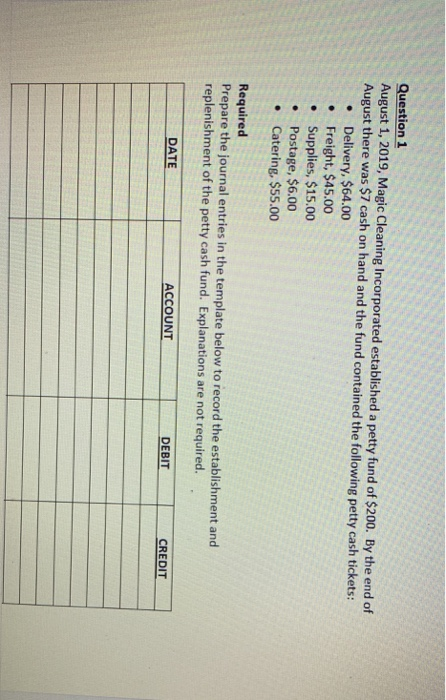

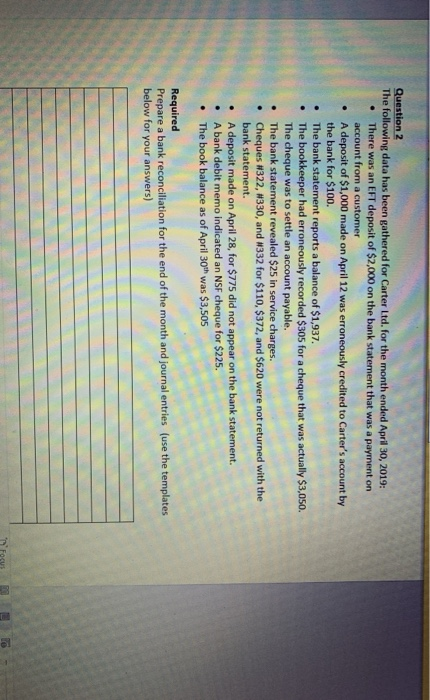

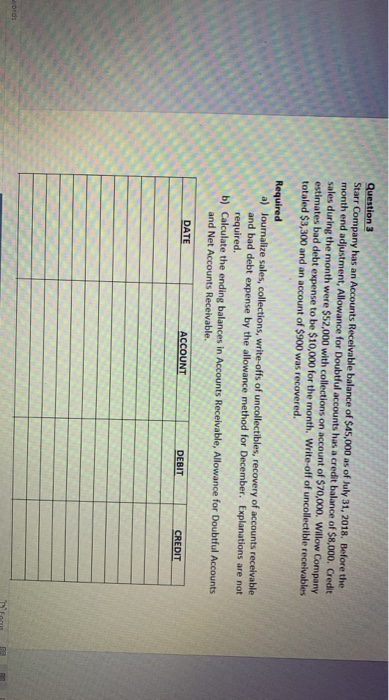

Question 1 August 1, 2019, Magic Cleaning Incorporated established a petty fund of $200. By the end of August there was $7 cash on hand and the fund contained the following petty cash tickets: Delivery, $64.00 Freight, $45.00 Supplies, $15.00 Postage, $6.00 Catering, $55.00 . Required Prepare the journal entries in the template below to record the establishment and replenishment of the petty cash fund. Explanations are not required. DATE ACCOUNT DEBIT CREDIT Question 2 The following data has been gathered for Carter Ltd. for the month ended April 30, 2019: There was an EFT deposit of $2,000 on the bank statement that was a payment on account from a customer A deposit of $1,000 made on April 12 was erroneously credited to Carter's account by the bank for $100. The bank statement reports a balance of $1,937. The bookkeeper had erroneously recorded $305 for a cheque that was actually $3,050. The cheque was to settle an account payable. The bank statement revealed $25 in service charges. Cheques #322, W330, and #332 for $110, $372, and $620 were not returned with the bank statement. A deposit made on April 28, for $775 did not appear on the bank statement A bank debit memo indicated an NSF cheque for $225. The book balance as of April 30th was $3,505 . Required Prepare a bank reconciliation for the end of the month and journal entries (use the templates below for your answers) Question 3 Starr Company has an Accounts Receivable balance of $45,000 as of July 31, 2018. Before the month end adjustment, Allowance for Doubtful accounts has a credit balance of $8,000. Credit sales during the month were $52,000 with collections on account of $70,000. Willow Company estimates bad debt expense to be $10,000 for the month. Write-off of uncollectible receivables totaled $3,300 and an account of $900 was recovered. Required a) Journalize sales, collections, write-offs of uncollectibles, recovery of accounts receivable and bad debt expense by the allowance method for December. Explanations are not required b) Calculate the ending balances in Accounts Receivable, Allowance for Doubtful Accounts and Net Accounts Receivable. DATE ACCOUNT DEBIT CREDIT words