Answered step by step

Verified Expert Solution

Question

1 Approved Answer

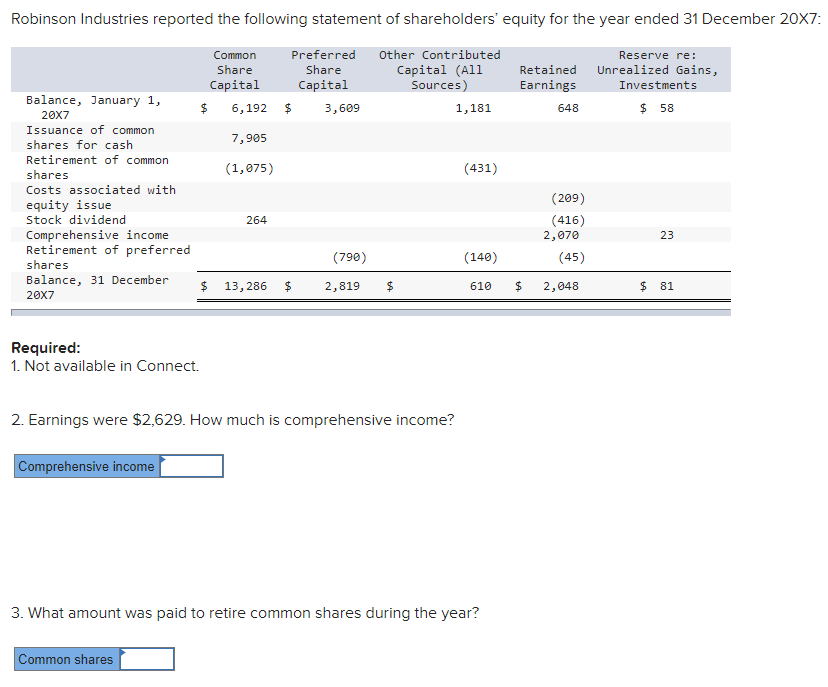

please answer ASAP FOR POSITIVE RATING!! Robinson Industries reported the following statement of shareholders' equity for the year ended 31 December 20x7: Common Preferred Share

please answer ASAP FOR POSITIVE RATING!!

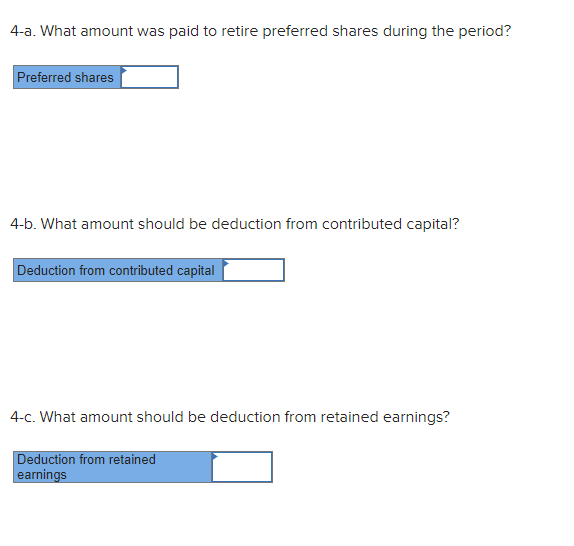

Robinson Industries reported the following statement of shareholders' equity for the year ended 31 December 20x7: Common Preferred Share Share Capital Capital 6,192 $ 3,609 Other Contributed Capital (All Sources) 1,181 Retained Earnings 648 Reserve re: Unrealized Gains, Investments $ 58 7,905 (1,075) (431) Balance, January 1, 20X7 Issuance of common shares for cash Retirement of common shares Costs associated with equity issue Stock dividend Comprehensive income Retirement of preferred shares Balance, 31 December 20X7 264 (209) (416) 2,070 (45) 23 (790) (140) $ 13,286 $ 2,819 610 $ 2,048 $ 81 Required: 1. Not available in Connect. 2. Earnings were $2,629. How much is comprehensive income? Comprehensive income 3. What amount was paid to retire common shares during the year? Common shares 4-a. What amount was paid to retire preferred shares during the period? Preferred shares 4-5. What amount should be deduction from contributed capital? Deduction from contributed capital 4-c. What amount should be deduction from retained earnings? Deduction from retained earningsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started