Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer clearly and in an organaized way this is a single question and has two parts that is it thanks Preparing a Cash Flow

Please answer clearly and in an organaized way this is a single question and has two parts that is it thanks

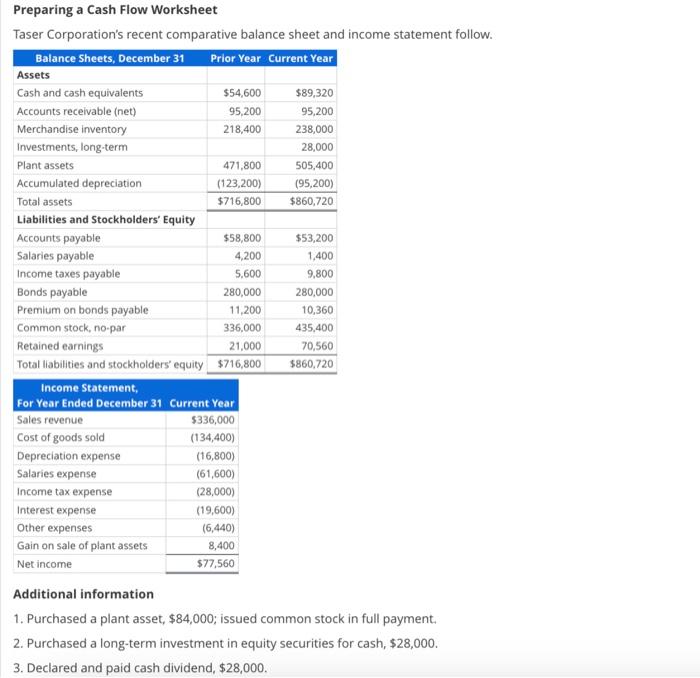

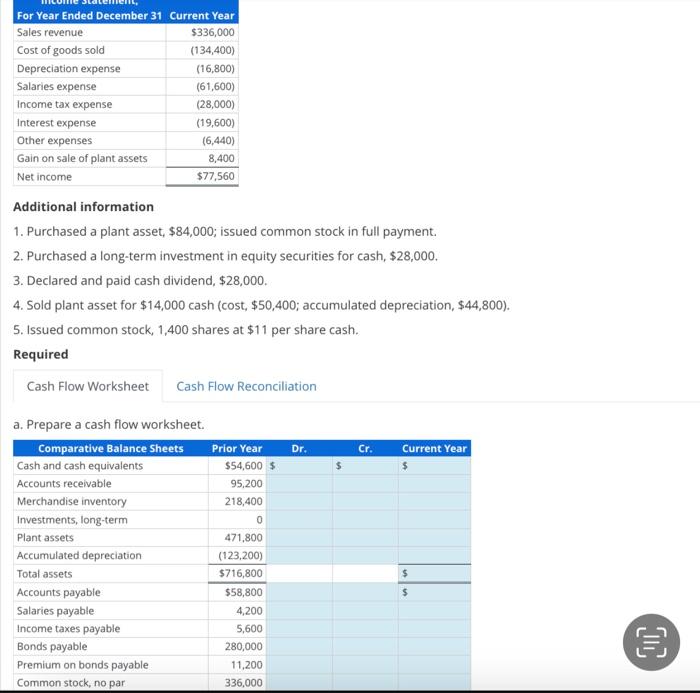

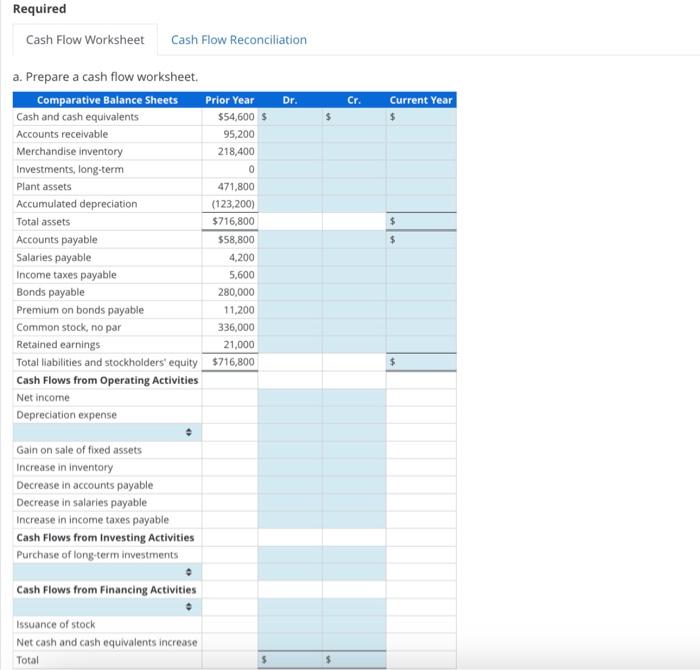

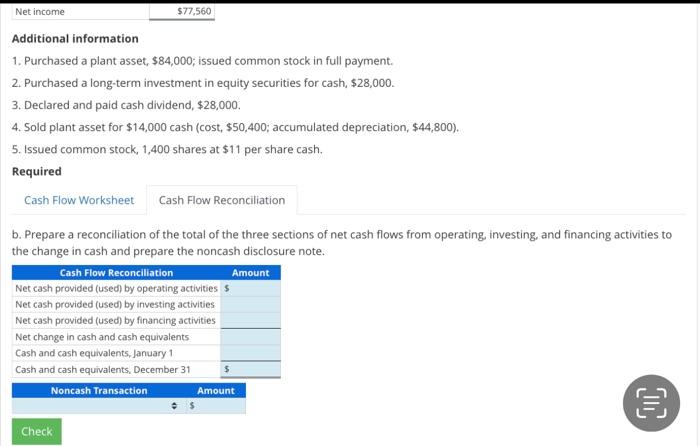

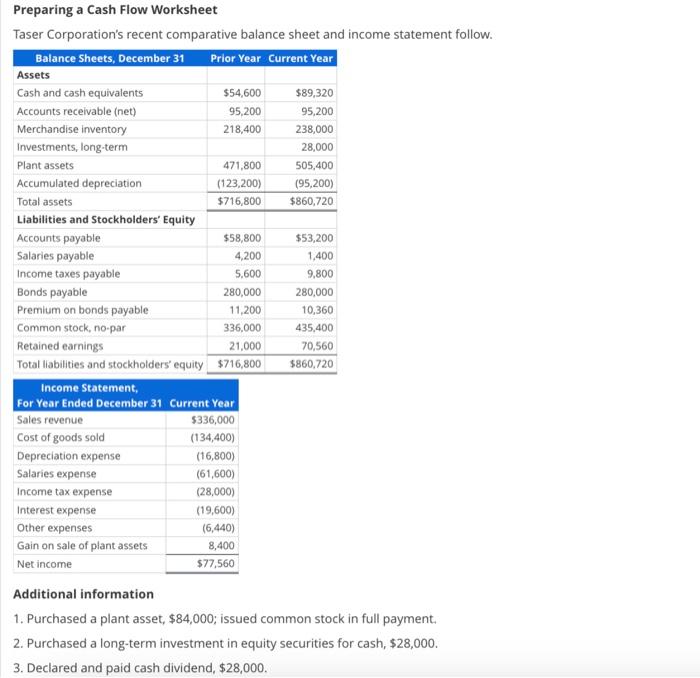

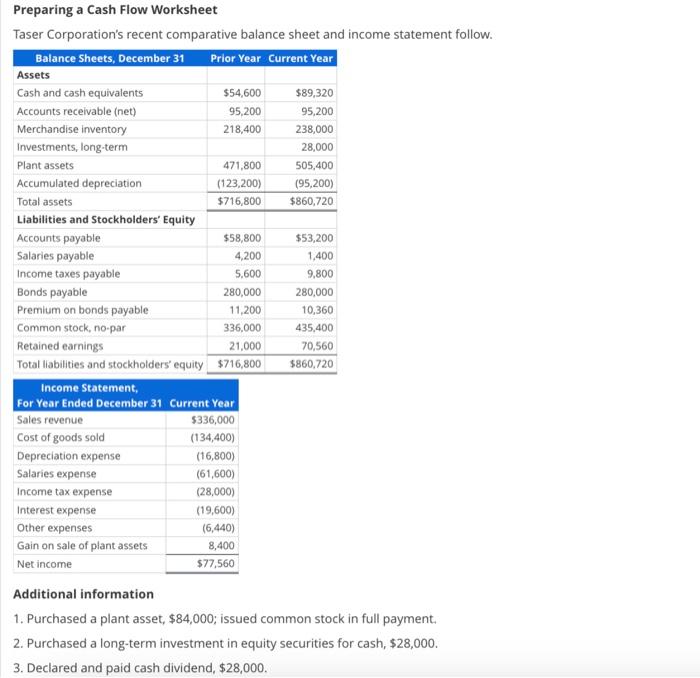

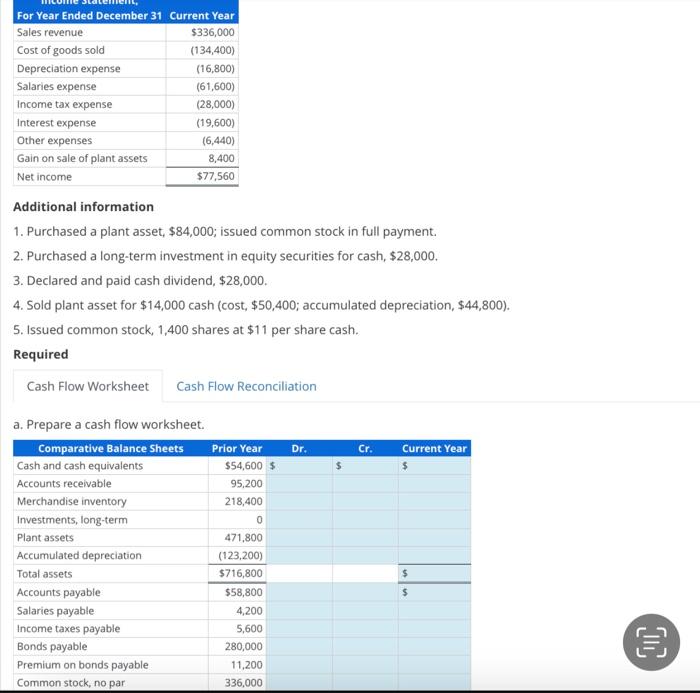

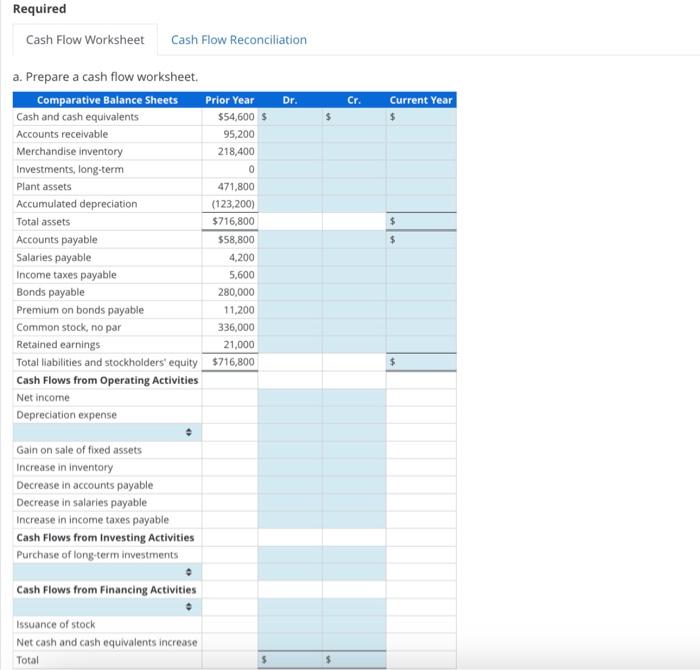

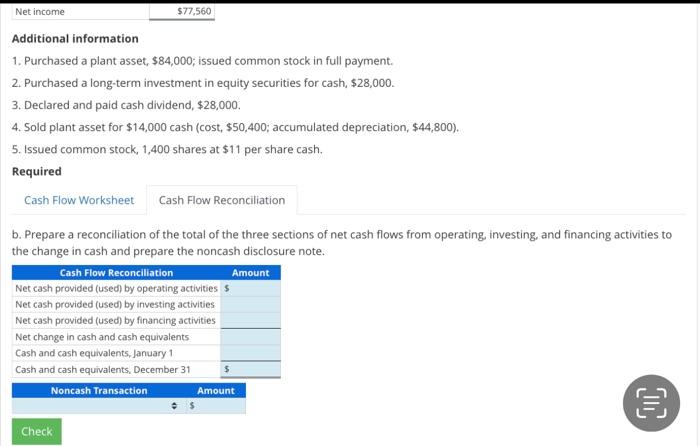

Preparing a Cash Flow Worksheet Taser Corporation's recent comparative balance sheet and income statement follow. Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. 4. Sold plant asset for $14,000 cash (cost, $50,400; accumulated depreciation, $44,800 ). 5. Issued common stock, 1,400 shares at $11 per share cash. Required a. Prepare a cash flow worksheet. Required a Dranaro a rach flaw uanrlehat Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. 4. Sold plant asset for $14,000 cash (cost, $50,400; accumulated depreciation, $44,800 ). 5. Issued common stock, 1,400 shares at $11 per share cash. Required b. Prepare a reconciliation of the total of the three sections of net cash flows from operating, investing, and financing activities to the change in cash and prepare the noncash disclosure note. Preparing a Cash Flow Worksheet Taser Corporation's recent comparative balance sheet and income statement follow. Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. 4. Sold plant asset for $14,000 cash (cost, $50,400; accumulated depreciation, $44,800 ). 5. Issued common stock, 1,400 shares at $11 per share cash. Required a. Prepare a cash flow worksheet. Required a Dranaro a rach flaw uanrlehat Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. 4. Sold plant asset for $14,000 cash (cost, $50,400; accumulated depreciation, $44,800 ). 5. Issued common stock, 1,400 shares at $11 per share cash. Required b. Prepare a reconciliation of the total of the three sections of net cash flows from operating, investing, and financing activities to the change in cash and prepare the noncash disclosure

Preparing a Cash Flow Worksheet Taser Corporation's recent comparative balance sheet and income statement follow. Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. 4. Sold plant asset for $14,000 cash (cost, $50,400; accumulated depreciation, $44,800 ). 5. Issued common stock, 1,400 shares at $11 per share cash. Required a. Prepare a cash flow worksheet. Required a Dranaro a rach flaw uanrlehat Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. 4. Sold plant asset for $14,000 cash (cost, $50,400; accumulated depreciation, $44,800 ). 5. Issued common stock, 1,400 shares at $11 per share cash. Required b. Prepare a reconciliation of the total of the three sections of net cash flows from operating, investing, and financing activities to the change in cash and prepare the noncash disclosure note. Preparing a Cash Flow Worksheet Taser Corporation's recent comparative balance sheet and income statement follow. Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. 4. Sold plant asset for $14,000 cash (cost, $50,400; accumulated depreciation, $44,800 ). 5. Issued common stock, 1,400 shares at $11 per share cash. Required a. Prepare a cash flow worksheet. Required a Dranaro a rach flaw uanrlehat Additional information 1. Purchased a plant asset, $84,000; issued common stock in full payment. 2. Purchased a long-term investment in equity securities for cash, $28,000. 3. Declared and paid cash dividend, $28,000. 4. Sold plant asset for $14,000 cash (cost, $50,400; accumulated depreciation, $44,800 ). 5. Issued common stock, 1,400 shares at $11 per share cash. Required b. Prepare a reconciliation of the total of the three sections of net cash flows from operating, investing, and financing activities to the change in cash and prepare the noncash disclosure

Please answer clearly and in an organaized way this is a single question and has two parts that is it thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started