Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer both questions and in excel format. Struggling with NPV an IRR in Excell and want to see all the work. I appreciate your

Please answer both questions and in excel format. Struggling with NPV an IRR in Excell and want to see all the work. I appreciate your help.

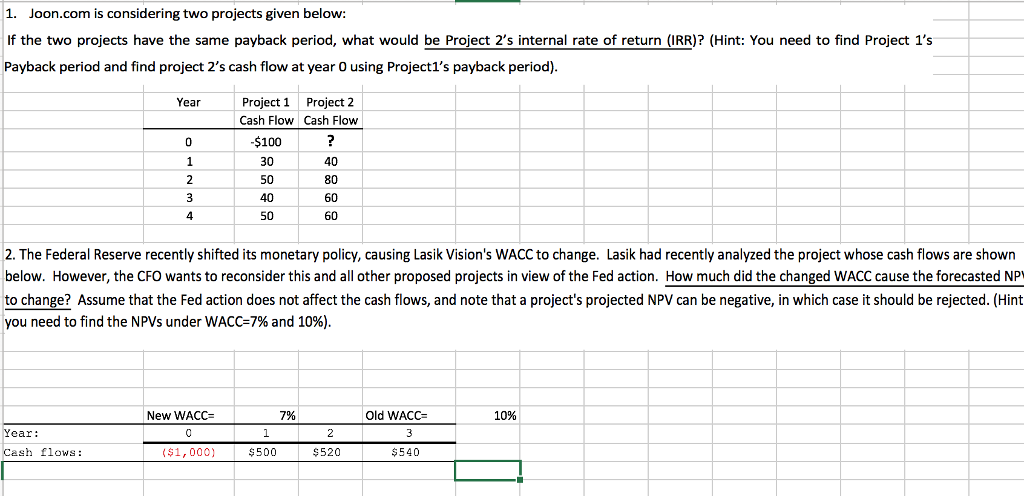

1. Joon.com is considering two projects given below: If the two projects have the same payback period, what would be Project 2's internal rate of return (IRR)? (Hint: You need to find Project 1's Payback period and find project 2's cash flow at year o using Project1's payback period). Project 1 Project 2 Year Cash Flow Cash Flow -$100 40 80 60 60 50 2. The Federal Reserve recently shifted its monetary policy, causing Lasik Vision's WACC to change. Lasik had recently analyzed the project whose cash flows are shown below. However, the CFO wants to reconsider this and all other proposed projects in view of the Fed action. How much did the changed WACC cause the forecasted NP to change? Assume that the Fed action does not affect the cash flows, and note that a project's projected NPV can be negative, in which case it should be rejected. (Hint you need to find the NPVs under WACC 7% and 10%). 7% Old WACC 10% New WACC Year: $500 $520 $540 Cash flows: ($1,000)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started