Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE ANSWER CLEARLY AND USE GRAPHS THANKS Paloma Company has four employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each

PLEASE ANSWER CLEARLY AND USE GRAPHS THANKS

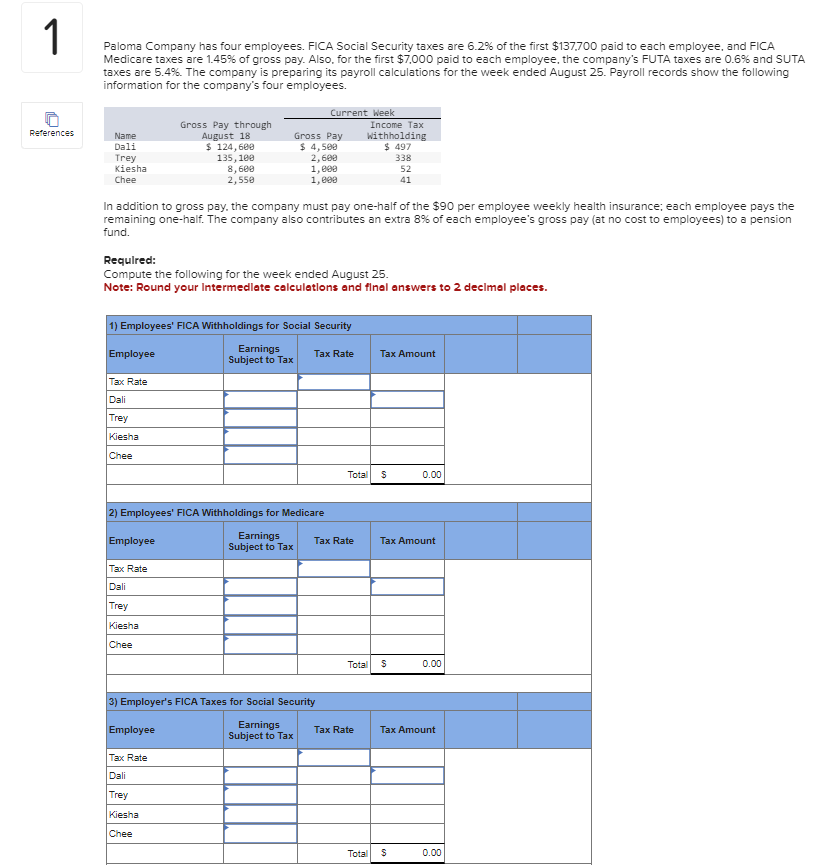

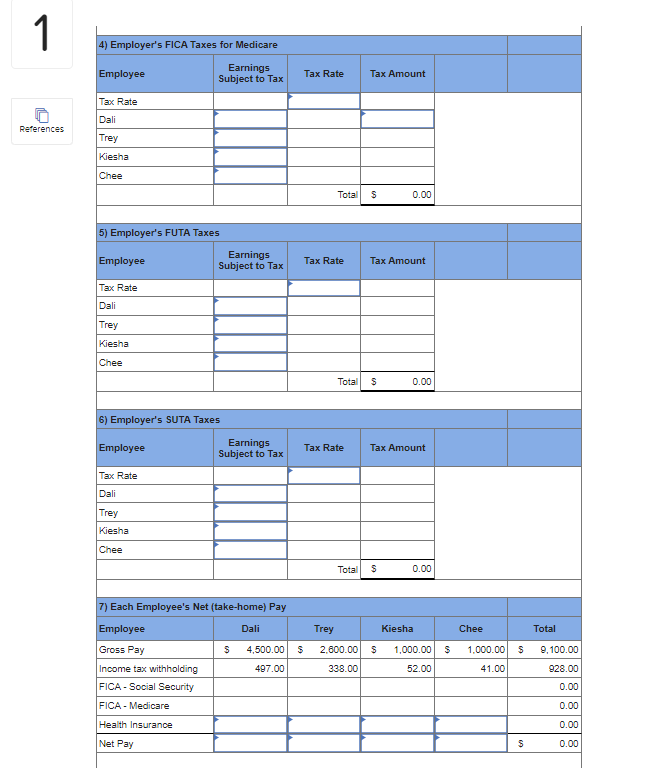

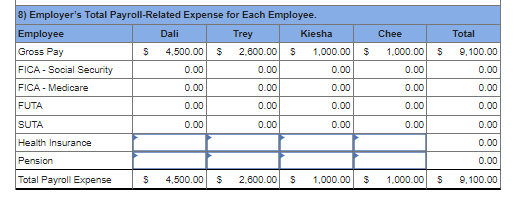

Paloma Company has four employees. FICA Social Security taxes are 6.2% of the first $137,700 paid to each employee, and FICA Medicare taxes are 1.45% of gross pay. Also, for the first $7,000 paid to each employee, the company's FUTA taxes are 0.6% and SUTA taxes are 5.4%. The company is preparing its payroll calculations for the week ended August 25 . Payroll records show the following information for the company's four employees. In addition to gross pay, the company must pay one-half of the $90 per employee weekly health insurance; each employee pays the remaining one-half. The company also contributes an extra 8% of each employee's gross pay (at no cost to employees) to a pension fund. Requlred: Compute the following for the week ended August 25 . Note: Round your Intermedlate caleulatlons and flnal answers to 2 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started