Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer correctly. Thank you in advance. 17 On July 1, 2021, Larkin Co, purchased a $440,000 tract of land that is intended to be

Please answer correctly. Thank you in advance.

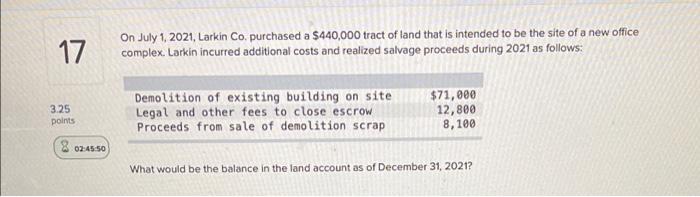

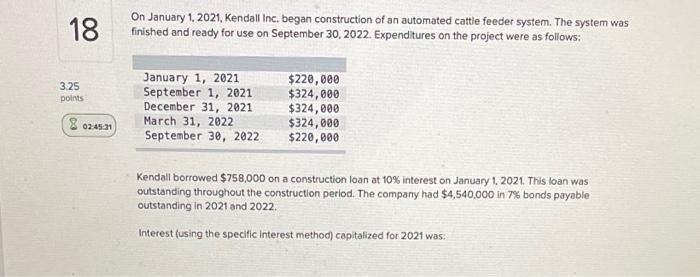

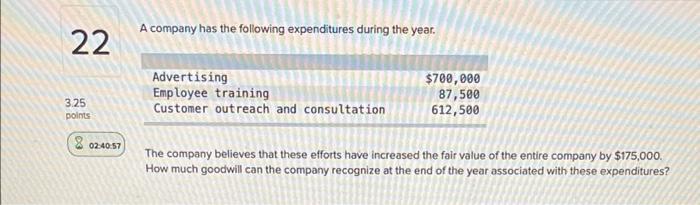

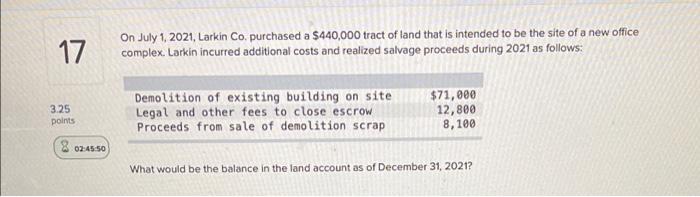

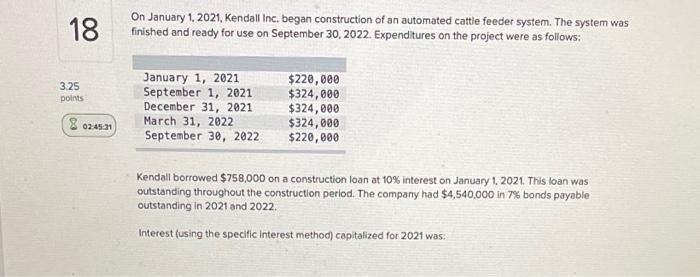

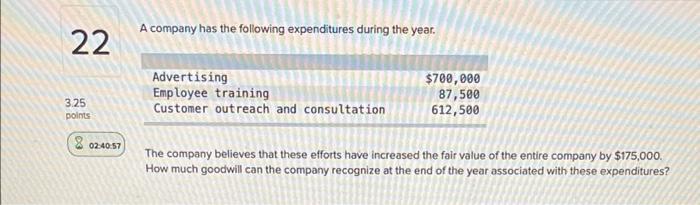

17 On July 1, 2021, Larkin Co, purchased a $440,000 tract of land that is intended to be the site of a new office complex. Larkin incurred additional costs and realized salvage proceeds during 2021 as follows: 3.25 points Demolition of existing building on site Legal and other fees to close escrow Proceeds from sale of demolition scrap $71,000 12,800 8,100 8 02:45:50 What would be the balance in the land account as of December 31, 2021? 18 On January 1, 2021, Kendall Inc. began construction of an automated cattle feeder system. The system was finished and ready for use on September 30, 2022. Expenditures on the project were as follows: 325 points January 1, 2021 September 1, 2021 December 31, 2021 March 31, 2022 September 30, 2022 $220,000 $324,000 $324,000 $324,000 $220,000 8 02451 Kendall borrowed $758,000 on a construction loan at 10% interest on January 1, 2021. This loan was outstanding throughout the construction period. The company had $4,540,000 in 7% bonds payable outstanding in 2021 and 2022. Interest (using the specific interest method) capitalized for 2021 was. A company has the following expenditures during the year. 22 Advertising Employee training Customer outreach and consultation $700,000 87,500 612,500 3.25 points 8 02:40:57 The company believes that these efforts have increased the fair value of the entire company by $175,000 How much goodwill can the company recognize at the end of the year associated with these expenditures

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started