Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer ASAP 15. Amortized loans Imagine you are finally able to buy your first classic sports car. To do so, you have arranged to

please answer ASAP

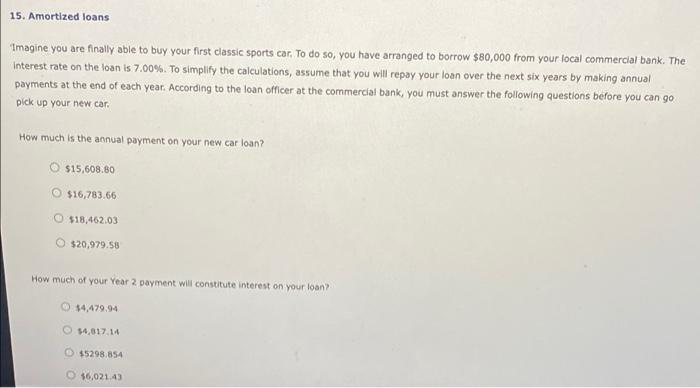

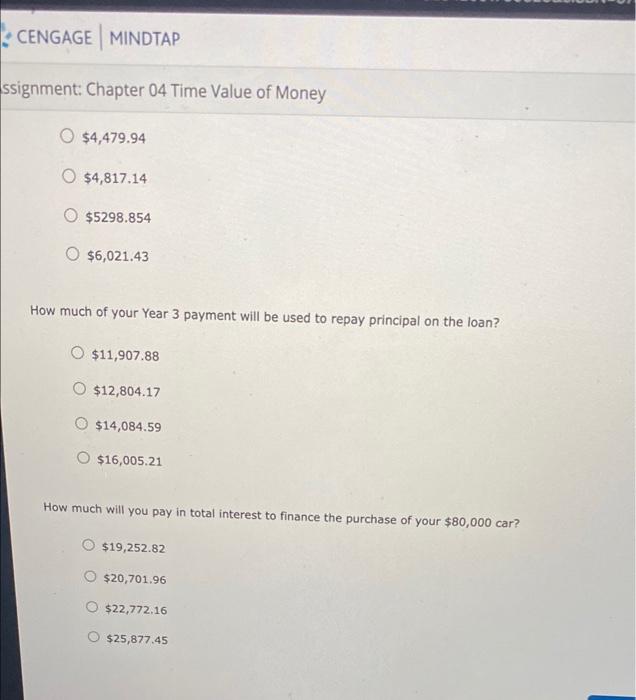

15. Amortized loans Imagine you are finally able to buy your first classic sports car. To do so, you have arranged to borrow $80,000 from your local commercial bank. The Interest rate on the loan is 7.00%. To simplify the calculations, assume that you will repay your loan over the next six years by making annual payments at the end of each year. According to the loan officer at the commercial bank, you must answer the following questions before you can go pick up your new car How much is the annual payment on your new car loan? O $15,608.80 $16,783.66 $18.462.03 $20.979.58 How much of your Year 2 payment will constitute interest on your loan? 14.479.94 14,017.14 $5298.854 $6,021.43 CENGAGE MINDTAP ssignment: Chapter 04 Time Value of Money $4,479.94 0 $4,817.14 $5298.854 $6,021.43 How much of your Year 3 payment will be used to repay principal on the loan? O $11,907.88 O $12,804.17 $14,084.59 $16,005.21 How much will you pay in total interest to finance the purchase of your $80,000 car? $19,252.82 $20,701.96 $22,772.16 $25,877.45

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started