Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer as soon as possible for my revision Willama Truns an electrical shop in Suva called Cletrico. After few years of consideration, she plans

please answer as soon as possible for my revision

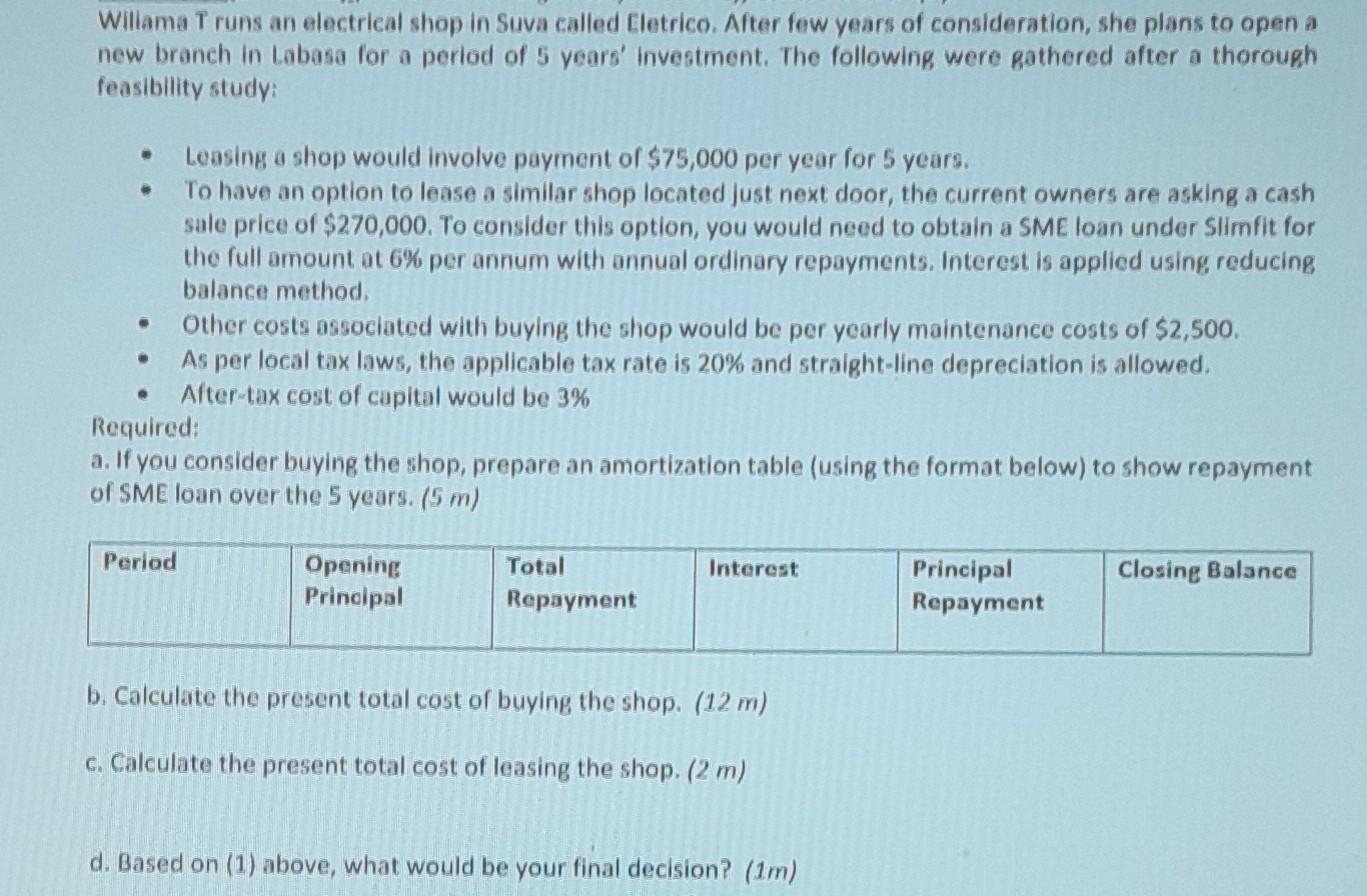

Willama Truns an electrical shop in Suva called Cletrico. After few years of consideration, she plans to open a new branch in Labase for a period of 5 years' Investment. The following were gathered after a thorough feasibility study: Leasing a shop would involve payment of $75,000 per year for 5 years. To have an option to lease a similar shop located just next door, the current owners are asking a cash sale price of $270,000. To consider this option, you would need to obtain a SME loan under Slimfit for the full amount ot 6% per annum with annual ordinary repayments. Interest is applied using reducing balance method Other costs associated with buying the shop would be per yearly maintenance costs of $2,500. As per local tax laws, the applicable tax rate is 20% and straight-line depreciation is allowed. After-tax cost of capital would be 3% Required: a. If you consider buying the shop, prepare an amortization table (using the format below) to show repayment of SME loan over the 5 years. (5 m) Period Interest Opening Principal Total Repayment Closing Balance Principal Repayment b. Calculate the present total cost of buying the shop. (12 m) c. Calculate the present total cost of leasing the shop. (2 m) d. Based on (1) above, what would be your final decision? (1m) Willama Truns an electrical shop in Suva called Cletrico. After few years of consideration, she plans to open a new branch in Labase for a period of 5 years' Investment. The following were gathered after a thorough feasibility study: Leasing a shop would involve payment of $75,000 per year for 5 years. To have an option to lease a similar shop located just next door, the current owners are asking a cash sale price of $270,000. To consider this option, you would need to obtain a SME loan under Slimfit for the full amount ot 6% per annum with annual ordinary repayments. Interest is applied using reducing balance method Other costs associated with buying the shop would be per yearly maintenance costs of $2,500. As per local tax laws, the applicable tax rate is 20% and straight-line depreciation is allowed. After-tax cost of capital would be 3% Required: a. If you consider buying the shop, prepare an amortization table (using the format below) to show repayment of SME loan over the 5 years. (5 m) Period Interest Opening Principal Total Repayment Closing Balance Principal Repayment b. Calculate the present total cost of buying the shop. (12 m) c. Calculate the present total cost of leasing the shop. (2 m) d. Based on (1) above, what would be your final decision? (1m)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started