please answer both!! will thumbs up(:

please answer both!! will thumbs up(:

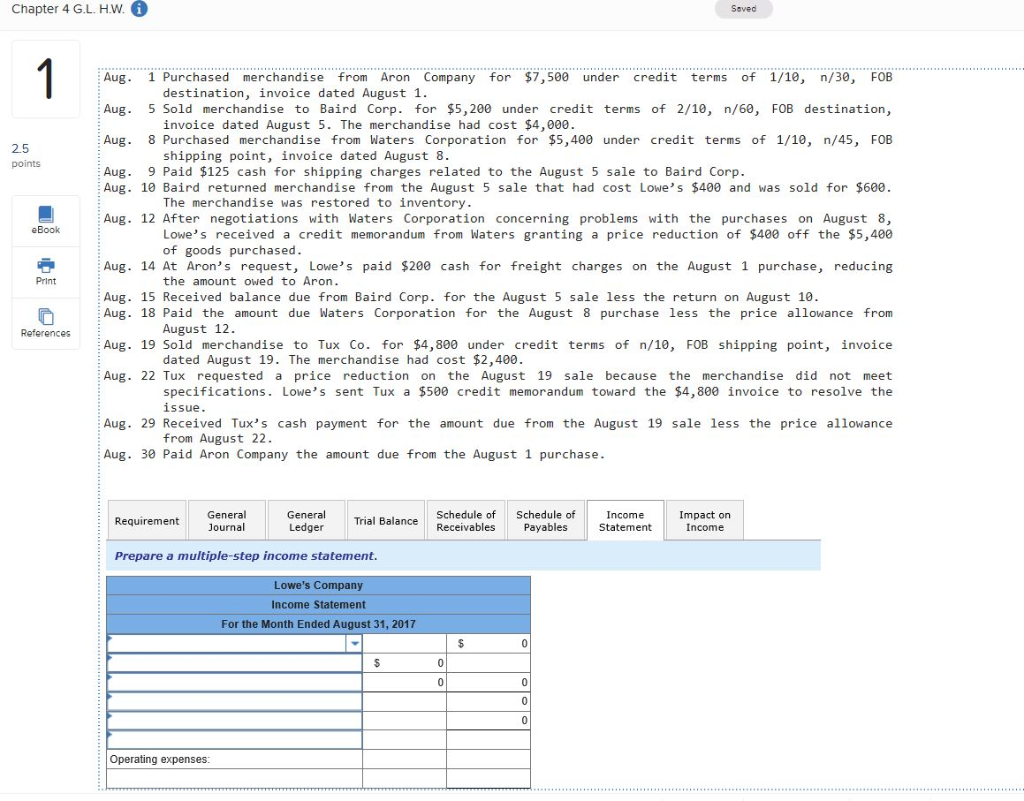

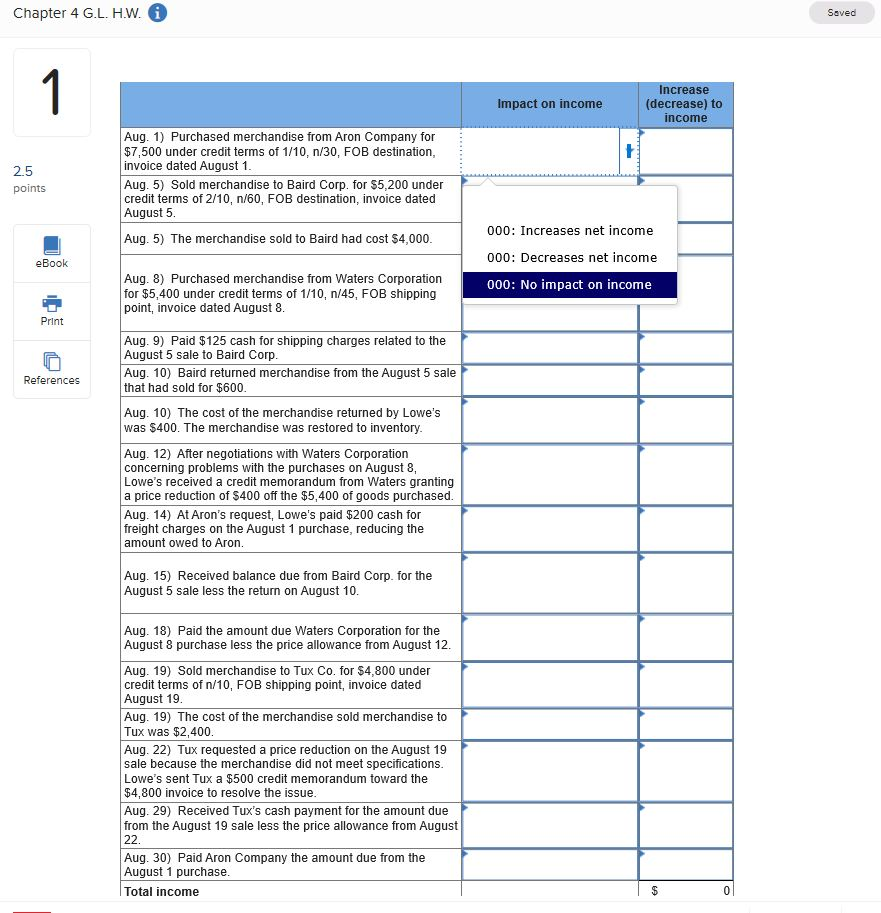

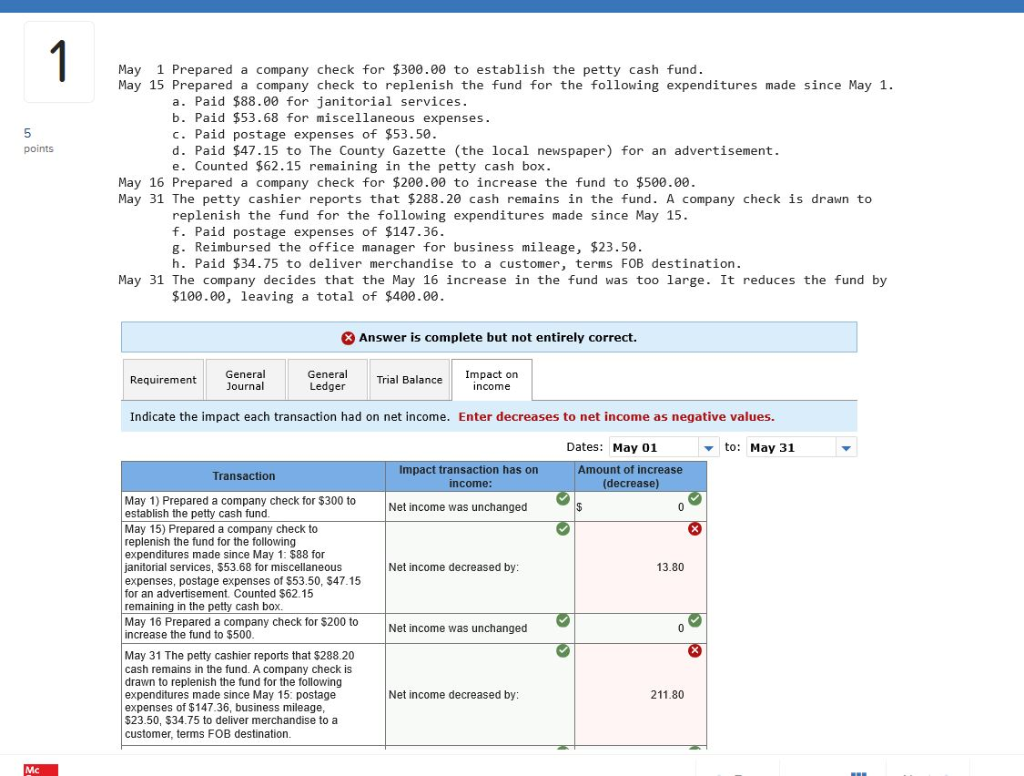

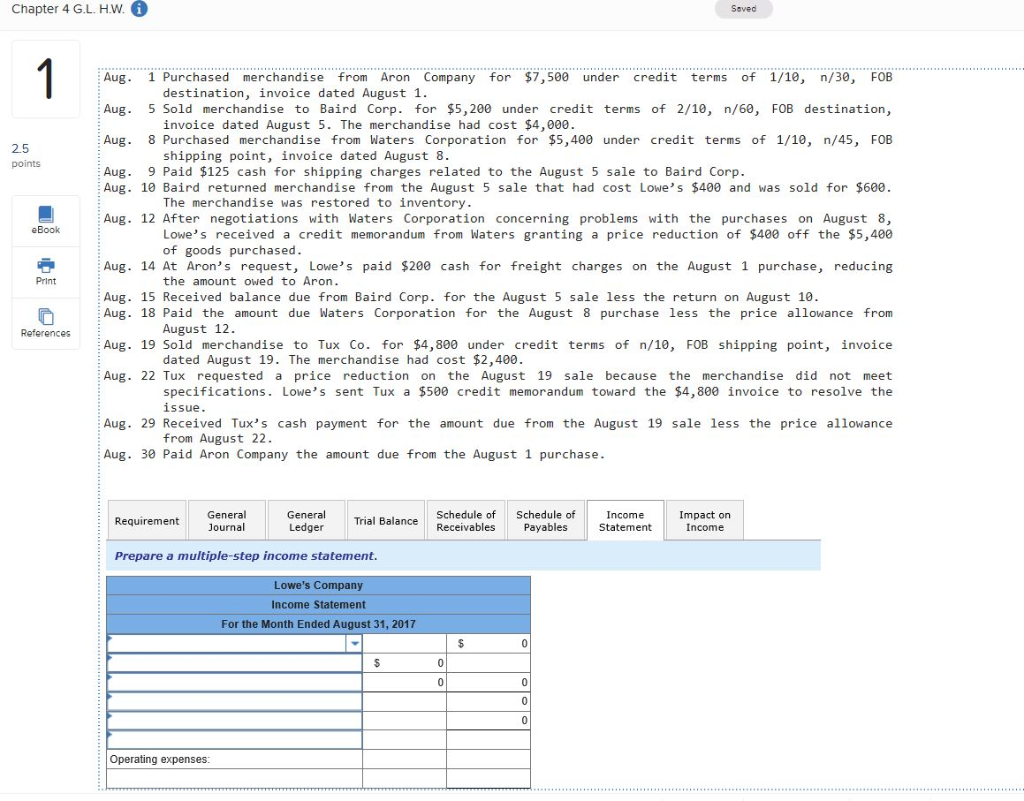

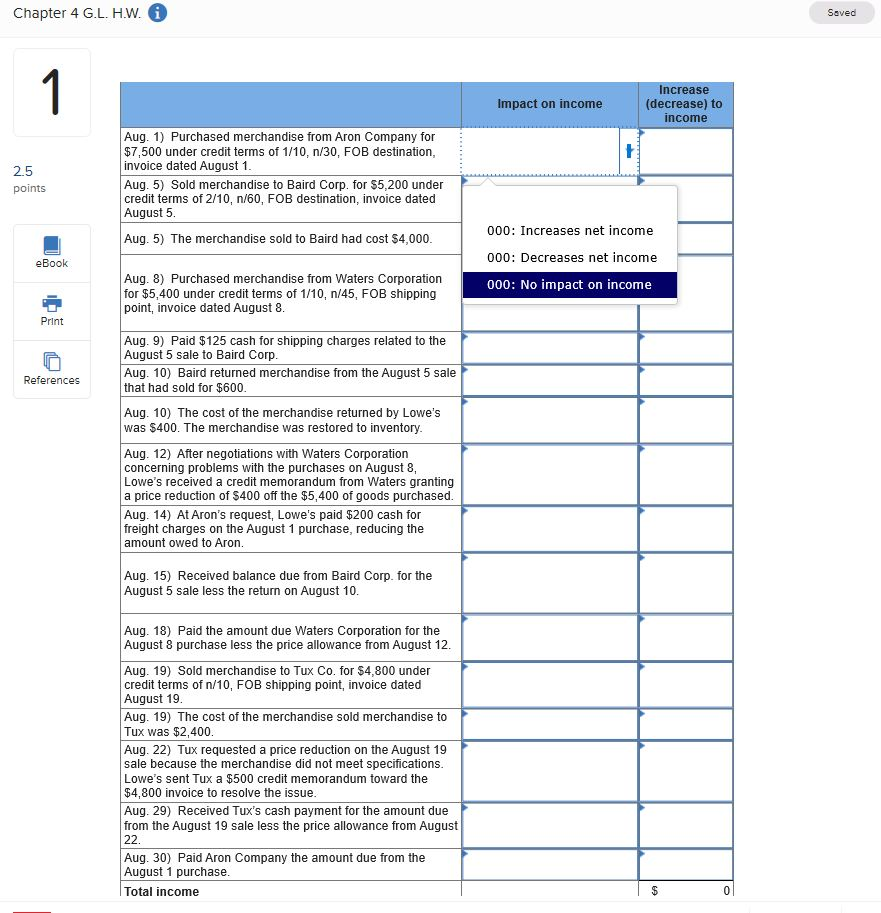

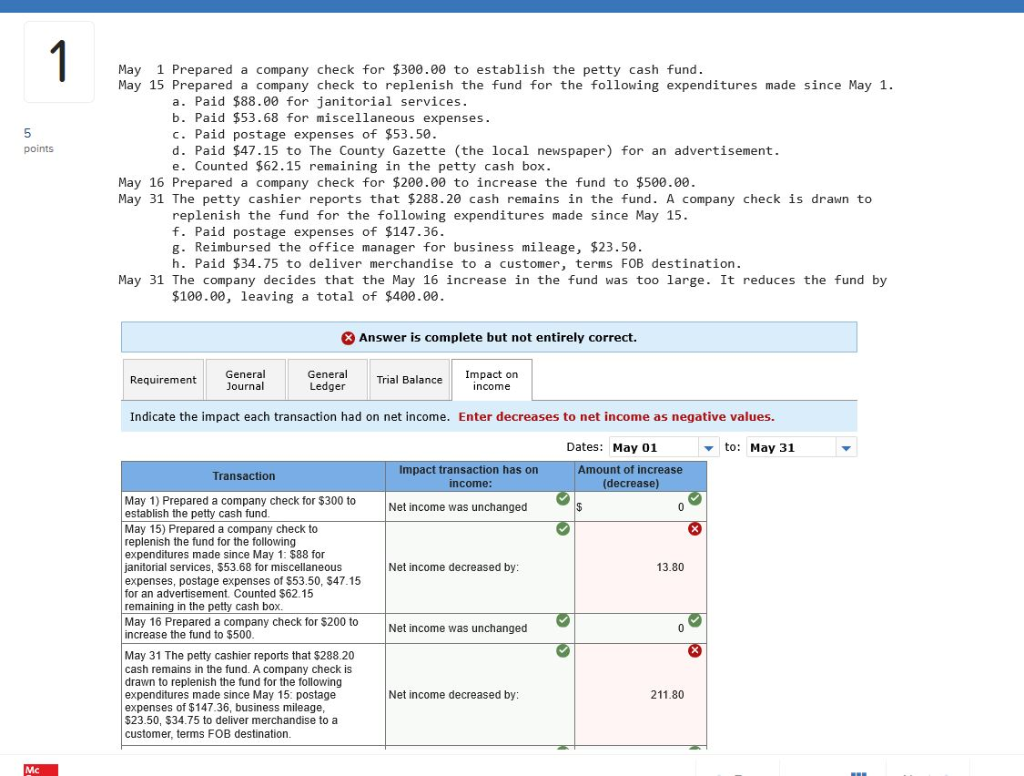

May 1 Prepared a company check for $300.00 to establish the petty cash fund May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1 a. Paid $88.00 for janitorial services b. Paid $53.68 for miscellaneous expenses. c. Paid postage expenses of $53.50 d. Paid $47.15 to The County Gazette (the local newspaper) for an advertisement. e. Counted $62.15 remaining in the petty cash box 5 points May 16 Prepared a company check for $200.00 to increase the fund to $500.00 May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15 f. Paid postage expenses of $147.36. g. Reimbursed the office manager for business mileage, $23.50 h. Paid $34.75 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $100.00, leaving a total of $400.00 Answer is complete but not entirely correct. General Journal General Ledger Impact on income Requirement Trial Balance Indicate the impact each transaction had on net income. Enter decreases to net income as negative values. Dates: May 01 to: May 31 Impact transaction has on ncome: Amount of increase (decrease) Transaction May 1) Prepared a company check for $300 to establish the petty cash fund May 15) Prepared a company check to replenish the fund for the following expenditures made since May 1: $88 for janitorial services, $53.68 for miscellaneous expenses, postage expenses of $53.50, $47.15 for an advertisement. Counted $62.15 remaining in the p May 16 Prepared a company check for $200 to increase the fund to $500 Net income was unchanged Net income decreased by 13.80 cash box Net income was unchanged May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15 postage expenses of $147.36, business mileage 523.50, S34.75 to deliver merchandise to a customer, terms FOB destination Net income decreased by 211.80 Mc Chapter 4 G.L. H.W. Aug. 1 Purchased merchandise from Aron Company for $7,500 under credit terms of 1/10, n/30, FOB Aug. 5 Sold merchandise to Baird Corp. for $5,200 under credit terms of 2/10, n/60, FOB destination, Aug. 8 Purchased merchandise from Waters Corporation for $5,400 under credit terms of 1/10, n/45, FOB Aug. 9 Paid $125 cash for shipping charges related to the August 5 sale to Baird Corp destination, invoice dated August 1. invoice dated August 5. The merchandise had cost $4,000 shipping point, invoice dated August8 2.5 Aug. 10 Baird returned merchandise from the August 5 sale that had cost Lowe's $400 and was sold for $600 The merchandise was restored to inventory. Aug. 12 After negotiations with Waters Corporation concerning problems with the purchases on August 8, eBook Lowe's received a credit memorandum from Waters granting a price reduction of $400 off the $5,400 of goods purchased Aug. 14 At Aron's request, Lowe's paid $200 cash for freight charges on the August 1 purchase, reducing the amount owed to Aron Print Aug. 15 Received balance due from Baird Corp. for the August 5 sale less the return on August 10 Aug. 18 Paid the amount due Waters Corporation for the August 8 purchase less the price allowance from August 12 dated August 19. The merchandise had cost $2,400. specifications. Lowe's sent Tux a $500 credit memorandum toward the $4,800 invoice to resolve the References Aug. 19 Sold merchandise to Tux Co. for $4,800 under credit terms of n/10, FOB shipping point, invoice Aug. 22 Tux requested a price reduction on the August 19 sale because the merchandise did not meet issue. Aug. 29 Received Tux's cash payment for the amount due from the August 19 sale less the price allowance from August 22. Aug. 30 Paid Aron Company the amount due from the August 1 purchase. GeneralTrial Balance Schedule of Receivables Schedule of Payables Income Statement Impact on Income Requirement General Journal Prepare a multiple-step income statement. Lowe's Company Income Statement For the Month Ended August 31, 2017 0 Operating expenses Chapter 4 G.L. H.w. Saved ncrease (decrease) to income Impact on income Aug. 1) Purchased merchandise from Aron Company for $7,500 under credit terms of 1/10, n/30, FOB destination, invoice dated August 1 Aug. 5) Sold merchandise to Baird Corp. for $5,200 under credit terms of 2/10, n/60, FOB destination, invoice dated August 5 2.5 points 000: Increases net income 000: Decreases net income 000: No impact on income Aug. 5) The merchandise sold to Baird had cost $4,000 Book Aug. 8) Purchased merchandise from Waters Corporation for $5,400 under credit terms of 1/10, n/45, FOB shipping point, invoice dated August 8 Print Aug. 9) Paid $125 cash for shipping charges related to the August 5 sale to Baird Corp Aug. 10) Baird returned merchandise from the August 5 sale that had sold for $600 References Aug. 10) The cost of the merchandise returned by Lowe's was $400. The merchandise was restored to inventory Aug. 12) After negotiations with Waters Corporation concerning problems with the purchases on August 8 Lowe's received a credit memorandum from Waters granting a price reduction of $400 off the $5,400 of goods purchased Aug. 14) At Aron's request, Lowe's paid $200 cash for freight charges on the August 1 purchase, reducing the amount owed to Aron Aug. 15) Received balance due from Baird Corp. for the August 5 sale less the return on August 10 Aug. 18) Paid the amount due Waters Corporation for the August 8 purchase less the price allowance from August 12 Aug. 19) Sold merchandise to Tux Co. for $4,800 under credit terms of n/10, FOB shipping point, invoice dated August 19 Aug. 19) The cost of the merchandise sold merchandise to Tux was $2,400 Aug. 22) Tux requested a price reduction on the August 19 sale because the merchandise did not meet specifications Lowe's sent Tux a $500 credit memorandum toward the $4,800 invoice to resolve the issue Aug. 29) Received Tux's cash payment for the amount due from the August 19 sale less the price allowance from August Aug. 30) Paid Aron Company the amount due from the August 1 purchase Total income May 1 Prepared a company check for $300.00 to establish the petty cash fund May 15 Prepared a company check to replenish the fund for the following expenditures made since May 1 a. Paid $88.00 for janitorial services b. Paid $53.68 for miscellaneous expenses. c. Paid postage expenses of $53.50 d. Paid $47.15 to The County Gazette (the local newspaper) for an advertisement. e. Counted $62.15 remaining in the petty cash box 5 points May 16 Prepared a company check for $200.00 to increase the fund to $500.00 May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15 f. Paid postage expenses of $147.36. g. Reimbursed the office manager for business mileage, $23.50 h. Paid $34.75 to deliver merchandise to a customer, terms FOB destination. May 31 The company decides that the May 16 increase in the fund was too large. It reduces the fund by $100.00, leaving a total of $400.00 Answer is complete but not entirely correct. General Journal General Ledger Impact on income Requirement Trial Balance Indicate the impact each transaction had on net income. Enter decreases to net income as negative values. Dates: May 01 to: May 31 Impact transaction has on ncome: Amount of increase (decrease) Transaction May 1) Prepared a company check for $300 to establish the petty cash fund May 15) Prepared a company check to replenish the fund for the following expenditures made since May 1: $88 for janitorial services, $53.68 for miscellaneous expenses, postage expenses of $53.50, $47.15 for an advertisement. Counted $62.15 remaining in the p May 16 Prepared a company check for $200 to increase the fund to $500 Net income was unchanged Net income decreased by 13.80 cash box Net income was unchanged May 31 The petty cashier reports that $288.20 cash remains in the fund. A company check is drawn to replenish the fund for the following expenditures made since May 15 postage expenses of $147.36, business mileage 523.50, S34.75 to deliver merchandise to a customer, terms FOB destination Net income decreased by 211.80 Mc Chapter 4 G.L. H.W. Aug. 1 Purchased merchandise from Aron Company for $7,500 under credit terms of 1/10, n/30, FOB Aug. 5 Sold merchandise to Baird Corp. for $5,200 under credit terms of 2/10, n/60, FOB destination, Aug. 8 Purchased merchandise from Waters Corporation for $5,400 under credit terms of 1/10, n/45, FOB Aug. 9 Paid $125 cash for shipping charges related to the August 5 sale to Baird Corp destination, invoice dated August 1. invoice dated August 5. The merchandise had cost $4,000 shipping point, invoice dated August8 2.5 Aug. 10 Baird returned merchandise from the August 5 sale that had cost Lowe's $400 and was sold for $600 The merchandise was restored to inventory. Aug. 12 After negotiations with Waters Corporation concerning problems with the purchases on August 8, eBook Lowe's received a credit memorandum from Waters granting a price reduction of $400 off the $5,400 of goods purchased Aug. 14 At Aron's request, Lowe's paid $200 cash for freight charges on the August 1 purchase, reducing the amount owed to Aron Print Aug. 15 Received balance due from Baird Corp. for the August 5 sale less the return on August 10 Aug. 18 Paid the amount due Waters Corporation for the August 8 purchase less the price allowance from August 12 dated August 19. The merchandise had cost $2,400. specifications. Lowe's sent Tux a $500 credit memorandum toward the $4,800 invoice to resolve the References Aug. 19 Sold merchandise to Tux Co. for $4,800 under credit terms of n/10, FOB shipping point, invoice Aug. 22 Tux requested a price reduction on the August 19 sale because the merchandise did not meet issue. Aug. 29 Received Tux's cash payment for the amount due from the August 19 sale less the price allowance from August 22. Aug. 30 Paid Aron Company the amount due from the August 1 purchase. GeneralTrial Balance Schedule of Receivables Schedule of Payables Income Statement Impact on Income Requirement General Journal Prepare a multiple-step income statement. Lowe's Company Income Statement For the Month Ended August 31, 2017 0 Operating expenses Chapter 4 G.L. H.w. Saved ncrease (decrease) to income Impact on income Aug. 1) Purchased merchandise from Aron Company for $7,500 under credit terms of 1/10, n/30, FOB destination, invoice dated August 1 Aug. 5) Sold merchandise to Baird Corp. for $5,200 under credit terms of 2/10, n/60, FOB destination, invoice dated August 5 2.5 points 000: Increases net income 000: Decreases net income 000: No impact on income Aug. 5) The merchandise sold to Baird had cost $4,000 Book Aug. 8) Purchased merchandise from Waters Corporation for $5,400 under credit terms of 1/10, n/45, FOB shipping point, invoice dated August 8 Print Aug. 9) Paid $125 cash for shipping charges related to the August 5 sale to Baird Corp Aug. 10) Baird returned merchandise from the August 5 sale that had sold for $600 References Aug. 10) The cost of the merchandise returned by Lowe's was $400. The merchandise was restored to inventory Aug. 12) After negotiations with Waters Corporation concerning problems with the purchases on August 8 Lowe's received a credit memorandum from Waters granting a price reduction of $400 off the $5,400 of goods purchased Aug. 14) At Aron's request, Lowe's paid $200 cash for freight charges on the August 1 purchase, reducing the amount owed to Aron Aug. 15) Received balance due from Baird Corp. for the August 5 sale less the return on August 10 Aug. 18) Paid the amount due Waters Corporation for the August 8 purchase less the price allowance from August 12 Aug. 19) Sold merchandise to Tux Co. for $4,800 under credit terms of n/10, FOB shipping point, invoice dated August 19 Aug. 19) The cost of the merchandise sold merchandise to Tux was $2,400 Aug. 22) Tux requested a price reduction on the August 19 sale because the merchandise did not meet specifications Lowe's sent Tux a $500 credit memorandum toward the $4,800 invoice to resolve the issue Aug. 29) Received Tux's cash payment for the amount due from the August 19 sale less the price allowance from August Aug. 30) Paid Aron Company the amount due from the August 1 purchase Total income

please answer both!! will thumbs up(:

please answer both!! will thumbs up(: