Answered step by step

Verified Expert Solution

Question

1 Approved Answer

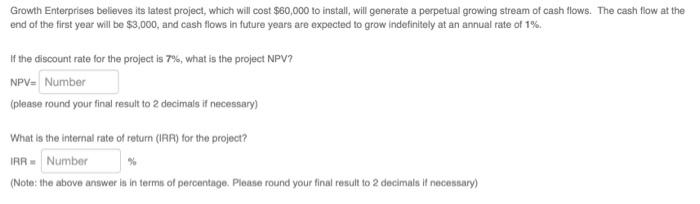

Please answer both. Thumbs up! Growth Enterprises believes its latest project, which will cost $60,000 to install, will generate a perpetual growing stream of cash

Please answer both. Thumbs up!

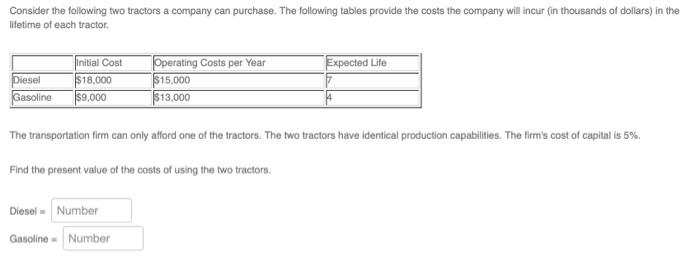

Growth Enterprises believes its latest project, which will cost $60,000 to install, will generate a perpetual growing stream of cash flows. The cash flow at the end of the first year will be $3,000, and cash flows in future years are expected to grow indefinitely at an annual rate of 1% If the discount rate for the project is 7%, what is the project NPV? NPV= Number (please round your final result to 2 decimals if necessary) What is the internal rate of return (IRR) for the project? IRR. Number (Note: the above answer is in terms of percentage. Please round your final result to 2 decimals If necessary) % Consider the following two tractors a company can purchase. The following tables provide the costs the company will incur (in thousands of dollars) in the lifetime of each tractor Expected Life Diesel Gasoline initial Cost $18,000 $9,000 Operating Costs per Year $15,000 $13,000 The transportation firm can only afford one of the tractors. The two tractors have identical production capabilities. The firm's cost of capital is 5%. Find the present value of the costs of using the two tractors. Diesel - Number Gasoline Number Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started