Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer both questions including journal entries. Thank you! On December 31, 2018, Big Company acquired all the capital stock of Little Company. Big acquired

Please answer both questions including journal entries. Thank you!

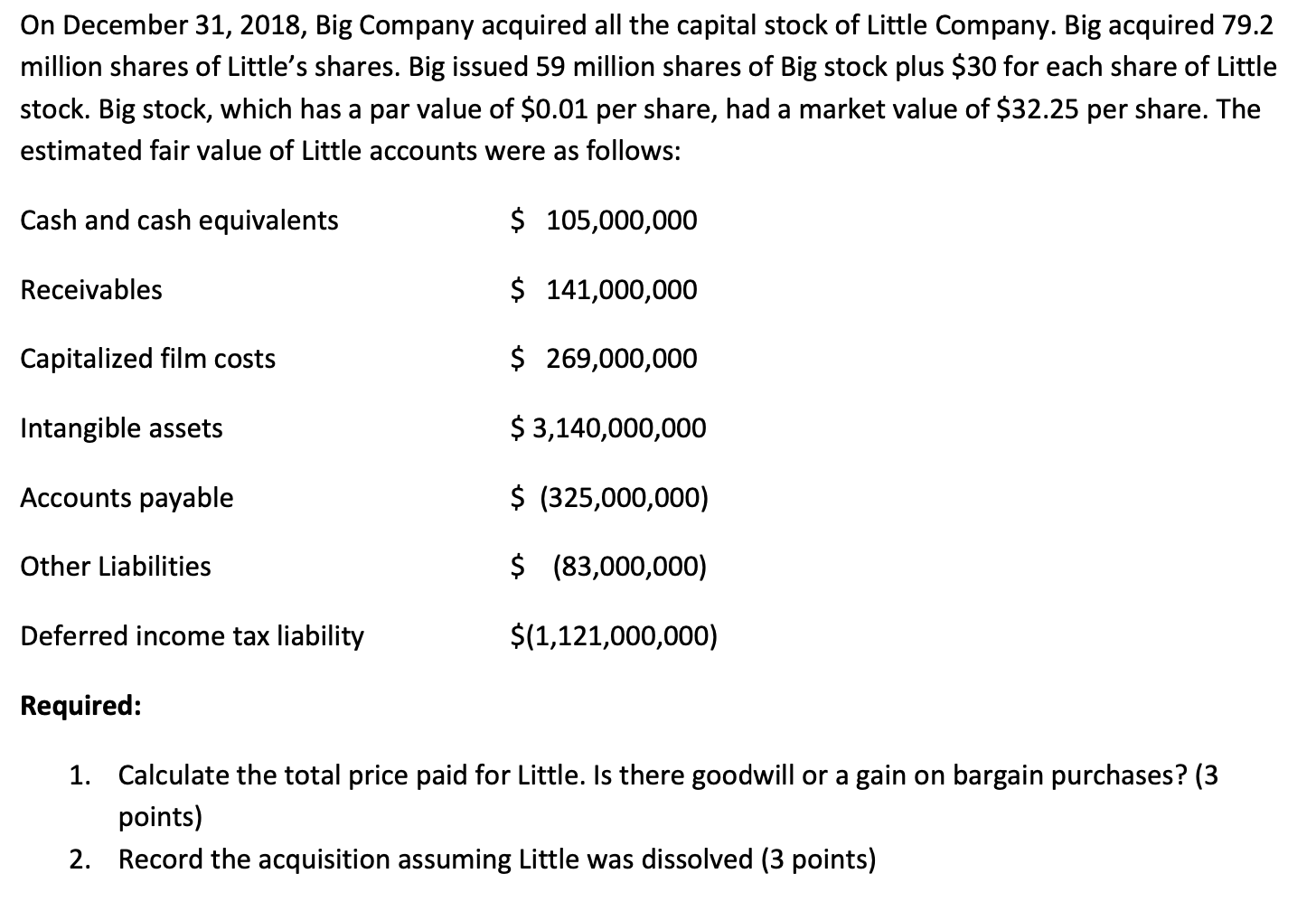

On December 31, 2018, Big Company acquired all the capital stock of Little Company. Big acquired 79.2 million shares of Little's shares. Big issued 59 million shares of Big stock plus $30 for each share of Little stock. Big stock, which has a par value of $0.01 per share, had a market value of $32.25 per share. The estimated fair value of Little accounts were as follows: Cash and cash equivalents $ 105,000,000 Receivables $ 141,000,000 Capitalized film costs $ 269,000,000 Intangible assets $ 3,140,000,000 Accounts payable $ (325,000,000) Other Liabilities $ (83,000,000) Deferred income tax liability $(1,121,000,000) Required: 1. Calculate the total price paid for Little. Is there goodwill or a gain on bargain purchases? (3 points) 2. Record the acquisition assuming Little was dissolved (3 points)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started