Answered step by step

Verified Expert Solution

Question

1 Approved Answer

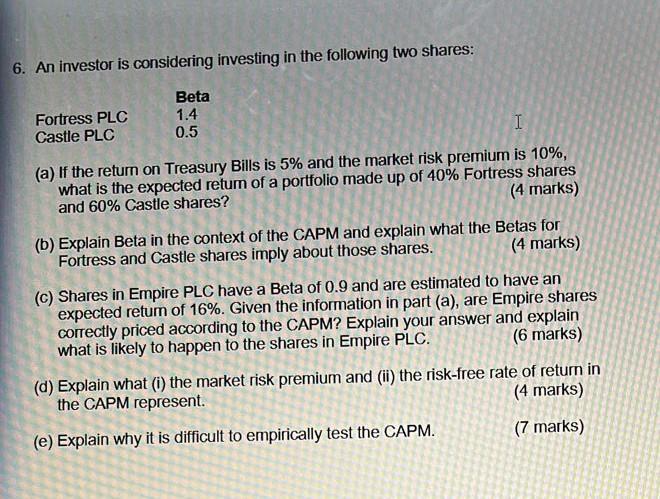

please answer ASAP 6. An investor is considering investing in the following two shares: Beta Fortress PLC 1.4 Castle PLC 0.5 I (a) If the

please answer ASAP

6. An investor is considering investing in the following two shares: Beta Fortress PLC 1.4 Castle PLC 0.5 I (a) If the return on Treasury Bills is 5% and the market risk premium is 10%, what is the expected return of a portfolio made up of 40% Fortress shares (4 marks) and 60% Castle shares? (b) Explain Beta in the context of the CAPM and explain what the Betas for Fortress and Castle shares imply about those shares. hares imply abo (4 marks) (c) Shares in Empire PLC have a Beta of 0.9 and are estimated to have an expected return of 16%. Given the information in part (a), are Empire shares correctly priced according to the CAPM? Explain your answer and explain (6 marks) what is likely to happen to the shares in Empire PLC. (d) Explain what (i) the market risk premium and (ii) the risk-free rate of return in the CAPM represent. (4 marks) (e) Explain why it is difficult to empirically test the CAPM. (7 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started