Question

PLEASE ANSWER EACH QUESTION 2. What are the allocations to each patient services department, and resulting profitability, under the four allocation methods using the base

PLEASE ANSWER EACH QUESTION

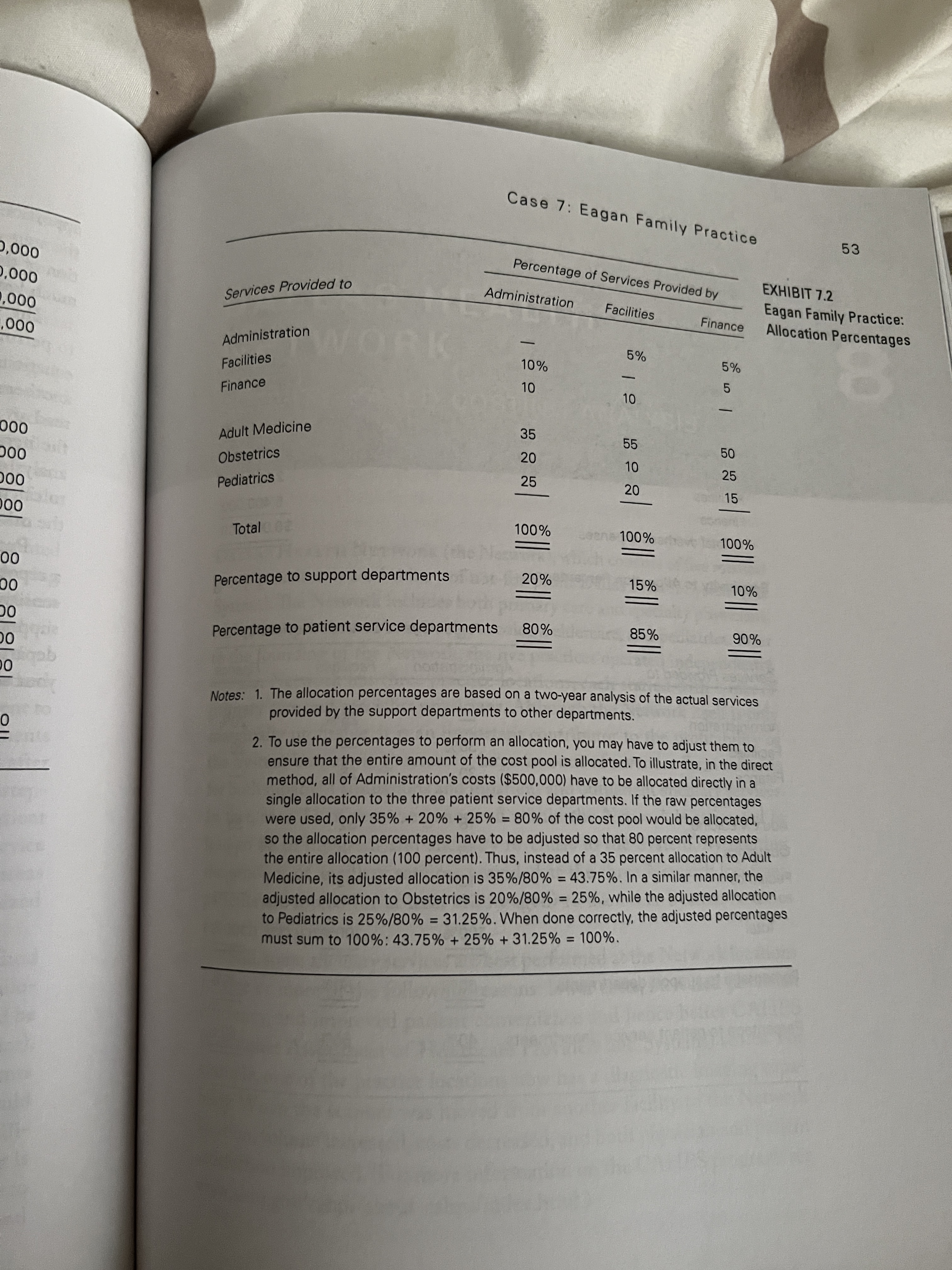

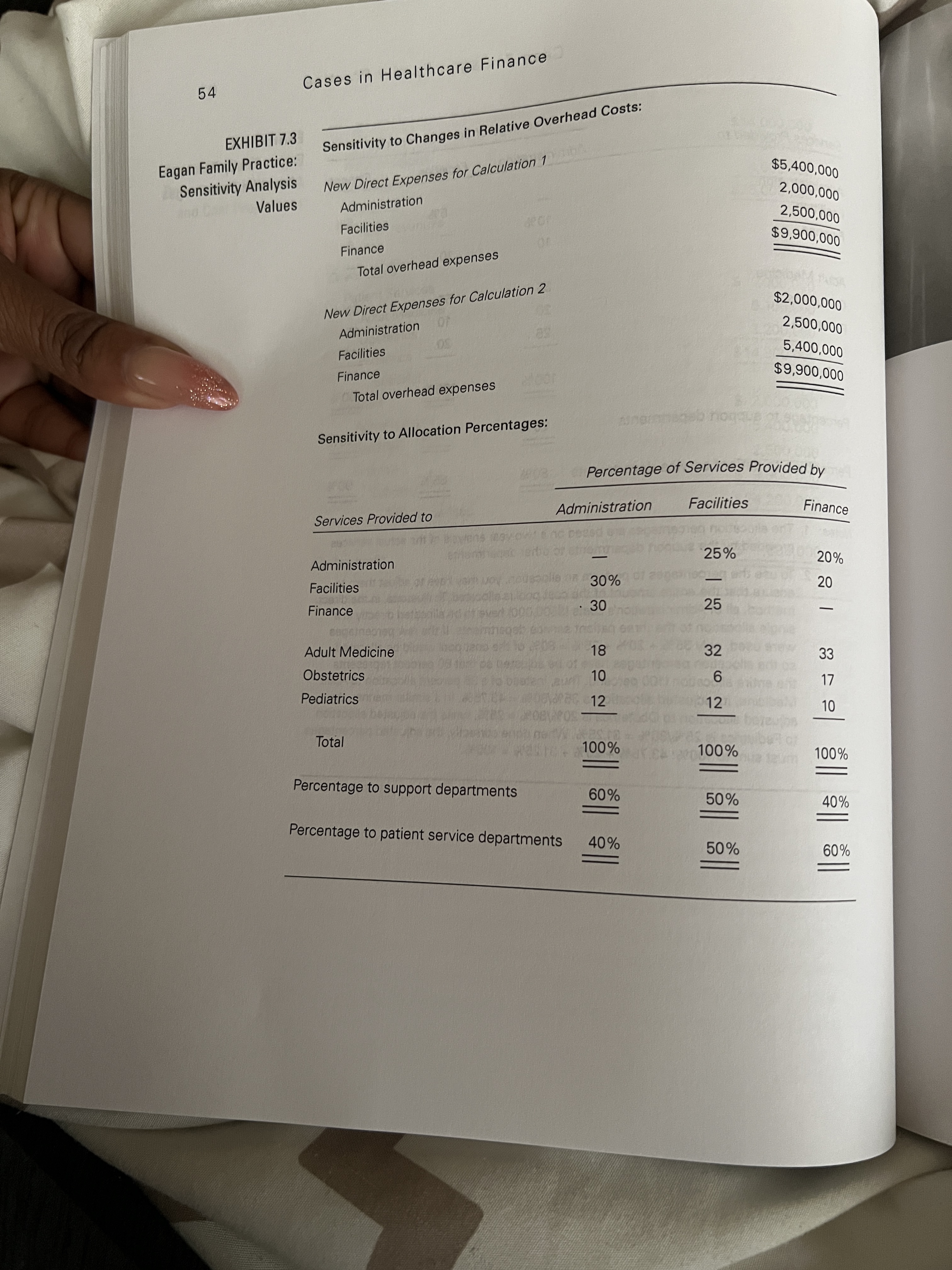

2. What are the allocations to each patient services department, and resulting profitability, under the four allocation methods using the base case cost amounts (exhibit 7.1) and allocation rates (exhibit 7.2)?

3. Consider the sensitivity of the results to changes in the values of the overhead cost pools. Repeat Question 2, but now use the overhead cost pool amounts from the first section of exhibit 7.3 along with the base case allocation percentages contained in exhibit 7.2. (Note that there are two different overhead cost pool amounts?Calculation 1 and Calculation 2.)

4. Consider the sensitivity of the results to changes in the allocation percentages. Repeat Question 2, but now use the percentages from exhibit 7.3 along with the base case overhead cost pool amounts given in exhibit 7.1.

5. Assess the sensitivity of patient services department profitability to the

a. Allocation method

b. Relative sizes of the overhead cost pools

c. Allocation rates

6. What does the analysis indicate about the true (but not really observable) profitability of each of the patient services departments?

7. What is your recommendation regarding the appropriate cost allocation method for the practice?

8. In your opinion, what are three key learning points from this case?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started