Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer below questions in an Excel file and return your solutions by uploading on Canvas No. Questions 1 You need 500,000 two years

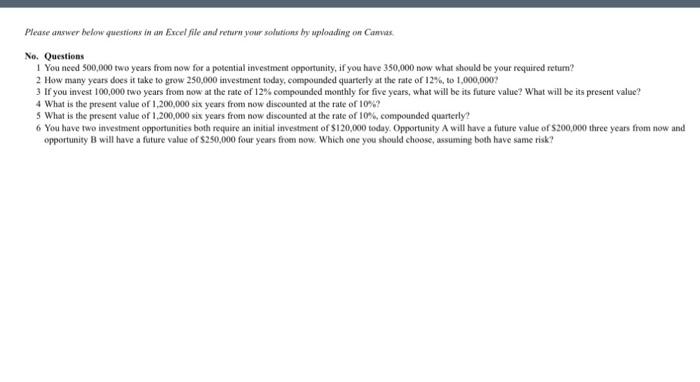

Please answer below questions in an Excel file and return your solutions by uploading on Canvas No. Questions 1 You need 500,000 two years from now for a potential investment opportunity, if you have 350,000 now what should be your required return? 2 How many years does it take to grow 250,000 investment today, compounded quarterly at the rate of 12%, to 1,000,000? 3 If you invest 100,000 two years from now at the rate of 12% compounded monthly for five years, what will be its future value? What will be its present value? 4 What is the present value of 1,200,000 six years from now discounted at the rate of 10%? 5 What is the present value of 1,200,000 six years from now discounted at the rate of 10%, compounded quarterly? 6 You have two investment opportunities both require an initial investment of $120,000 today. Opportunity A will have a future value of $200,000 three years from now and opportunity B will have a future value of $250,000 four years from now. Which one you should choose, assuming both have same risk?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required Return Calculation Cell A1 Initial investment 350000 Cell A2 Future value needed 500000 Cel...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started