PLEASE ANSWER ASAP

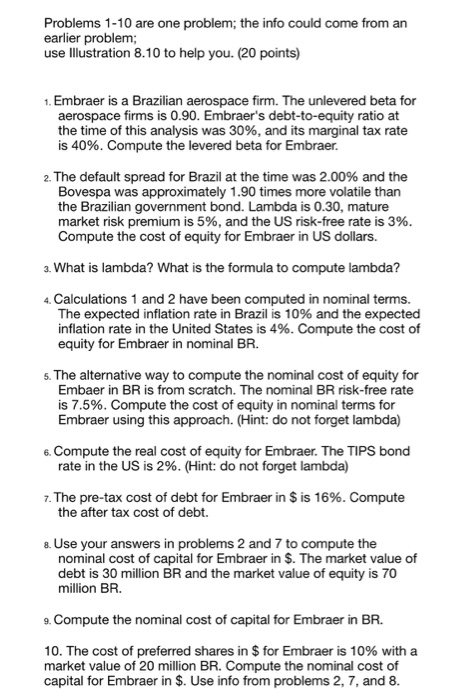

Problems 1-10 are one problem; the info could come from an earlier problem; use Illustration 8.10 to help you. (20 points) 1. Embraer is a Brazilian aerospace firm. The unlevered beta for aerospace firms is 0.90. Embraer's debt-to-equity ratio at the time of this analysis was 30%, and its marginal tax rate is 40%. Compute the levered beta for Embraer. 2. The default spread for Brazil at the time was 2.00% and the Bovespa was approximately 1.90 times more volatile than the Brazilian government bond. Lambda is 0.30, mature market risk premium is 5%, and the US risk-free rate is 3%. Compute the cost of equity for Embraer in US dollars. 3. What is lambda? What is the formula to compute lambda? 4. Calculations 1 and 2 have been computed in nominal terms. The expected inflation rate in Brazil is 10% and the expected inflation rate in the United States is 4%. Compute the cost of equity for Embraer in nominal BR. 6. The alternative way to compute the nominal cost of equity for Embaer in BR is from scratch. The nominal BR risk-free rate is 7.5%. Compute the cost of equity in nominal terms for Embraer using this approach. (Hint: do not forget lambda) 6. Compute the real cost of equity for Embraer. The TIPS bond rate in the US is 2%. (Hint: do not forget lambda) 7. The pre-tax cost of debt for Embraer in $ is 16%. Compute the after tax cost of debt. 8. Use your answers in problems 2 and 7 to compute the nominal cost of capital for Embraer in $. The market value of debt is 30 million BR and the market value of equity is 70 million BR. . Compute the nominal cost of capital for Embraer in BR. 10. The cost of preferred shares in $ for Embraer is 10% with a market value of 20 million BR. Compute the nominal cost of capital for Embraer in $. Use info from problems 2, 7, and 8. ILLUSTRATION 8.10: Estimating the Cost of Equity for Embraer March 2008 Te estimate its cost of quity, we first estimated the levere bete by Embraer is a Brazilian aerospace firm looking at acrospace firms globally Unlevered beta for aerospace firm -0.75 Embar's debt-to-equity ratio at the time of this analysis was 26.5%. ling in a levered beta form er (with a mwinamate of 34% for Bail: Lovered beta for Embraer -0.75[1 + (1 - 34) 2684) -0.88 To estimate the cost of equity for Embraer in US dollar terms, we began with the Treasury hond rate of 3.8% at the time of the analysis, but incorporated the country risk associated with Branil into the risk premium. Using the approach described in Chapter 7 we estimated a country risk premium of 3.66% in March 2008, the default spread for Hiraril at the time was 2.00% and the Bovespa was approximately 13 times more volatile than the Brain government bond. In conjunction with a mature market risk premium of 4% estimated for the United States at the time, this yields a cost of equity of 10.54% Cost of equity for Embraer-3.8% +0.88(4.00% +3.56%) - 10.54% Again, there are several points that are worth making on this estimate. The first is that this cost of equity can be expected to change over time as Brazil matures as a market and country risk declines. The second is that we have assumed that botas measure exposure to country risk. A company like Embraer that drives the bulk of its revenus outside Brazil could argue that it is less exposed to country risk. In the preceding section, we introduced the concept of lambda and came up with two estimates for Embraer: 0.15, using revenue exposure and 0.27, using the regression of Embraer stock returns against the Brazilian dollar bond. We will use the latter to compute the cost of equity Cost of equity in U.S. dollars - Risk-free rate + Beta(Mature market risk premium) + [Country risk premium) -3.8%+0.884.00%) +0.27(3.66%) - 8.31% The final point is that the cost of equity in dollar terms can be converted into a nominal Branian real (BR) cost of equity fairly simply by considering the differences in expected inflation rates in Brazil and the United States. For instance, if the expected inflation rate in Brazil is 6% and the expected inflation rate in the United States is 2% the cost of equity in nominal BR is as follows: Cost of equity. - (1 Cost of equity)(Inflation rate Inflation ratus) - 1 - (10831)(1.06/1.02) - 1 - 12.56% Implicitly, we assume that BRrisk-free rates around the world are the same with this approach and that the risk premium scales up with inflation as well. The alternative is to estimate a cost of equity from scratch, beginning with a nominal BRrisk-free rate (which was 8% at the time of this analysis) and adding the premiums from before Cost of equity -Risk-tree rate+Beta Mature market risk premium) + Country risk premium -8% +0.884.00%) 0.27(3.66%) -12.515 Schatting realis-free rate in the equation would yield a real cost of equity. Thes e that the real risk-free rate is 1.3% (the rate on an inflation-adjusted TIPS bond the real cost of equity would have been Cost of equity - 1.5%+0.88 (4%) +0.27 (3.56%) -6.01%