Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please answer each part. Thank you. Jason purchased a new vehicle for $45,000 from the auto dealership. Jason put down $10,000 on the vehicle and

Please answer each part. Thank you.

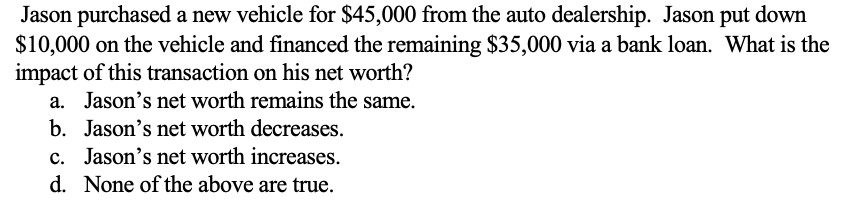

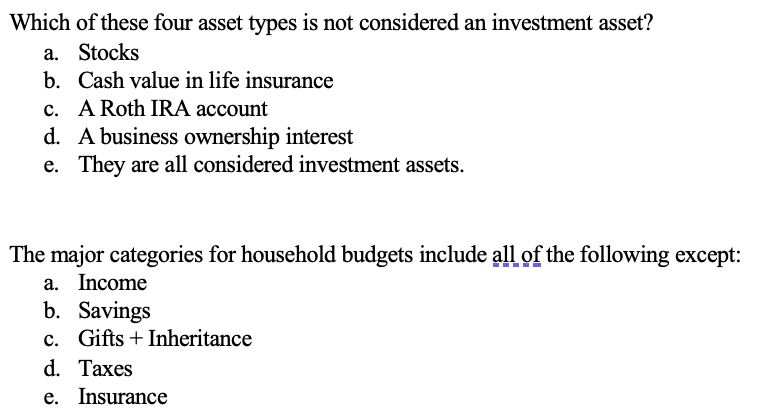

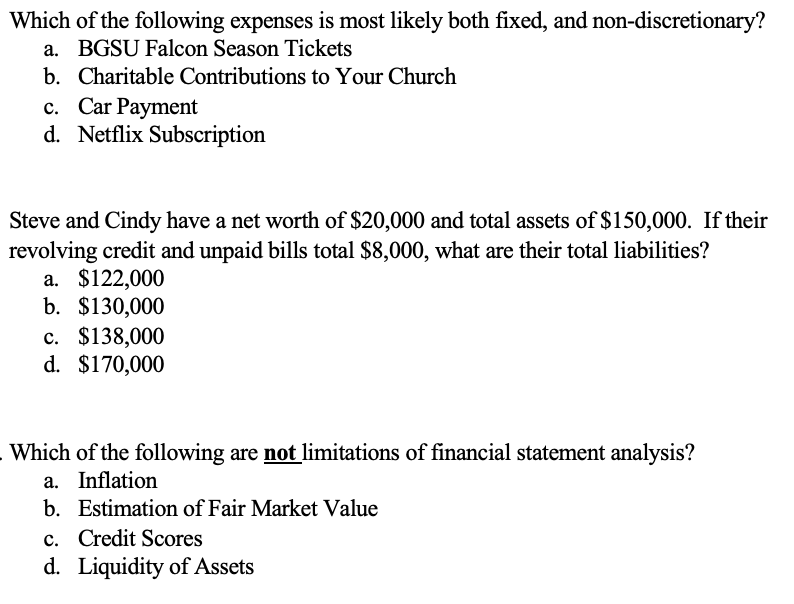

Jason purchased a new vehicle for $45,000 from the auto dealership. Jason put down $10,000 on the vehicle and financed the remaining $35,000 via a bank loan. What is the impact of this transaction on his net worth? a. Jason's net worth remains the same. b. Jason's net worth decreases. c. Jason's net worth increases. d. None of the above are true. Which of these four asset types is not considered an investment asset? a. Stocks b. Cash value in life insurance c. A Roth IRA account d. A business ownership interest e. They are all considered investment assets. The major categories for household budgets include all of of the following except: a. Income b. Savings c. Gifts + Inheritance d. Taxes e. Insurance Which of the following expenses is most likely both fixed, and non-discretionary? a. BGSU Falcon Season Tickets b. Charitable Contributions to Your Church c. Car Payment d. Netflix Subscription Steve and Cindy have a net worth of $20,000 and total assets of $150,000. If their revolving credit and unpaid bills total $8,000, what are their total liabilities? a. $122,000 b. $130,000 c. $138,000 d. $170,000 Which of the following are not limitations of financial statement analysis? a. Inflation b. Estimation of Fair Market Value c. Credit Scores d. Liquidity of AssetsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started