Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer as soon as possible Ms. M (55 years old) is married out of community of property. Ms. M has been an employee of

please answer as soon as possible

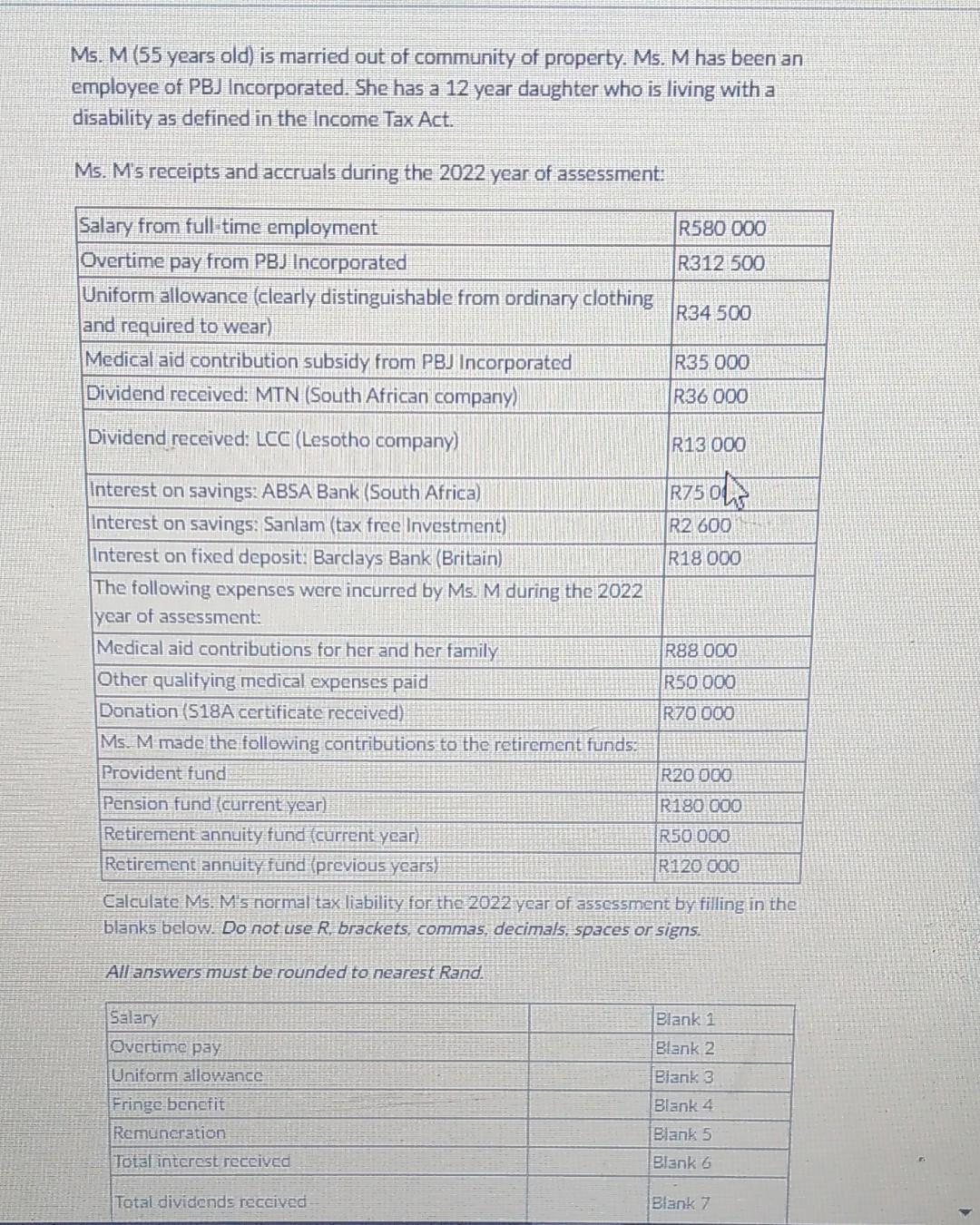

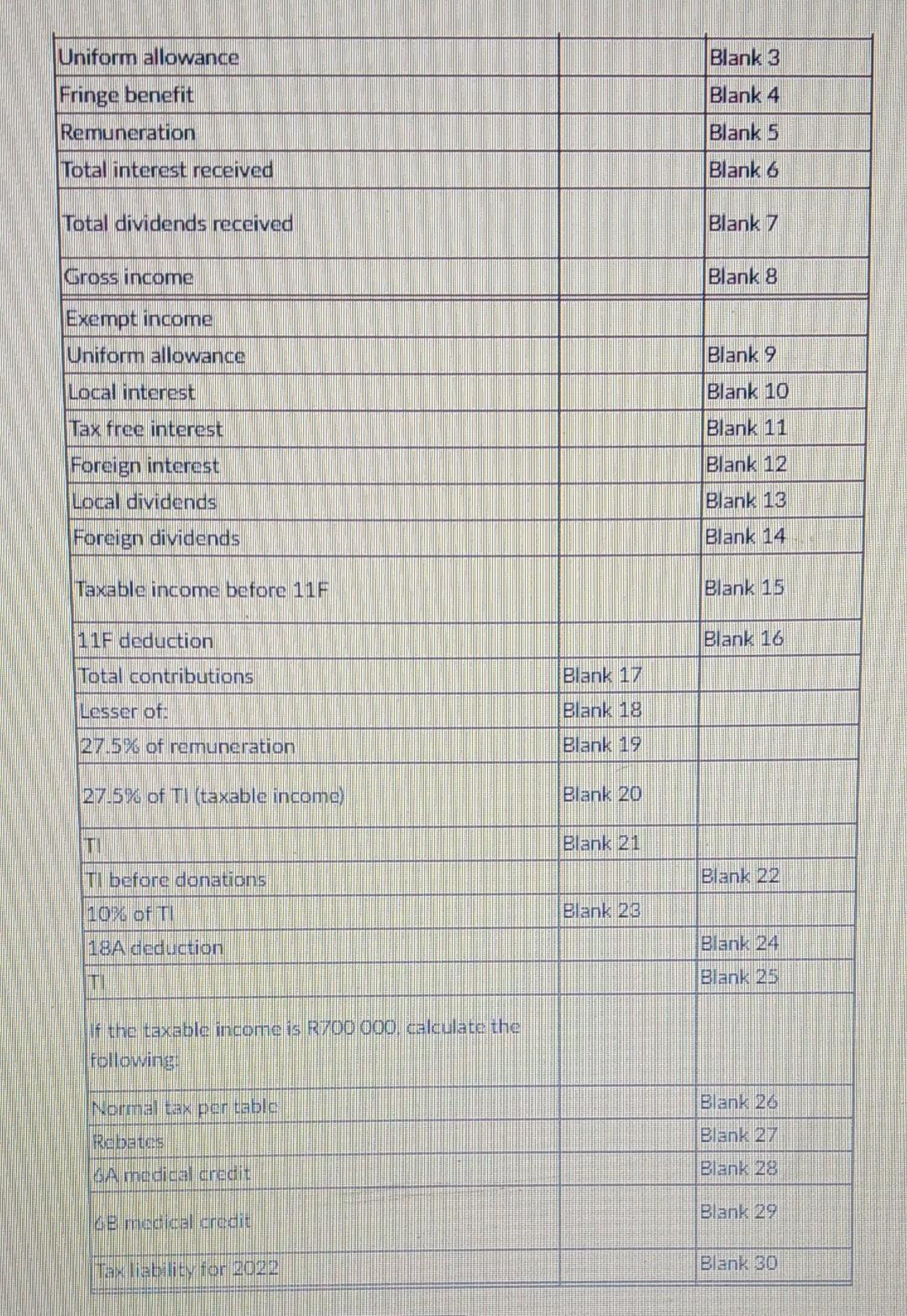

Ms. M (55 years old) is married out of community of property. Ms. M has been an employee of PBJ Incorporated. She has a 12 year daughter who is living with a disability as defined in the Income Tax Act. Ms. M's receipts and accruals during the 2022 year of assessment: Salary from full-time employment R580 000 Overtime pay from PBJ Incorporated R312 500 Uniform allowance (clearly distinguishable from ordinary clothing and required to wear) R34 500 R35 000 Medical aid contribution subsidy from PBJ Incorporated Dividend received: MTN (South African company) R36 000 Dividend received: LCC (Lesotho company) R13 000 Interest on savings: ABSA Bank (South Africa) R75 04F Interest on savings: Sanlam (tax free Investment) R2 600 R18 000 Interest on fixed deposit: Barclays Bank (Britain) The following expenses were incurred by Ms. M during the 2022 year of assessment: Medical aid contributions for her and her family R88.000 Other qualifying medical expenses paid R50 000 Donation (518A certificate received) R70 000 Ms. M made the following contributions to the retirement funds: Provident fund R20 000 Pension fund (current year) R180 000 Retirement annuity fund (current year) R50 000 Retirement annuity fund (previous years) R120 000 Calculate Ms. M's normal tax liability for the 2022 year of assessment by filling in the blanks below. Do not use R. brackets, commas, decimals, spaces or signs. All answers must be rounded to nearest Rand. Salary Blank 1 Overtime pay Blank 2 Uniform allowance Blank 3 Fringe benefit Blank 4 Remuneration Blank 5 Total interest received Blank 6 Total dividends received Blank 7 Uniform allowance Fringe benefit Remuneration Total interest received Total dividends received Gross income Exempt income Uniform allowance Local interest Tax free interest Foreign interest Local dividends Foreign dividends Taxable income before 11F 11F deduction Total contributions Lesser of: 27.5% of remuneration 27.5% of Tl (taxable income) TI TI before donations 10% of TI 18A deduction ITI If the taxable income is R700 000, calculate the following. Normal tax per table Rebates GA medical credit 62 medical credit Tax liability for 2022 Blank 17 Blank 18 Blank 19 Blank 20 Blank 21 Blank 23 Blank 3 Blank 4 Blank 5 Blank 6 Blank 7 Blank 8 Blank 9 Blank 10 Blank 11 Blank 12 Blank 13 Blank 14 Blank 15 Blank 16 Blank 22 Blank 24 Blank 25 Blank 26 Blank 27 Blank 28 Blank 29 Blank 30 Ms. M (55 years old) is married out of community of property. Ms. M has been an employee of PBJ Incorporated. She has a 12 year daughter who is living with a disability as defined in the Income Tax Act. Ms. M's receipts and accruals during the 2022 year of assessment: Salary from full-time employment R580 000 Overtime pay from PBJ Incorporated R312 500 Uniform allowance (clearly distinguishable from ordinary clothing and required to wear) R34 500 R35 000 Medical aid contribution subsidy from PBJ Incorporated Dividend received: MTN (South African company) R36 000 Dividend received: LCC (Lesotho company) R13 000 Interest on savings: ABSA Bank (South Africa) R75 04F Interest on savings: Sanlam (tax free Investment) R2 600 R18 000 Interest on fixed deposit: Barclays Bank (Britain) The following expenses were incurred by Ms. M during the 2022 year of assessment: Medical aid contributions for her and her family R88.000 Other qualifying medical expenses paid R50 000 Donation (518A certificate received) R70 000 Ms. M made the following contributions to the retirement funds: Provident fund R20 000 Pension fund (current year) R180 000 Retirement annuity fund (current year) R50 000 Retirement annuity fund (previous years) R120 000 Calculate Ms. M's normal tax liability for the 2022 year of assessment by filling in the blanks below. Do not use R. brackets, commas, decimals, spaces or signs. All answers must be rounded to nearest Rand. Salary Blank 1 Overtime pay Blank 2 Uniform allowance Blank 3 Fringe benefit Blank 4 Remuneration Blank 5 Total interest received Blank 6 Total dividends received Blank 7 Uniform allowance Fringe benefit Remuneration Total interest received Total dividends received Gross income Exempt income Uniform allowance Local interest Tax free interest Foreign interest Local dividends Foreign dividends Taxable income before 11F 11F deduction Total contributions Lesser of: 27.5% of remuneration 27.5% of Tl (taxable income) TI TI before donations 10% of TI 18A deduction ITI If the taxable income is R700 000, calculate the following. Normal tax per table Rebates GA medical credit 62 medical credit Tax liability for 2022 Blank 17 Blank 18 Blank 19 Blank 20 Blank 21 Blank 23 Blank 3 Blank 4 Blank 5 Blank 6 Blank 7 Blank 8 Blank 9 Blank 10 Blank 11 Blank 12 Blank 13 Blank 14 Blank 15 Blank 16 Blank 22 Blank 24 Blank 25 Blank 26 Blank 27 Blank 28 Blank 29 Blank 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started