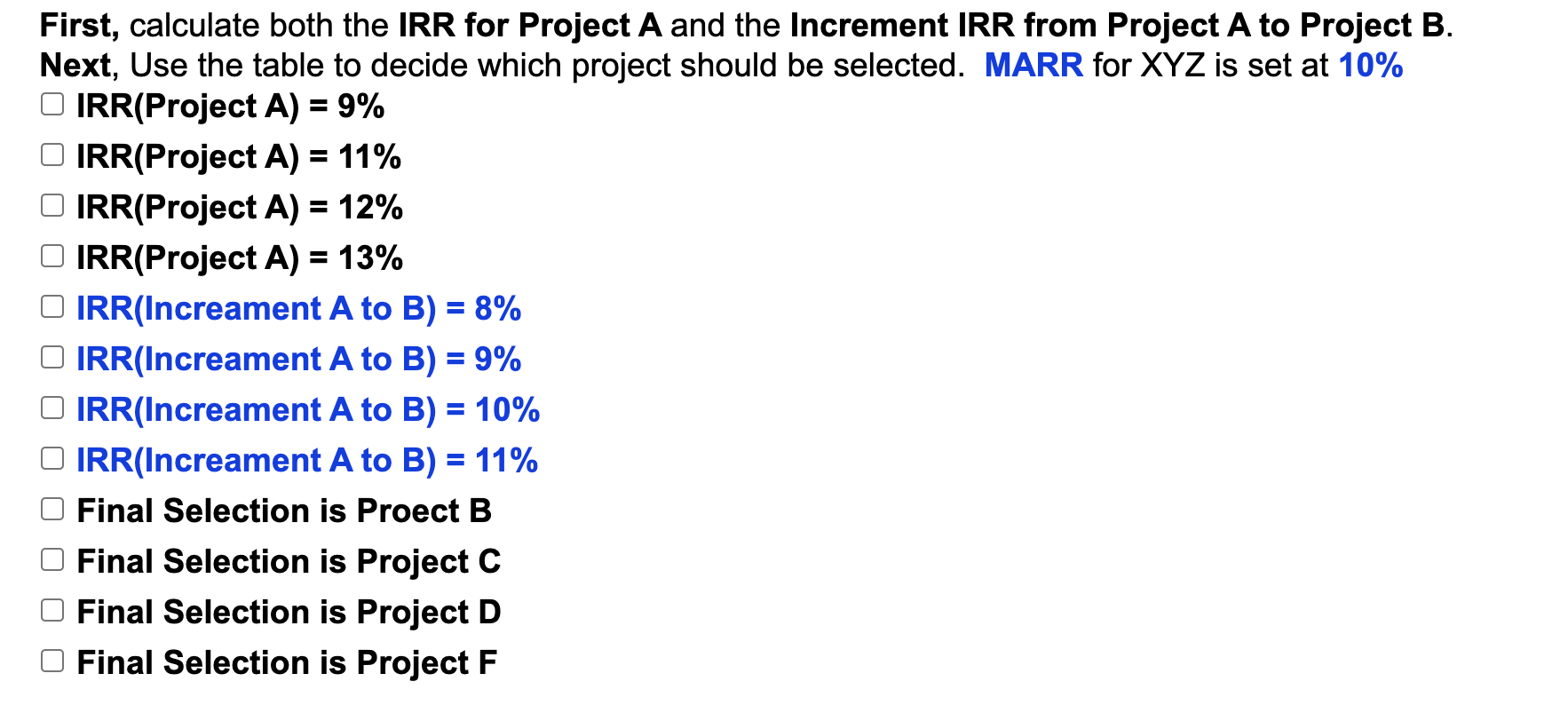

Six mutually exclusive projects A,B,C,D,E, and F, are being considered by XYZ. They have been ordered by first costs so that project A has the lowest first cost, project F the largest. Specifically, detailed cash flows for Projects A and B are given below. Project A: Initial Cost of $359,545. annual benefit of $50,000 for 15 years Project B: Initial Cost of $503,363. annual benefit of $70,000 for 15 years Also, the table below apply to all projects (A through F). The data can be interpreted as follows: the IRR on the incremental investment from project C to D is 13%. First, calculate both the IRR for Project A and the Increment IRR from Project A to Project B. Next, Use the table to decide which project should be selected. MARR for XYZ is set at 10% IRR( Project A)=9% IRR( Project A)=11% IRR( Project A)=12% IRR(Project A)=13% IRR(Increament A to B)=8% IRR( Increament A to B)=9% IRR(IncreamentA to B)=10% IRR(Increament A to B)=11% Final Selection is Proect B Final Selection is Project C Final Selection is Project D Final Selection is Project FStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started