Answered step by step

Verified Expert Solution

Question

1 Approved Answer

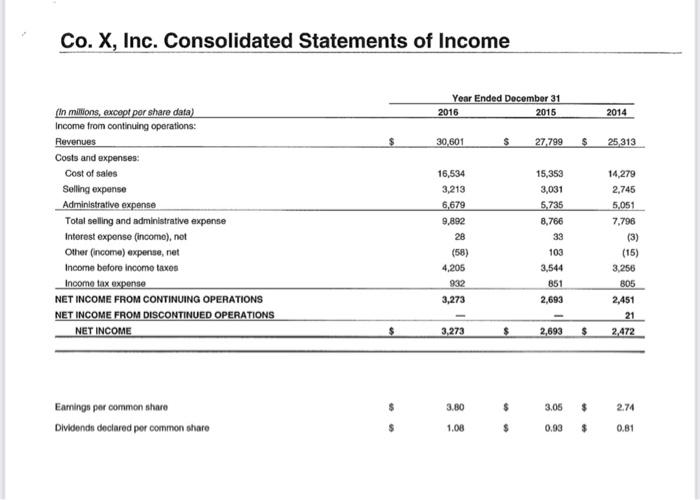

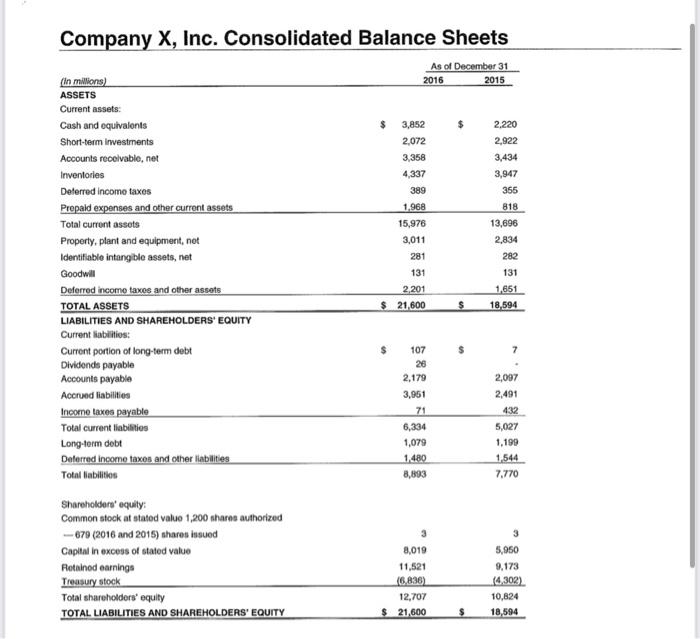

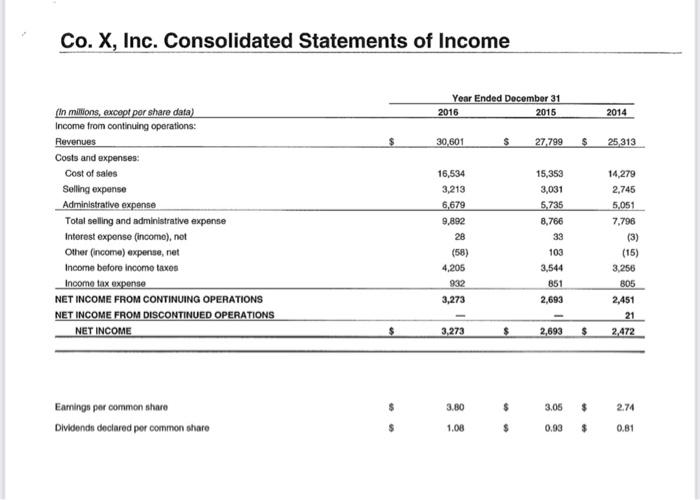

Use the financial statements for Corporation X , Inc. to answer the following question . The gross profit percentage was 44.8% in 2015 and 43.6%

Use the financial statements for Corporation X , Inc. to answer the following question . The gross profit percentage was 44.8% in 2015 and 43.6% in 2014. Which of the following statements is true ?

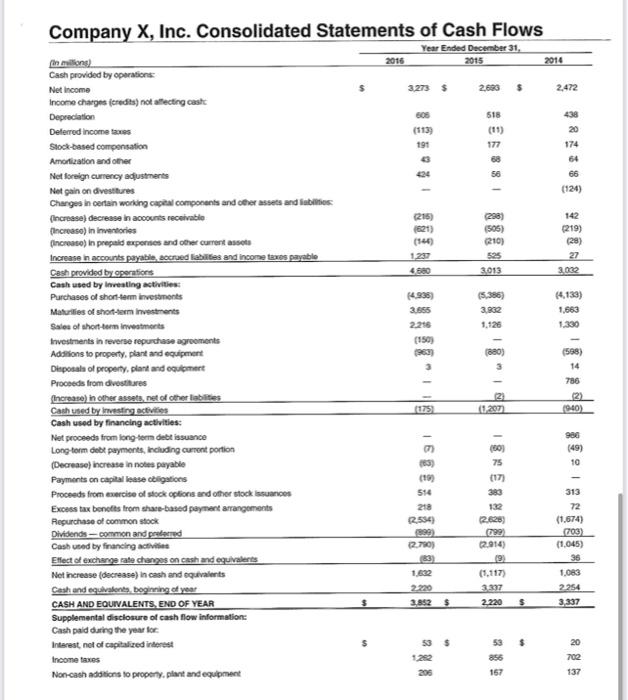

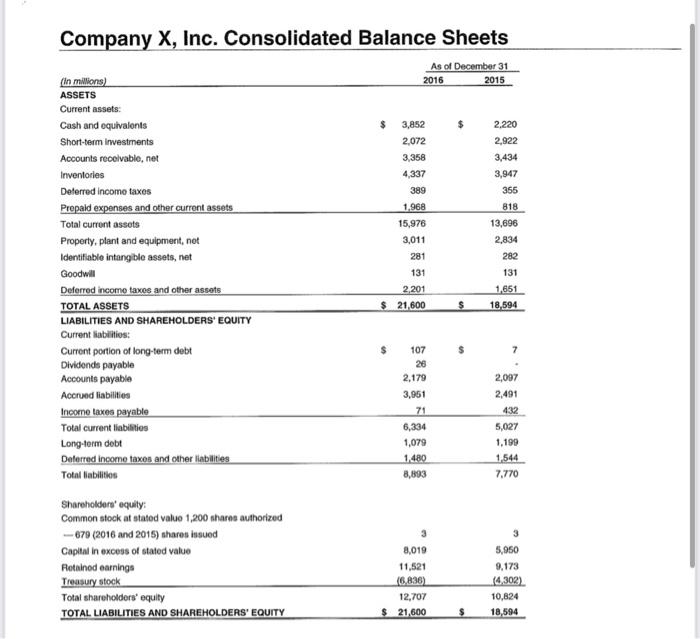

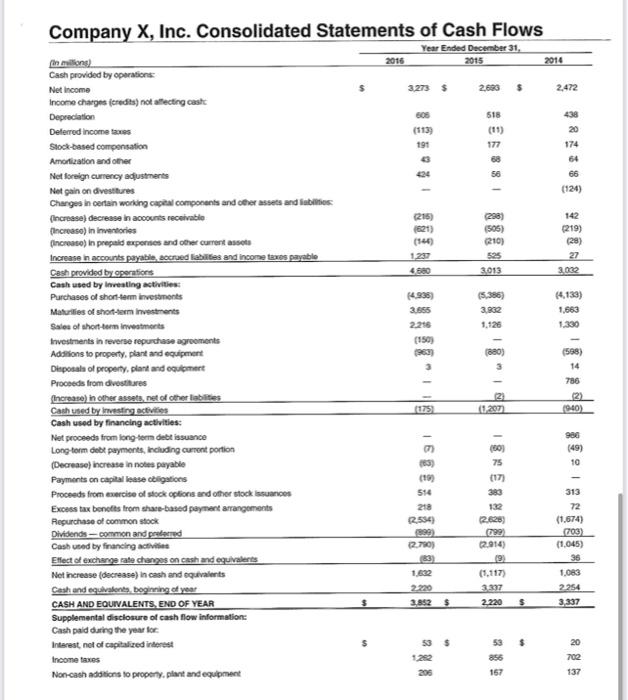

Common Ratios Used in Financial Statement Analysis Net Working Capital - Current Assets. Current Liabilities Current Ratio Current Assets Current Liabilities Quick (Acid-Test) Ratio Cash + ST Investments + Net Current Receivables Current Liabilities Cost of Goods Sold Inventory Turnover Average Inventory Gross Profit Percentage = Gross Profit Sales Days' Sales in Receivables Average Net Accounts Receivable One Day's Sales Debt Ratio Total Liabilities Total Assets Return on Assets Net Income Average Total Assets Net Income Return on Equity Average Common Stockholders' Equity Net Income - Preferred Dividends Earnings per Share Average Number of Common Stock Shares Outstanding Days' Sales in Receivables: A/R Turnover = Net Credit Sales Ave Accts Rec Days' Sales = 365 A/R Turnover 2.472 (203) 142 27 Company X, Inc. Consolidated Statements of Cash Flows Year Ended December 31, in mo 2016 2015 2014 Cash provided by Operations Net Income 3.273 2.685 $ Income charge credits) not affecting cast Depreciation 608 518 438 Deferred Income mes (113) 20 Stock-based compensation 191 177 174 Amortization and other 68 64 Net foreign currency austments 424 56 66 Net gain on vestures (124) Changes in contain working capital components and other assets and labios Increase) decrease in accounts receivable (215) Increase) in Inventories 621) 505) (219) (increase in prepaid expenses and other current assets (146) 210) (28) Increase in accounts payabile, accrued abilities and income taxes payable 1287 525 Cash provided by operations 4.680 3013 3.002 Cash used by investing activities Purchases of short-term investments (4938 (5.356) (4.133) Maurities of short-term investments 3.685 3,902 1.663 Sales of short-term investments 2.216 1.126 1.330 Investments in reverse repurchase agreements (150) Additions to property, plant and equipment 962 (380) (588) Disposal of property, plant and coulomert 14 Proceeds from dvostres 786 Increase in other assets, net of other liabilities 2) Cash used by investing activities 102077 (940) Cash used by financing activities: Net proceeds from long-term debt issuance 986 Long-term debt payments, including current portion (60) (49) (Decrease increase in notes payable 75 10 Payments on capital de blations (199 (17) Proceeds from exercise of stock options and other stock issuances 514 380 Excess tax benefits from share-based payment arrangements 218 72 Repurchase of common stock 2.534) (2.628) (1.674) Dividends - common and perd 999 299 703 Cash used by financing activities 2.790) 2.914) (1.045) Effect of exchange rate changes on cash and equivalents 83) 19 36 Net increase (decrease in cash and equivalents 1.632 (1.117) 1.083 Cash and equivalente beginning of year 3.397 2254 CASH AND EQUIVALENTS, END OF YEAR 3.852 $ $ 3337 Supplemental disclosure of cash flow information: Cash paid during the year for Interest, not of capitalized interest 53 $ 53 20 Income taxes 1282 856 702 Non-cash additions to property, plant and equipment 200 137 231 313 2.220 157 818 15,976 Company X, Inc. Consolidated Balance Sheets As of December 31 (in Millions) 2016 2015 ASSETS Current assets: Cash and equivalents $ 3,852 2.220 Short-term Investments 2,072 2,922 Accounts receivable, net 3,358 3,434 Inventories 4,337 3,947 Deterred income taxes 389 365 Prepaid expenses and other current assets 1.968 Total current assots 13,696 Property, plant and equipment, net 3,011 2,834 Identifiable intangible assets, niet 281 282 Goodwill 131 131 Deferred income taxos and other ascots 2,201 1,651 TOTAL ASSETS $21.600 $ 18,594 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities: Curront portion of long-term debt Dividends payable 28 Accounts payable 2,179 2,097 Accrued liabilities 3,951 2,491 Income taxes payable 71 432 Total current liabilities 6,334 5,027 Long-term debt 1,079 1,199 Deferred Income taxes and other liabilities 1480 1544 Total liabilities 8,893 7.770 107 Shareholders' equity: Common stock at stated Value 1,200 shares authorized ---679 (2016 and 2015) shares issued Capital in excess of stated value Retained earnings Treasury stock Total shareholders' equity TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY 8,019 11,521 (6.836) 12,707 $ 21,600 5,950 9,173 (4,302) 10,824 18,594 $ Co. X, Inc. Consolidated Statements of Income Year Ended December 31 2016 2015 2014 30.601 $ 27.799 S 25,313 in millions, except por share data) Income from continuing operations: Revenues Costs and expenses: Cost of sales Selling expense Administrative expense Total selling and administrative expense Interest expense (incomo), not Other (income) expense, net Income before income taxes Income tax expense NET INCOME FROM CONTINUING OPERATIONS NET INCOME FROM DISCONTINUED OPERATIONS NET INCOME 16,534 3,213 6,679 9,892 28 (58) 4,205 932 15,353 3,031 5.735 8,766 33 103 3,544 851 2,693 14,279 2,745 5,051 7,796 (3) (15) 3,256 805 2,451 21 2.472 3,273 3,273 $ 2,693 $ 3.80 $ 3.05 $ 2.74 Earnings per common share Dividends declared por common share 1.08 $ 0.93 $ 0.81 A. The gross profit percentage improved over the three-year period.

B. The gross profit percentage was 54% in 2016.

C. Cost of goods sold is increasing relative to sales...

D. The gross profit was $3,273 in 2016.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started