Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer ASAP! (3) Junky Auto Supplies began operations in 2012. The company's inventory purchases and sales are as follows: Year 2012 2013 2014 20,000

Please answer ASAP!

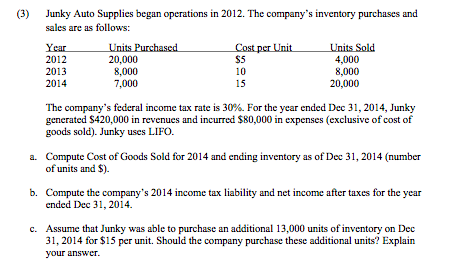

(3) Junky Auto Supplies began operations in 2012. The company's inventory purchases and sales are as follows: Year 2012 2013 2014 20,000 8,000 7,000 S5 10 15 4,000 8,000 20,000 The company's federal income tax rate is 30%. For the year ended Dec 31, 2014, Junky generated $420,000 in revenues and incurred $80,000 in expenses (exclusive of cost of goods sold). Junky uses LIFO Compute Cost of Goods Sold for 2014 and ending inventory as of Dec 31, 2014 (number of units and S). a. b. Compute the company's 2014 income tax liability and net income after taxes for the year ended Dec 31, 2014 Assume that Junky was able to purchase an additional 13,000 units of inventory on Dec 31, 2014 for $15 per unit. Should the company purchase these additional units? Explain your answer. cStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started