Answered step by step

Verified Expert Solution

Question

1 Approved Answer

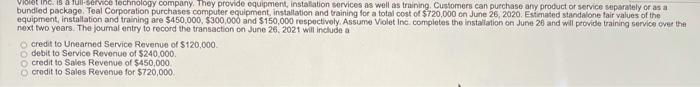

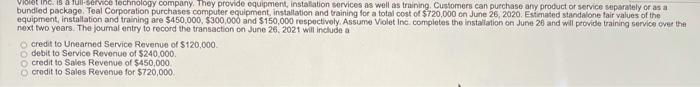

PLEASE ANSWER ASAP Violetinvio fechnology company. They provide equipment installation services as well as training. Customers can purchase any product of service separately or as

PLEASE ANSWER ASAP

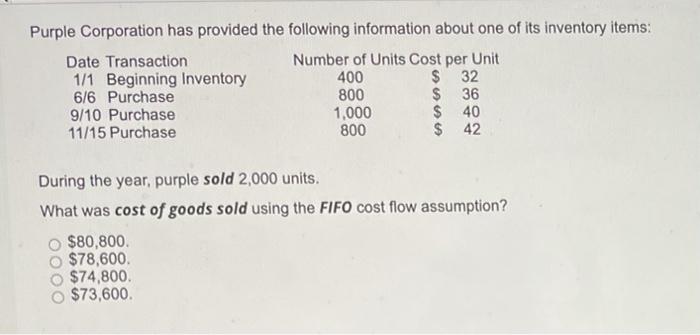

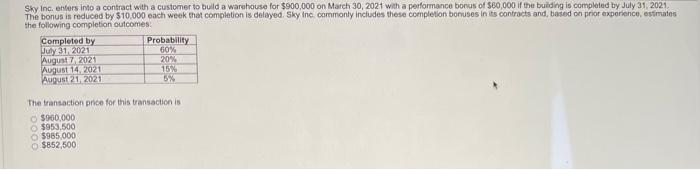

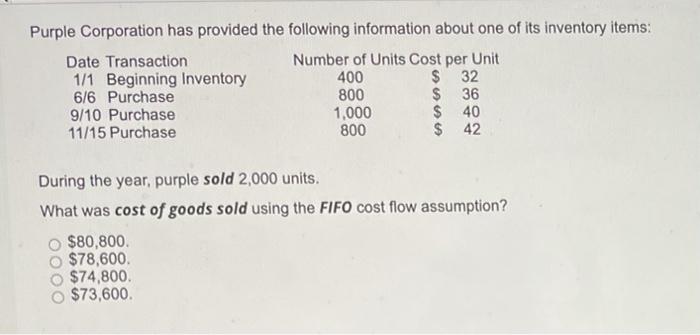

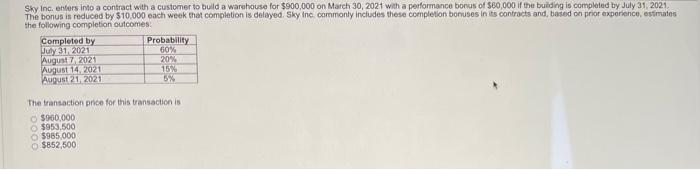

Violetinvio fechnology company. They provide equipment installation services as well as training. Customers can purchase any product of service separately or as a bundled package. Toal Corporation purchases computer equipment installation and training for a total cost of $720,000 on June 26, 2020. Estimated standalone fair values of the equipment installation and training are $450,000 $300,000 and $150,000 respectively. Assume Violet Inc. completes the installation on June 26 and will provide training service over the next two years. The journal entry to record the transaction on June 26, 2021 will include a credit to Unearned Service Revenue of $120,000 debit to Service Revenue of $240,000 credit to Sales Revenue of $450,000 credit to Sales Revenue for $720,000 Purple Corporation has provided the following information about one of its inventory items: Date Transaction Number of Units Cost per Unit 1/1 Beginning Inventory 400 $ 32 6/6 Purchase 800 $ 36 9/10 Purchase 1,000 $ 40 11/15 Purchase 800 $ 42 During the year, purple sold 2,000 units. What was cost of goods sold using the FIFO cost flow assumption? $80,800 $78,600 $74,800. $73,600 Sky Inc. enters into a contract with a customer to build a warehouse for $900,000 on March 30, 2021 with a performance bonus of $60,000 if the building is completed by July 31, 2021 The bonus is reduced by $10,000 each week that completion is delayed Sky Inc. commonly includes these completion bonuses in its contracts and based on prior experience, ostmates the following completion outcomes Completed by Probability July 31, 2021 60% August 7 2021 20% August 14.2021 15% August 21, 2021 5% The transaction price for this transaction is 3960,000 $953.500 $985.000 $852,500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started