Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer C LOS 5.16 Computing and Interpreting Risk and Bankruptcy Prediction Ratios for a Firm That Declared Bankruptcy. Delta Air Lines, Inc., is one

please answer C

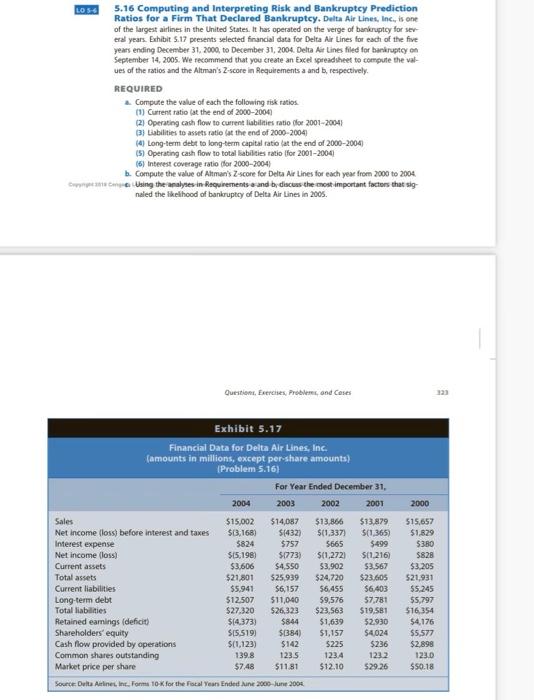

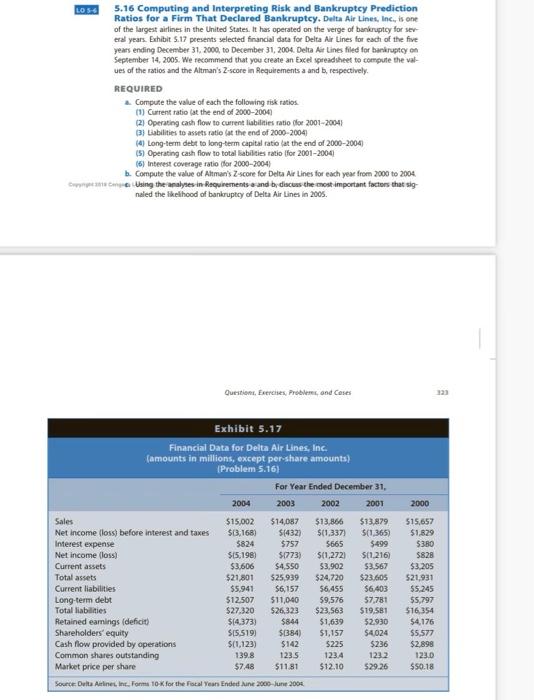

LOS 5.16 Computing and Interpreting Risk and Bankruptcy Prediction Ratios for a Firm That Declared Bankruptcy. Delta Air Lines, Inc., is one of the largest airlines in the United States. It has operated on the verge of bankruptcy for ser eral years. Exhibit 5.17 presents selected financial data for Delta Air Lines for each of the five years ending December 31, 2000, to December 31, 2004. Delta Air Lines filed for bankruptcy on September 14, 2005. We recommend that you create an Excel spreadsheet to compute the val ues of the ratios and the Altman's Z-score in Requirements a and b, respectively REQUIRED & Compute the value of each the following tisk ratios (1) Current ratio at the end of 2000-2004 (2) Operating cash flow to current liabilities ratio for 2001-2004 (3) Liabilities to assets ratio at the end of 2000-2004 (4) Long-term debt to long-term capital ratio at the end of 2000-2004) 15) Operating cash flow to total abilities ratio for 2001-2004 (5) Interest coverage ratio for 2000-2004) b. Compute the value of Altman's Z-score for Delta Air Lines for each year from 2000 to 2004 Cup Using the analyses in Requirements and by discuss the most important factors that sig naled the likelihood of bankruptcy of Delta Air Lines in 2005. Question, Exercises. Problems and Cases 323 Exhibit 5.17 Financial Data for Delta Air Lines, Inc. (amounts in millions, except per-share amounts) [Problem 5.16) For Year Ended December 31, 2004 2003 2001 2002 2000 Sales $15,002 $14,087 Net Income (loss) before interest and taxes $13.168 $(432) Interest expense 5824 $757 Net income (loss) $15,198 507733 Current assets $3.606 $4,550 Total assets $21,801 $25,939 Current liabilities $5.941 $6,157 Long-term debit $12.507 $11,040 Total liabilities $27.320 $26,323 Retained earings (deficit) $14.373) $844 Shareholders' equity $15,519) 5384 Cash flow provided by operations $(1123) $142 Common shares outstanding 139.8 1235 Market price per share $7.48 $11.81 Source: Delta Airlines in Form 10-K for the Fiscal Year Ended in 2000-lur 2004 $13,866 5(1,3371 5665 $(1,2721 53,902 $24.720 56,455 59,576 $23,563 $1,639 $1,157 5225 1234 $12.10 $13,879 $(1,365) $499 $11.216) $3.567 $23.605 $6,403 57,781 $19,581 52.930 $4,024 $236 1232 $29.26 515,657 $1,829 5380 5828 $3.205 521,931 55.245 55,797 $16.354 $4,176 $5.577 $2.898 123.0 $50.18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started