Answered step by step

Verified Expert Solution

Question

1 Approved Answer

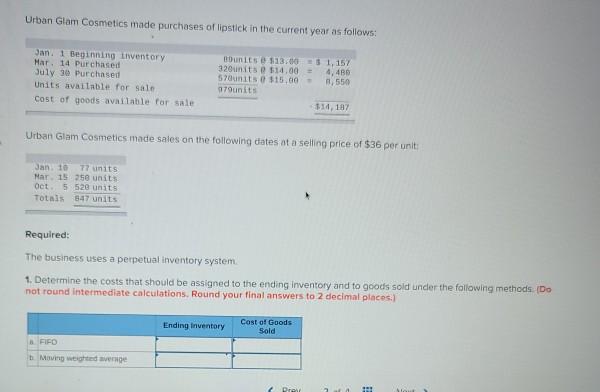

Please answer as soon as possible. Thank you in advance for answer. Urban Glam Cosmetics made purchases of lipstick in the current year as follows:

Please answer as soon as possible. Thank you in advance for answer.

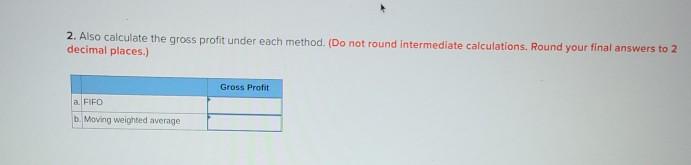

Urban Glam Cosmetics made purchases of lipstick in the current year as follows: Jan. 1 Beginning inventory Mar. 14 Purchased July 30 Purchased Units available for sale Cost of goods available for sale units $13.00 1,157 320units $14.00 4,40 570units $15.00 1,550 970unit $14.187 Urban Glam Cosmetics made sales on the following dates at a selling price of $36 per unit: Jan 10 77 units Mar 15 358 units Oct. 5520 units Totals 547 units Required: The business uses a perpetual inventory system 1. Determine the costs that should be assigned to the ending inventory and to goods sold under the following methods. (Do not round Intermediate calculations. Round your final answers to 2 decimal places Ending Inventory Cost of Goods Sold FIRD Moving weighted average Pras 2. Also calculate the gross profit under each method. (Do not round Intermediate calculations. Round your final answers to 2 decimal places.) Gross Profit a FIFO b. Moving weighted averageStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started