Answered step by step

Verified Expert Solution

Question

1 Approved Answer

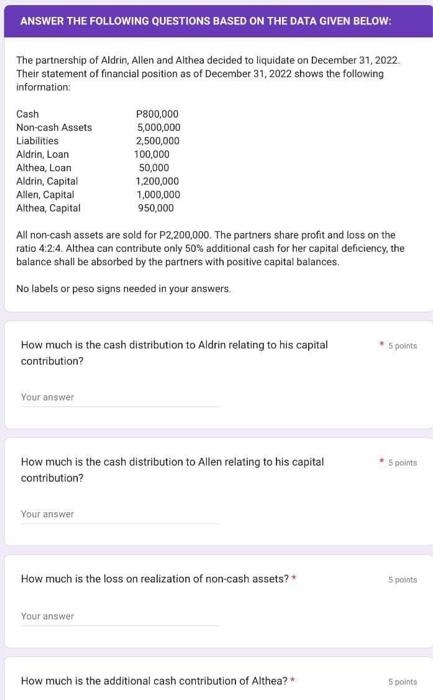

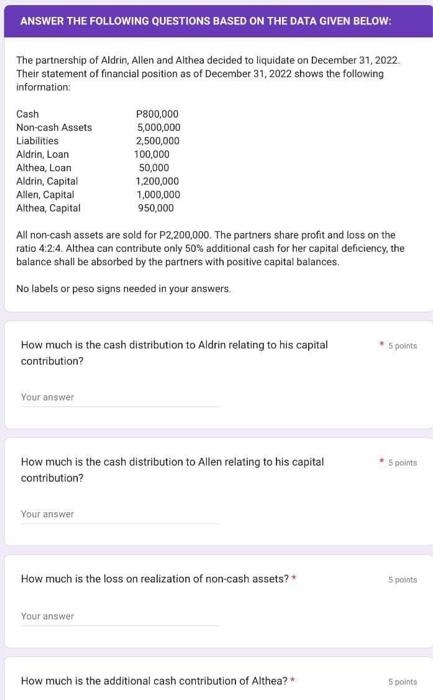

please answer asap. thank you ANSWER THE FOLLOWING QUESTIONS BASED ON THE DATA GIVEN BELOW: The partnership of Aldrin, Allen and Althea decided to liquidate

please answer asap. thank you

ANSWER THE FOLLOWING QUESTIONS BASED ON THE DATA GIVEN BELOW: The partnership of Aldrin, Allen and Althea decided to liquidate on December 31, 2022. Their statement of financial position as of December 31, 2022 shows the following information: All non-cash assets are sold for P2,200,000. The partners share profit and loss on the ratio 4:2:4. Althea can contribute only 50% additional cash for her capital deficiency, the balance shall be absorbed by the partners with positive capital balances. No labels or peso signs needed in your answers. How much is the cash distribution to Aldrin relating to his capital 5 points contribution? How much is the cash distribution to Allen relating to his capital contribution? How much is the loss on realization of non-cash assets? * 5 points How much is the additional cash contribution of Althea? * 5 points

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started