Answered step by step

Verified Expert Solution

Question

1 Approved Answer

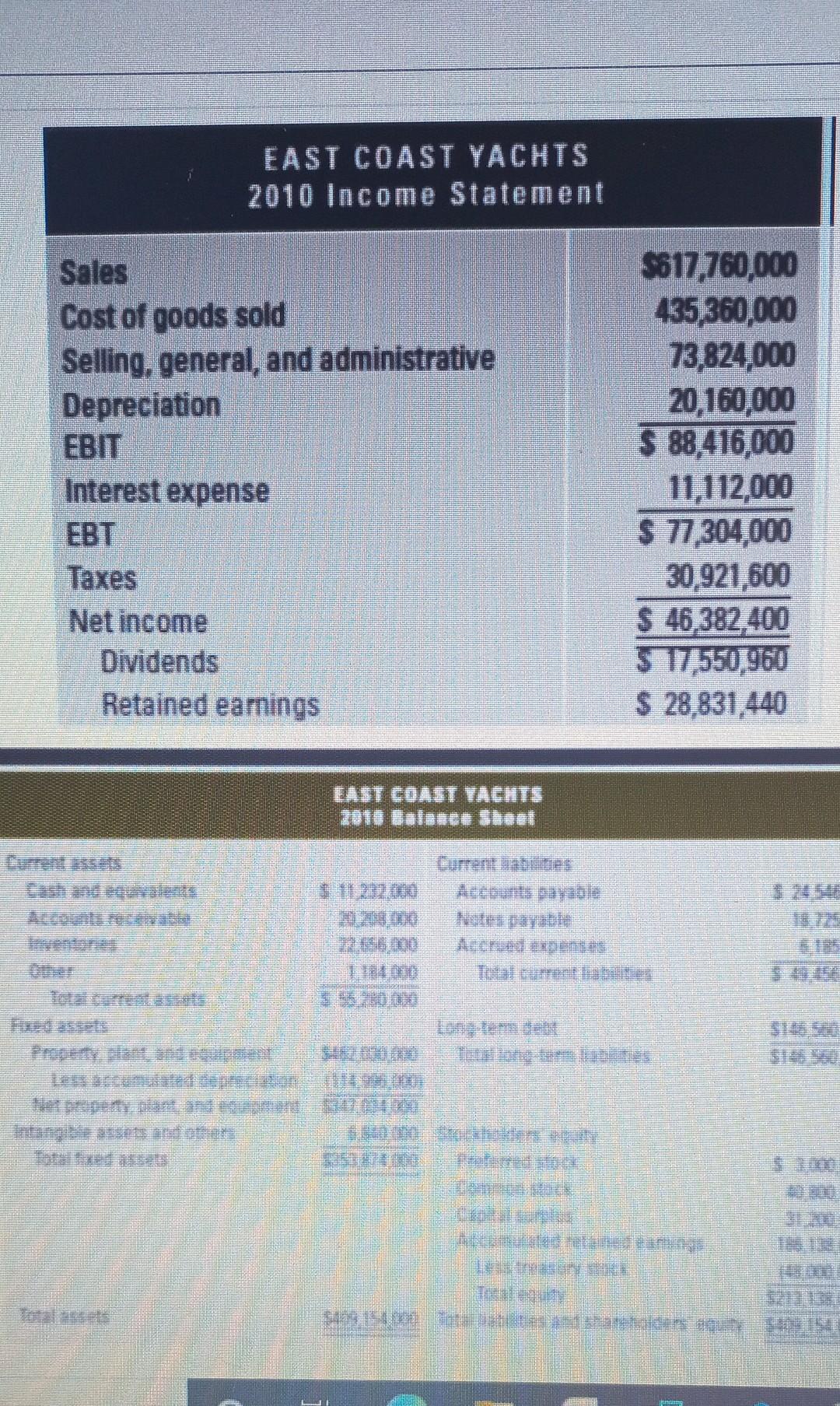

please answer ASAP, I NEED IT RN EAST COAST YACHTS 2010 Income Statement Sales Cost of goods sold Selling, general, and administrative Depreciation EBIT Interest

please answer ASAP, I NEED IT RN

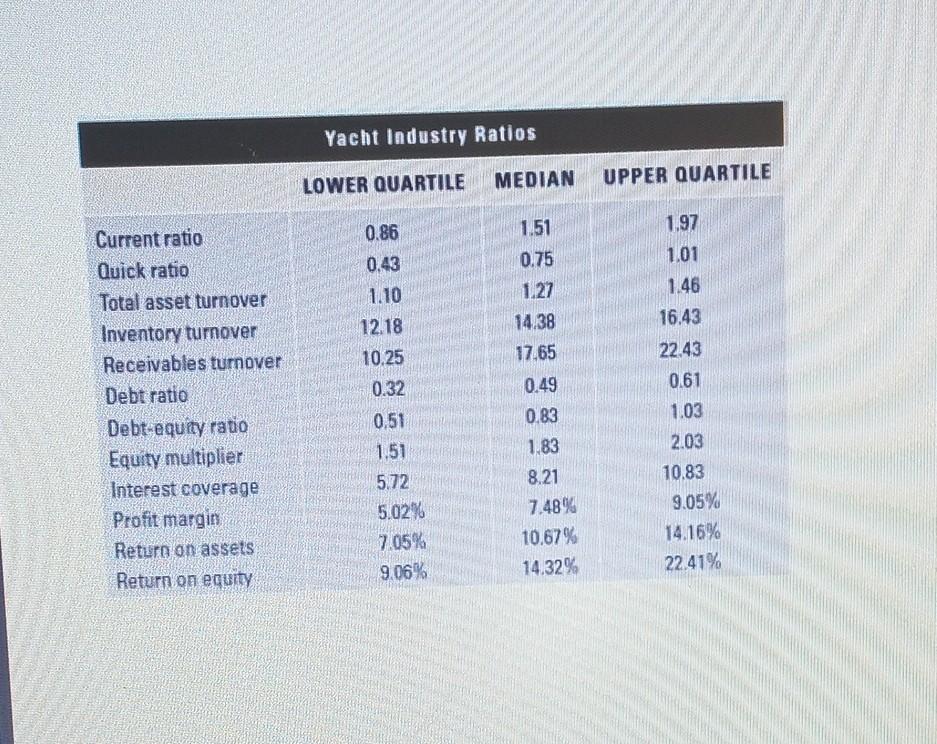

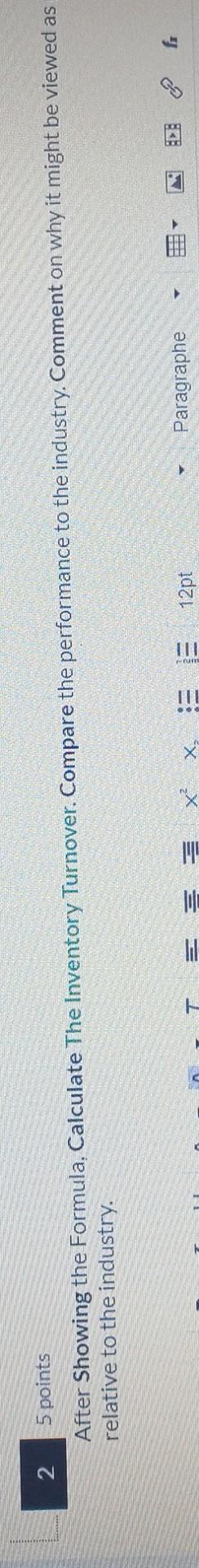

EAST COAST YACHTS 2010 Income Statement Sales Cost of goods sold Selling, general, and administrative Depreciation EBIT Interest expense EBT Taxes Net income Dividends Retained earrings $617,760,000 435,360,000 73,824,000 20,160,000 $ 88,416,000 11 112,000 $ 71 304,000 30.921,600 $ 46,382,400 5 17,550,960 $ 28.831 440 EAST COAST TACHTS 2010 Balance Sheet Current abilities $ 11 232 000 Accounts payable 29.223.00 27696,000 cum 123 Yacht Industry Ratios LOWER QUARTILE MEDIAN UPPER QUARTILE 0.86 0.43 1.10 12.18 10.25 0.32 1.51 0.75 1.27 14.38 17.65 1.97 1.01 1.46 16.43 Current ratio Quick ratio Total asset turnover Inventory turnover Receivables turnover Debt ratio Debt-equity ratio Equity multiplier Interest coverage Profit margir Return on assets Return on equity 0.51 1.51 22.43 0.61 1.03 2.03 10.83 9.05% 14.16% 22.41% 0.49 0.83 1.83 8.21 7.48% 10,67% 14.32% 5.72 5.02% 7.05% 9.06% 2 5 points After Showing the Formula, Calculate The Inventory Turnover. Compare the performance to the industry. Comment on why it might be viewed as relative to the industry. - & fi T = Paragraphe lil E 12pt x X

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started